Monthly Growth Rate Continues to Rise... Concerns Over Mid- to Long-Term Financial Insolvency Risks

"Risks Keep Accumulating Despite Various Grace Periods Preventing Immediate Explosion"

[Asia Economy Reporters Kim Hyojin, Kim Cheolhyun] Concerns over a 'debt bomb' among the self-employed, the lifeblood of the economy, are intensifying. The number of self-employed individuals surviving on debt is rapidly increasing amid structural recession and the shock of the novel coronavirus disease (COVID-19). If the impact of COVID-19 prolongs, their repayment ability will inevitably weaken further. There are growing worries that self-employed loans could act as a fuse for medium- to long-term financial instability.

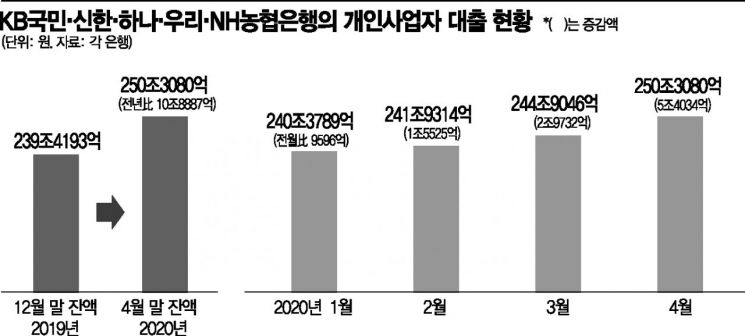

According to the financial sector on the 13th, the outstanding loans to self-employed (individual business owners) by the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 239.4193 trillion KRW at the end of December last year. This amount increased by 10.8887 trillion KRW over four months until the end of April this year, reaching 250.308 trillion KRW. The growth rate of self-employed loans at these banks was only 0.64% from January to February this year but sharply rose to 1.22% in March and 2.20% in April. According to the 'April 2020 Financial Market Trends' report released by the Bank of Korea the day before, the total outstanding self-employed loans at all banks reached 356.8 trillion KRW at the end of April, an increase of 10.8 trillion KRW compared to the previous month?the largest increase ever recorded.

Industries particularly sensitive to economic conditions, such as restaurants and wholesale/retail trade, showed relatively higher loan dependency. According to the Financial Services Commission, from February 7, when COVID-19-related financial support measures were first announced, until June 8, a total of 1.044 million cases amounting to 87 trillion KRW in financial support for small and medium enterprises and small business owners were provided by policy financial institutions, commercial banks, and secondary financial institutions over three months. By number of cases, support for the restaurant industry (221,000 cases) was the highest, followed by retail (176,000 cases) and wholesale (118,000 cases).

Delinquency rates are also showing signs of rising. According to the Financial Supervisory Service, the delinquency rate on individual business loans was 0.35% in February, when COVID-19 began to spread in earnest, up 0.02 percentage points from the previous month. A financial sector official said, "Due to various grace measures such as principal or interest repayment deferrals, delinquency rates may not surge sharply in the near future," but added, "Although not visible, risk factors are continuously accumulating."

The market situation, which had shown signs of recovery, worsened again after the COVID-19 outbreak linked to Itaewon clubs. The Ministry of SMEs and Startups conducted a sales survey of about 520 small business owners and traditional market tenants nationwide. Small business owners in Seoul reported that sales in the 15th week after the COVID-19 outbreak (May 11) decreased by 64% compared to before COVID-19. This sales decline rate was 10.2 percentage points higher than the 53.8% decline recorded in the previous week, the 14th week (April 27).

Although small business sales generally showed a recovery trend from early April, the Ministry explained that sales of small business owners in Seoul, Gyeonggi, and Incheon were hit immediately after the COVID-19 confirmed cases linked to Itaewon clubs occurred in early May.

The trend of net increase in loans to the self-employed is expected to continue. The government prepared 12 trillion KRW (3.5 trillion KRW from commercial banks, 5.8 trillion KRW from Industrial Bank of Korea) in emergency management fund loans for small business owners, of which about 5 trillion KRW (around 2 trillion KRW from commercial banks and 3 trillion KRW from Industrial Bank of Korea) was disbursed in April alone. Approximately 5 trillion KRW is being disbursed this month, and due to higher-than-expected demand, an additional 4.4 trillion KRW was allocated. As this fund also shows signs of rapid depletion, the government will launch a second emergency loan program worth 10 trillion KRW starting on the 18th (application start date).

Because of this, the market expects that the banking sector will continue to see an increase in self-employed loans of at least 6 trillion KRW per month. There are also forecasts that the annual growth rate of won-denominated loans by banks will exceed the original target by more than double this year. According to the Financial Supervisory Service, the growth rate of won-denominated loans by banks has been on a downward trend from 7.73% in 2015 to 4.62% last year. The target growth rate for commercial banks this year is in the low 4% range. However, there are even projections that the loan growth rate could reach over 9% this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.