Two out of Three Retirees Cut Living Expenses by 28%

Unprepared for Retirement Biggest Concern

Hana Financial Group Opens 100-Year Happiness Research Center

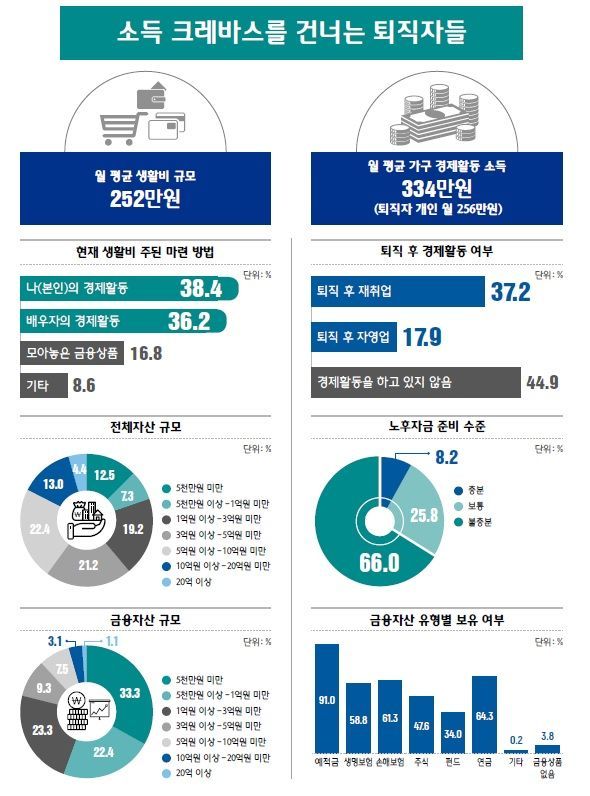

[Asia Economy Reporter Kim Min-young] Retirees aged 50 and above in South Korea were found to spend about 2.5 million KRW per month. Most of their living expenses were covered by income from reemployment. Retirees faced an income cliff, having to cover all living expenses for about ten years until they started receiving the National Pension. Those retirees with pension income or real estate rental income enjoyed a higher quality of life and had fewer worries about old age.

Hana Financial Group published a life finance report titled "How Retirees in South Korea Live" on the 11th to commemorate the opening of the "100-Year Happiness Research Center."

The survey found that retirees spend an average of 2.52 million KRW per month on living expenses. Two out of three reduced their living expenses by 28.7% compared to before retirement. They believed that at least 4 million KRW per month was necessary for a decent standard of living, but reality was far from this ideal.

Although retired, many were actually back in the workforce. Among retirees, half (55.1%) reported either reemployment (37.2%) or starting a business (18.9%). Among the unemployed, 65% were preparing for employment. More than half of spouses (58.6%) were also working, raising the household economic activity rate to 84.8%. Average monthly income was found to be 3.937 million KRW. Among retirees, 36.4% lived with the worry that their financial situation would become difficult immediately or within a year if they stopped working.

Preparing for old age remained an unfinished task for retirees. The average income cliff period until eligibility for the National Pension was about 12 years and 6 months. Their biggest concerns were "increasing medical expenses (71.7%)" and "insufficient retirement funds (62.0%)." Additionally, "children's marriage expenses (56.2%)" were also a concern.

Among those surveyed, 54.2% saved an average of 1.095 million KRW per month for retirement and planned to receive the National Pension according to the scheduled timing (72.4%). Even after receiving the National Pension, most (92.1%) intended to continue economic activities. More than half (54.4%) of retirees said they planned to use a reverse mortgage if retirement funds became insufficient.

Among retirees, 65.4% experienced psychological aftereffects after leaving their jobs. These aftereffects were mainly caused by the pressure of being the breadwinner (44.8%) and the loss of previous achievements and social status (42.7%). Men experienced these aftereffects more frequently, especially men who retired early before age 55, who suffered from pressure as the head of the household. They overcame these aftereffects by returning to work.

The research center defined retirees who self-assessed their retirement funds as sufficient as the "Geumtoe-jok" (Gold Retirement Group). The Geumtoe-jok accounted for 8.2% of all respondents and cited early enrollment in pension products such as retirement pensions and pension savings, as well as the use of investment products like stocks, funds, and derivatives, as the secrets to retiring without worries. Additionally, 92.7% of the Geumtoe-jok owned their own homes, and 72.0% managed investment real estate.

Cho Yong-jun, director of the Happiness Research Center, emphasized, "Because retirees face various issues in succession?from managing retirement funds to children's marriage, real estate utilization, and preparation for caregiving and inheritance?professional asset management after retirement is more essential."

Meanwhile, this survey was conducted on 1,000 male and female retirees aged 50 and above residing in Seoul, Gyeonggi, and five major metropolitan cities (Incheon, Daegu, Busan, Daejeon, Gwangju). In-depth interviews were also conducted with 10 individuals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)