On the 18th, citizens visiting the Incheon International Airport observatory were watching the aircraft stopped at the airport. / Photo by Mun Ho-nam munonam@

On the 18th, citizens visiting the Incheon International Airport observatory were watching the aircraft stopped at the airport. / Photo by Mun Ho-nam munonam@

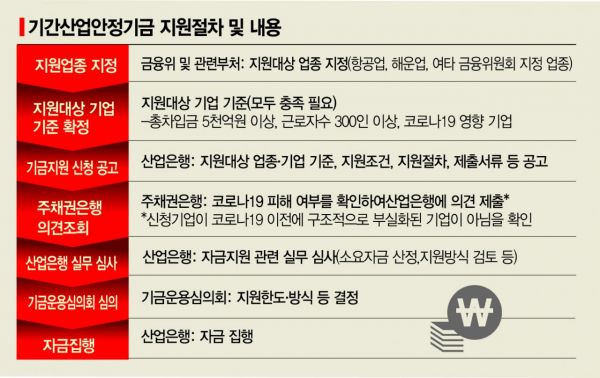

[Asia Economy reporters Kim Hyo-jin and Yoo Je-hoon] At the Emergency Economic Central Countermeasures Headquarters (Economic Central Headquarters) meeting on the 20th, specific support targets and utilization methods for the 40 trillion won-scale Period Industry Stabilization Fund were presented, raising expectations that the aviation and shipping industries, which are facing management crises after the COVID-19 pandemic, will breathe a sigh of relief.

However, smaller low-cost carriers (LCCs) and small- to medium-sized shipping companies are likely to be excluded from the support targets, leading to mixed feelings within the industry.

◆Possibility of Additional Support for Exceptional Industries = The recently confirmed amendment to the Korea Development Bank Act Enforcement Decree reduced the originally seven supported industries to aviation and shipping. However, if the case significantly affects core technology protection, industrial ecosystem maintenance, the national economy, employment stability, or national security, the Ministry of Economy and Finance and the Financial Services Commission may consult and provide support regardless of the industry regulations in the enforcement decree. Ssangyong Motor, which is on the brink of collapse, is mentioned in this context.

The government plans to provide funds in various ways tailored to the conditions of companies, such as liquidity support and capital expansion. It calculates the necessary operating funds that are difficult to cover due to the decreased expected sales flow caused by COVID-19 and supports that amount accordingly.

Funds required for repayment of existing borrowings are not included in the calculation of the support scale; however, if repayment of existing borrowings is impossible despite changes in borrowing conditions and if it is judged that achieving employment stability is difficult even with fund support, exceptions may be made to include such cases.

Supported companies must simultaneously meet the requirements of total borrowings of 500 billion won or more and 300 or more employees. The government plans to collect opinions from the main creditor banks for companies meeting the requirements, conduct reviews by the Korea Development Bank, and have the Fund Operation Deliberation Committee, composed of private experts, deliberate and decide on support eligibility.

The controversial condition of 'maintaining a certain employment ratio' has been settled as maintaining at least 90% employment from the fund support start date for six months, based on the number of employees as of the 1st of this month. For example, if a company has 100 employees as of the 1st of this month and receives support at the end of June, it must maintain employment of 90 or more until the end of this year.

If it is unavoidable to set the ratio lower than 90%, adjustments may be made after consulting relevant ministries. Compliance with employment maintenance will be checked by verifying the number of insured employees under employment insurance.

Companies receiving support must submit efforts made by labor and management to maintain employment to the Korea Development Bank, and if necessary, the bank will verify this with the cooperation of the Ministry of Employment and Labor. 'Efforts' refer to joint efforts by labor and management such as refraining from layoffs for business reasons, reassignment, adjustment of working hours, and reduction of welfare expenses.

To ensure that the benefits from fund support are shared with the public beyond the supported companies, at least 10% of the support amount will be provided in the form of stock-related bonds such as convertible bonds (CB) and bonds with warrants (BW). Restrictions on dividends and treasury stock acquisition to prevent moral hazard are also maintained.

These conditions reflect the goal that the establishment of the Period Industry Stabilization Fund is not merely to support crisis-hit companies but to protect jobs, and the principle that the benefits of support should not be concentrated within the supported companies or their management. The government intends to accelerate the start of the Period Industry Stabilization Fund support as early as next month.

In this regard, the Financial Services Commission announced at the Financial Risk Response Team meeting chaired by Vice Chairman Son Byung-doo the day before that it plans to launch the Period Industry Stabilization Fund Secretariat at the Korea Development Bank within this week and complete the formation of the Fund Operation Deliberation Committee next week. The Period Industry Stabilization Fund bonds will be issued early next month, and support applications will also be accepted early next month.

◆LCCs and Small- to Medium-Sized Shipping Companies Face Difficulty Meeting Requirements = The aviation and shipping industries are experiencing mixed feelings. Large airlines such as Korean Air and Asiana Airlines have borrowings in the trillion won range, so they are expected to be comfortably included in the Period Industry Stabilization Fund support targets. However, smaller LCCs are likely to be excluded due to their scale.

According to the Financial Supervisory Service's electronic disclosure system, the short- and long-term borrowings of four listed LCCs are approximately 148.4 billion won for Jeju Air, 30 billion won for Jin Air and Air Busan, and 6.5 billion won for T'way Air. A representative from a mid-sized LCC said, "Due to the nature of airlines, most have more than 300 employees, but the borrowing scale is the problem," adding, "With these conditions, most LCCs will be excluded from support."

In the shipping industry, small- to medium-sized shipping companies are also expected to find it difficult to meet these requirements. The Korea Shipowners' Association stated that they are "reviewing detailed operational guidelines."

Previously, LCCs received emergency funds of 300 billion won from the government, but this amount is considered insufficient to overcome the crisis. As the COVID-19 situation prolongs, international routes, which were the main source of income for LCCs, remain suspended.

An industry insider commented on the government's detailed operational guidelines, saying, "It seems the government has raised the hurdles with restructuring in mind, which was already in an overcapacity state," and added, "Without additional funding, some LCCs may find it difficult to survive beyond the first half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)