[Asia Economy Reporter Kim Min-young] Terra Funding (Terafintech), the nation's No.1 peer-to-peer (P2P) financial platform, announced on the 7th that it recorded an operating loss of 2.4 billion KRW last year. This represents a 15.7% increase compared to approximately 2 billion KRW in 2018.

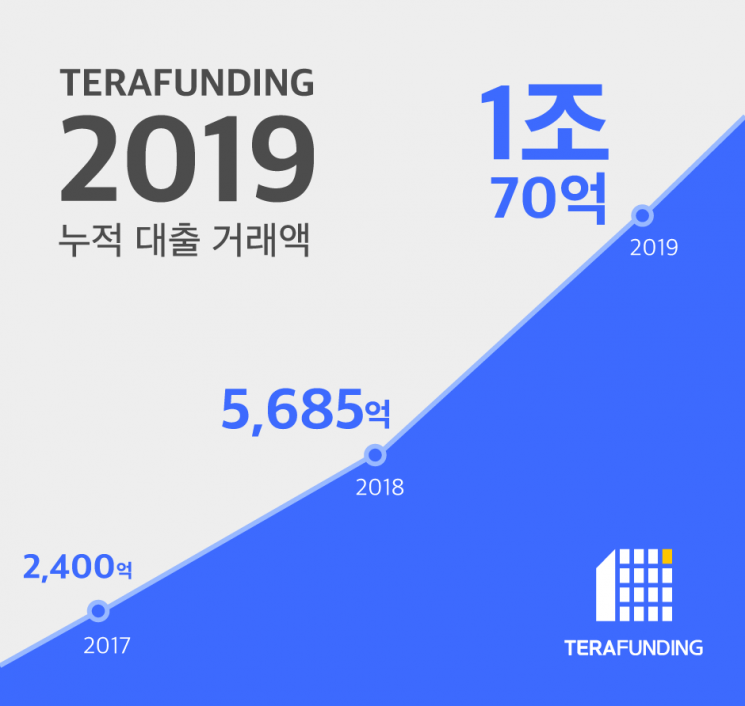

According to Terra Funding on the day, the company achieved a cumulative loan transaction amount of 1.007 trillion KRW by the end of last year, the first in the industry. The cumulative principal repaid by borrowers reached 669.4 billion KRW, and the cumulative interest income earned by investors after tax amounted to 41.9 billion KRW.

With the increase in loan transaction volume, operating revenue (fees and interest income) also rose 50% year-on-year to 51.7 billion KRW last year. Operating loss increased by 15.7% year-on-year to approximately 2.4 billion KRW.

Regarding the increase in operating loss, Terra Funding explained that it was the result of investments in building infrastructure at the level of regulated financial companies, including compliance, information security, risk management, and system advancement, ahead of the enforcement of the Online Investment-Linked Finance Act.

The number of members increased by 33% year-on-year to about 720,000. Looking at the age distribution of investors, those in their 20s and 30s accounted for 69%, more than two-thirds. Terra Funding evaluated that it "led the popularization of small-scale real estate investment centered on the younger generation." The reinvestment rate was 65.8%, with one investor diversifying small investments across an average of 7.7 products.

As of the end of last month, the principal loss rate was favorable at 0.57%. Among 219 loan agreements, 4 cases of default occurred, which is 1.8% based on the number of loan transactions.

Yang Tae-young, CEO of Terra Funding, said, "We have grown with the determination to innovate the inefficiencies prevalent in the existing financial industry," and added, "Since 2020 is expected to be a year with big and small waves in the industry, including the enforcement of the law, we will strengthen our fundamentals and devote all efforts to risk and bond management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.