[Asia Economy Reporter Kim Hyo-jin] A bill to more clearly prohibit management interference and unfair pressure by financial authorities on financial companies and to specify punishment provisions has failed to see the light of day in the 20th National Assembly and is on track to be discarded.

According to financial and political circles on the 20th, the amendment to the "Act on the Establishment of the Financial Services Commission, etc.," proposed in November last year by Jeong Tae-ok of the United Future Party along with 12 fellow lawmakers, was submitted to the Standing Committee on Political Affairs, the relevant committee, in February but was not processed. When the 20th National Assembly adjourns after its final plenary session on this day, the amendment will be automatically discarded.

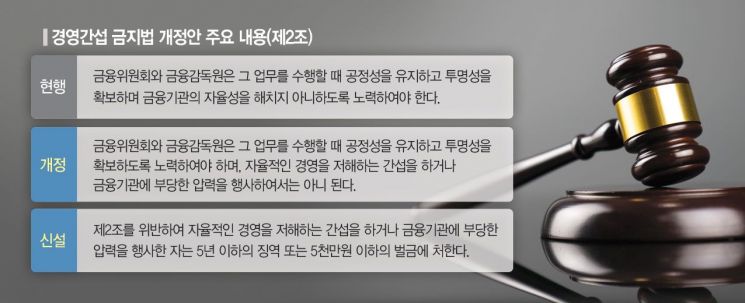

The amendment changed the clause "shall endeavor not to undermine the autonomy of financial institutions" to "shall not interfere in a way that hinders autonomous management or exert unfair pressure on financial institutions." It also newly included a punishment clause stipulating imprisonment for up to five years or a fine of up to 50 million won for violations.

The current law stipulates that the purpose of the financial authorities is to promote the advancement of the financial industry and the stability of the financial market, establish sound credit order and fair financial transaction practices, and protect financial consumers such as depositors and investors.

However, there have been ongoing criticisms that financial authorities excessively interfere and influence the management of financial companies by abusing their hierarchical authority in work, such as excessive involvement in personnel matters and hiring pressure, regardless of maintaining market stability and sound credit order.

Accordingly, the amendment clarified that since the financial industry is the foundation not only of the ordinary economy but also of other industries, it is necessary to guarantee responsible management and management autonomy of individual financial companies to modernize the entire industry in line with the rapidly changing industrial environment.

The amendment drew attention as it was proposed amid heightened critical public opinion against financial companies due to the incomplete sales of overseas interest rate-linked derivative-linked funds (DLF) and the resulting large-scale loss incidents.

A financial sector official said, "Supervisory actions that are temporarily strengthened due to a specific issue are likely to exert pressure on financial companies beyond the severity of the issue," adding, "While accountability for major accidents triggered by financial companies should be strictly enforced, the bill was meaningful in terms of balancing overall supervisory actions."

During the legislative review process of the amendment, opinions were raised that the legislative intent was valid from the perspective of protecting the rights and interests of financial institutions. On the other hand, there were criticisms that since financial authorities already have obligations to prohibit abuse of authority under the current Criminal Act and the Act on the Establishment of the Financial Services Commission, and obligations to prohibit abuse of investigation rights regarding supervision, inspection, investigation, and audit, the practical benefits of the amendment are limited.

However, the Legislative Research Office judged that considering that the current "Capital Markets and Financial Investment Business Act" and the "Monopoly Regulation and Fair Trade Act" also have overlapping provisions prohibiting abuse of authority, there is no particular problem in clearly stipulating the prohibition of abuse of authority over the entire work of the financial authorities in the Act on the Establishment of the Financial Services Commission.

In the financial sector, there is also a view that similar discussions may take place in the 21st National Assembly depending on the results of lawsuits between financial authorities and financial companies or their executives over various sanctions. A financial sector official said, "The government and financial authorities are continuously strengthening control and regulation under the policy of protecting financial consumers, so there is a possibility of conflicts or controversies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)