KT's Strong Performance Despite COVID-19

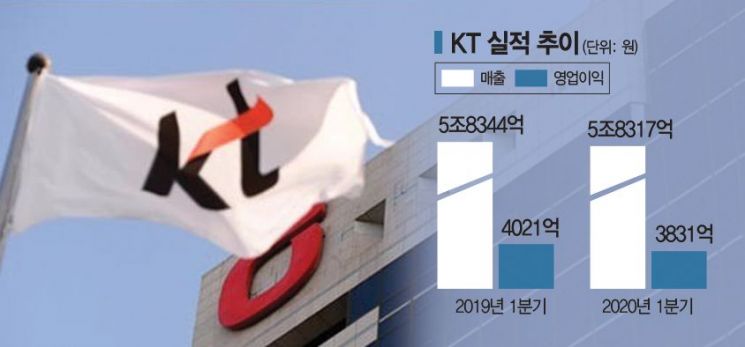

Revenue of 5.8317 Trillion KRW, Operating Profit of 383.1 Billion KRW

5G Subscribers Increase Drives 2.2% Growth in Wireless Service Revenue

BC Card and Estate Underperform... Genie Music and KTH Fill the Gap

[Asia Economy Reporter Koo Chae-eun] KT recorded solid performance in the first quarter despite the spread of the novel coronavirus infection (COVID-19). This is notable as it is the first report card under CEO Koo Hyun-mo. Although there were concerns about performance due to a sharp decline in roaming revenue caused by COVID-19, the increase in media and content consumption thanks to more people staying at home worked in their favor.

◆ Sales Growth Despite COVID-19 = On the 13th, KT announced that its consolidated financial statements for the first quarter of this year showed sales of 5.8317 trillion KRW, a 0.04% decrease compared to the same period last year (5.8344 trillion KRW), maintaining a similar level of sales despite the impact of COVID-19. Operating profit was 383.1 billion KRW, down 4.7%, and net profit was 226.2 billion KRW. The decrease in operating profit was due to increased expenses from ongoing 5G network investments. The three major mobile carriers agreed in a meeting with Minister Choi Ki-young of the Ministry of Science and ICT last March to expand 5G investments to around 4 trillion KRW in the first half of the year to mitigate the economic downturn caused by COVID-19. This amount is a 50% increase from the initially expected investment of 2.7 trillion KRW for the first half of this year.

Industry insiders evaluate that although operating profit decreased, KT performed relatively well considering the economic downturn caused by COVID-19. The biggest contributor to improved performance was the media and content business. KT's 'Olleh TV,' the number one paid broadcasting service in Korea, maintained steady growth with a total subscriber base of 8.43 million. In the content sector, group affiliates also showed solid growth, including an increase in Genie Music subscribers and growth in KTH's T-commerce business. The OTT platform 'Season' continued to increase its paid subscribers, benefiting from the 'COVID-19 special.'

With the steady increase in 5G subscribers, revenue also improved in the core mobile network operator (MNO) segment. KT's wireless service revenue excluding access fees was 1.6324 trillion KRW, up 2.2% year-on-year. As the proportion of subscribers under the 25% discount plan fell below half, the MNO business segment's growth is expected to continue into the second quarter. A KT official said, "With the increase in 5G subscribers, the average revenue per user (ARPU) has improved, and wireless segment growth is expected to continue moderately this year."

◆ Will Growth Continue in the Second Quarter? = Although the first quarter passed smoothly, CEO Koo Hyun-mo faces significant challenges. In the overall economic downturn, factors such as poor sales of the Galaxy S20, fines for violations of the 5G Device Distribution Improvement Act (Mobile Device Distribution Structure Improvement Act) expected from the Korea Communications Commission in the second quarter, and costs related to supporting distribution channels in response to COVID-19 are expected to weigh on performance.

Maintaining the number one position in the paid broadcasting market is also a challenge. On the 30th of last month, one month after CEO Koo's appointment, the merged entity of SK Broadband and T-broad officially launched, sounding an alarm for KT's paid broadcasting market defense strategy. As of the second half of last year, KT (including KT Skylife) had 10,588,439 paid broadcasting subscribers (31.52%), ushering in the '10 million subscriber' era. However, LG Uplus, which launched LG Hello with 8,368,791 subscribers, and SK Broadband, merged with T-broad with 5,098,640 subscribers, are closely pursuing KT with additional M&A plans, making it crucial for KT to defend its leading position. Kim Hong-sik, a researcher at Hana Financial Investment, said, "CEO Koo Hyun-mo is expected to focus more on ARPU growth and cost control to improve performance rather than on M&A such as cable TV acquisitions. Operating profit is likely to turn to an upward trend after the third quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.