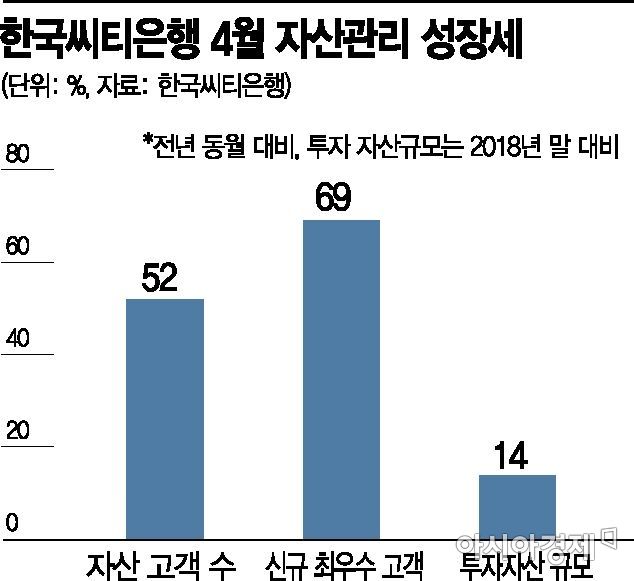

High-Net-Worth Individuals with Deposits Over 1 Billion KRW Increase by 69%

Investment Asset Size Grows 14% Compared to End of 2018

[Asia Economy Reporter Kim Min-young] Citibank Korea is continuing its strong growth in the wealth management (WM) sector, having attracted over 50% more new high-net-worth clients in just one year. It appears to have avoided all the shocks that have hit the financial sector, including the overseas interest rate-linked derivative-linked funds (DLF), the Lime Asset Management scandal, and the spread of the novel coronavirus infection (COVID-19).

According to the financial sector on the 14th, the number of new high-net-worth clients at Citibank at the end of last month surged 52% compared to the same month last year. High-net-worth clients refer to 'Citi Gold' clients who have entrusted 200 million KRW or more to Citibank.

The group of ultra-high-net-worth clients who have deposited 1 billion KRW or more at Citibank, called 'Premier Clients' (Citi Gold Private Client - CPC clients), also increased by 69% during the same period.

The size of investment assets grew by 14.46% compared to the end of 2018. A Citibank official said, "The number of customers wanting to experience Citibank's WM services is increasing," adding, "Especially, satisfied WM clients continue to recommend us to their acquaintances."

Citibank attributes this achievement to the model portfolio system introduced in the second half of 2015. The portfolios proposed according to the customer's investment propensity are readjusted every three months to maximize returns. Citibank's asset allocation strategy using the model portfolio has shone since 2018. Despite the sharp stock market decline in Q4 2018 due to global economic slowdown concerns and last year's US-China trade dispute, it achieved significant results. Notably, Citibank did not sell DLFs and Lime funds sold by other financial companies, and as other banks faced difficulties due to fund issues, Citibank's stringent product selection process attracted market and customer attention.

Citibank is known among asset managers as a meticulous distributor. To launch a product at Citibank, detailed due diligence materials must be prepared and passed, including the product's investment objectives and management strategy, consistency of past management performance, appropriateness of fund size, liquidity, fund managers, and risk management. No matter how popular a product is in the market, if it does not align with Citibank's Global Investment Committee's market outlook or asset allocation strategy, it cannot receive sales approval.

Earlier this year, Citibank further strengthened its WM division through organizational restructuring. The WM Products Department was split into the Investment Products Department and the Investment Advisory Department to provide more detailed customer management. Under the Investment Advisory Department, there are a Research Team covering various research materials, a Portfolio Counselor Team supporting objective portfolio reviews for CPC clients, and a TSO (Treasury Service Officer) Team for foreign exchange market and foreign exchange investment strategies.

The portfolio counselor service, previously provided only to CPC clients, received such positive feedback that it was recently expanded to Citi Gold clients as well.

Kim Ji-kang, head of Citibank Korea's Personal Finance Division, said, "We are making continuous efforts to lead the domestic WM market, including large centers for team-based WM and the introduction of model portfolios," adding, "Even in the situation where global stock markets have sharply declined due to COVID-19, the Citi model portfolio is showing better performance compared to major markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)