Bank of Korea March and Q1 Balance of Payments (Preliminary)

March Current Account Surplus of $6.23 Billion... 11 Consecutive Months of Surplus

Goods Balance Reduced by $1.34 Billion Due to COVID-19 Impact

Q1 Goods Balance Records Smallest Surplus in 7 Years

Park Yang-su, Director of the Economic Statistics Bureau at the Bank of Korea, is presenting at the briefing on the provisional balance of international payments for March 2020, held on the 7th at the Bank of Korea in Jung-gu, Seoul.

Park Yang-su, Director of the Economic Statistics Bureau at the Bank of Korea, is presenting at the briefing on the provisional balance of international payments for March 2020, held on the 7th at the Bank of Korea in Jung-gu, Seoul.

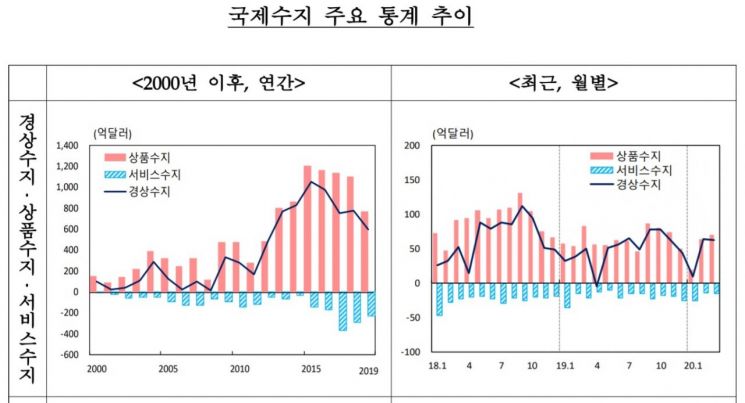

[Asia Economy Reporter Kim Eunbyeol] Due to the impact of the novel coronavirus infection (COVID-19), South Korea's current account balance is expected to record a deficit again in April after one year. Until March, the current account balance maintained a surplus for 11 consecutive months, but in April, the concentrated payment of dividends to foreigners coincided with a trade deficit. The impact of COVID-19 had already begun to appear since March. Exports to China decreased, and with the decline in prices of semiconductors and petroleum products, the goods balance, which accounts for a significant portion of the current account, saw its surplus shrink by as much as $1.34 billion compared to the same month last year. The goods balance for the first quarter recorded the smallest surplus in seven years.

According to the 'March 2020 and 1st Quarter International Balance of Payments (Provisional)' released by the Bank of Korea on the 7th, the current account balance in March recorded a surplus of $6.23 billion. However, the goods balance was $7 billion, down $1.34 billion from $8.34 billion a year earlier. The current account surplus for the first quarter was $13.61 billion, marking 32 consecutive quarters of surplus, but the goods balance ($15.34 billion) was the smallest in seven years since the first quarter of 2013.

Park Yang-su, Director of the Economic Statistics Bureau at the Bank of Korea, said at a press briefing, "Exports in April fell by 24.3%, and the trade balance showed a deficit for the first time in 99 months, so the goods balance surplus in April is expected to shrink significantly." He added, "Usually, dividend payments to foreign investors are concentrated in April, and since the goods balance surplus is greatly reduced and may even turn negative, the possibility of a current account deficit is very high." However, Director Park added that since dividend payments tend to decrease compared to the previous year due to deteriorating corporate earnings last year, and the exchange rate increase is a factor improving the primary income balance, it is difficult to definitively predict the size of the current account balance.

The current account balance also recorded a deficit in April last year. However, at that time, it was a temporary shock, which differs from this year. Director Park said, "The current account balance is expected to worsen in May as well, but if the spread of COVID-19 calms down, exports may increase again, so the extent of this year's impact will vary depending on when the direction changes."

For the time being, the decline in South Korea's exports is bound to be greater than the decline in imports. This is because COVID-19 continues to spread in the US and Europe, making exports difficult, while domestically, COVID-19 is stabilizing, potentially increasing imports. Exports in March were $46.42 billion, down 3.3% year-on-year. Meanwhile, imports were $39.42 billion, decreasing by only 0.6% year-on-year. Director Park explained, "Although imports of raw materials and consumer goods decreased due to falling international oil prices and weakened consumer sentiment, imports of capital goods such as semiconductor manufacturing equipment increased, limiting the decline in imports." For the first quarter, exports decreased by 4.5%, while imports decreased by 1.7%.

The services balance improved. The service balance deficit in March was $1.46 billion, reduced by $640 million compared to $2.1 billion in the same month last year. The service balance deficit for the first quarter ($5.28 billion) also shrank by $1.9 billion year-on-year. However, this result is not welcome as it occurred due to COVID-19 causing people not to travel or visit, and a decrease in cargo volume. In particular, the travel balance deficit in March expanded by $200 million year-on-year to $370 million.

Due to a base effect from one-time large dividend payments in the first quarter of last year and a decrease in dividend income payments caused by deteriorating profitability of foreign direct investment companies, the primary income balance surplus for the first quarter increased by $2.34 billion year-on-year to $3.86 billion. The primary income balance in March also turned to a surplus (+$930 million) compared to the same month last year. The net assets in the financial account, which indicate capital inflows and outflows, increased by $13.82 billion in the first quarter. Foreigners' domestic stock investment decreased by $12.27 billion in the first quarter. Banks, facing difficulties in foreign currency conditions, increased borrowing, with borrowings rising by $15.2 billion in the first quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.