Shinhan to Suspend Loans for Non-Apartment Properties from the 15th... No Loans for Villas, Multi-Family Houses, etc.

Reviewing Lifting Restrictions When COVID Normalizes... Surge in Jeonse Loans This Year

If Loan Suspension Spreads to Banks, Borrowers May Turn to Higher-Interest Secondary Financial Institutions

[Asia Economy Reporter Kangwook Cho] Shinhan Bank will temporarily suspend major jeonse (long-term lease) loans excluding apartments. This decision comes as the rapid increase in jeonse loans prompts the bank to slow down the pace in order to concentrate limited resources on loans supporting COVID-19 relief efforts. Consequently, attention is focused on whether other commercial banks will also temporarily halt jeonse loans and other loan products.

According to the financial sector on the 12th, Shinhan Bank has decided to stop issuing jeonse loans for newly built houses excluding apartments starting from the 15th. As a result, among the guarantee products from the Korea Housing Finance Corporation and Seoul Guarantee Insurance, multi-family villas, detached houses, and officetels will no longer be eligible for jeonse loans from Shinhan Bank.

A Shinhan Bank official stated, "Regarding unsecured loans, we already took measures by adjusting the limit ratio earlier last month, and for jeonse loans, we plan to impose restrictions on certain products based on the collateral as of the 15th," adding, "If the COVID-19 situation normalizes, we will consider lifting these measures."

Overall, household loans in the financial sector are rapidly increasing, especially jeonse loans and unsecured loans showing the largest growth. Shinhan Bank explained that due to limited resources, it is necessary to slow down household loans to prioritize supplying funds to support COVID-19 affected companies and small business owners.

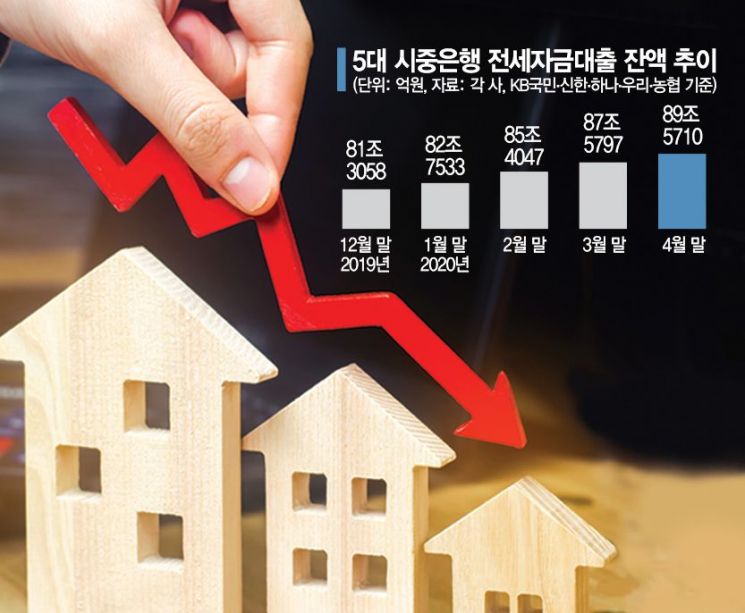

Since the beginning of this year, jeonse loans at Shinhan Bank and other commercial banks have surged sharply. The combined balance of jeonse loans at the five major commercial banks?Shinhan, KB Kookmin, Hana, Woori, and NH Nonghyup?stood at 82.7533 trillion KRW at the end of January, an increase of 1.4475 trillion KRW from the previous month. Subsequently, jeonse loans surged by more than 2.6 trillion KRW in February alone and increased by about 2 trillion KRW in both March and April. Notably, Shinhan Bank showed a remarkable increase. The monthly increase in jeonse loans, which was about 400 billion KRW in January, rapidly grew to exceed 800 billion KRW in April, double that of January. Shinhan Bank’s jeonse loan balance was understood to have surpassed 20 trillion KRW first among the five banks in February.

Some critics suggest that Shinhan Bank is consecutively tightening conditions to reduce risk. In recent years, reckless gap investments have caused tenants to fail to recover their jeonse deposits, raising concerns in the financial sector about losses from uncollected loans. Amid this, warnings about loan defaults due to COVID-19 have been triggered, leading to interpretations that Shinhan Bank is taking preemptive measures for risk management. The fact that restrictions are only imposed on multi-family villas and similar properties with higher collateral risk compared to apartments supports this interpretation.

A Shinhan Bank official explained, "Fund loans such as the Support Jeonse Loan and Newlywed Jeonse Loan remain available," adding, "The loans temporarily suspended this time account for about 60% of total jeonse loans, and among these, the ratio of apartments to non-apartments is almost half and half, so the actual proportion of newly suspended loans is about 30%."

The market is paying close attention to whether Shinhan Bank’s suspension of jeonse loans will spread to other banks. This is because other banks are also experiencing rapid increases in household loans, including jeonse loans, mortgage loans, and unsecured loans. While other commercial banks currently have no plans to suspend jeonse loans, if resources for COVID-19 related loans are depleted and they slow down other loans, there is a risk of creating a wave of "jeonse refugees." If other banks also suspend non-apartment jeonse loans, borrowers may have no choice but to turn to second-tier financial institutions with higher interest rates.

A financial sector official said, "Due to the government's strengthened regulations on mortgage loans, jeonse demand has surged, causing the scale of bank jeonse loans to increase by about 2 trillion KRW recently," adding, "Shinhan Bank’s recent measure appears to be aimed at curbing the steep rise in jeonse loans amid increasing COVID-19 support loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)