First Emergency Loan for Medium-Low Credit Fully Utilized

Second Loan to Begin in Earnest Next Month

[Asia Economy Reporter Kim Hyo-jin] Concerns are rising over a financial support gap for small business owners with medium to low credit ratings who have been affected by the novel coronavirus infection (COVID-19). This is because the first round of emergency loans prepared in March is about to be fully exhausted. Since the second round of emergency loan supply is expected to begin no earlier than the end of this month, small business owners with medium to low credit facing unprecedented financial difficulties are likely to be pushed into a 'financial cliff' for about a month.

According to financial authorities on the 4th, the ultra-low interest loan product (1.5%) from Industrial Bank of Korea targeting small business owners with credit ratings of 4 to 6 ended on the 29th of last month.

The government's financial support (loan) measures for small business owners in response to COVID-19 are broadly divided into three categories: the Management Stabilization Fund from the Small Enterprise and Market Service (SEMAS) for low-credit borrowers rated 7 or below, loans from Industrial Bank of Korea for medium-credit borrowers rated 4 to 6, and interest subsidy loans from commercial banks for high-credit borrowers rated 1 to 3.

The funds supported by SEMAS are expected to be depleted around the 5th to 6th of this month. Although the interest subsidy loans from 14 commercial banks still have some availability except for Woori Bank, which is expected to close on the 8th, these loans target borrowers with credit ratings of 1 to 3, so they do not provide a safety net for small business owners with medium to low credit who have relatively urgent cash needs.

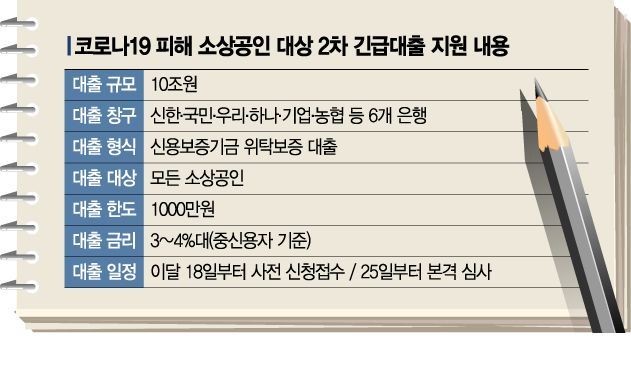

The government initially allocated 12 trillion won for emergency loans to small business owners in March, but as applications surged, it added 4.4 trillion won, increasing the budget to 16.4 trillion won. The second emergency loan program for small business owners, worth 10 trillion won and confirmed at the first Emergency Economic Central Countermeasures Headquarters (Economic Central Headquarters) meeting chaired by Deputy Prime Minister and Minister of Strategy and Finance Hong Nam-ki on the 29th of last month, will begin accepting pre-applications from the 18th.

Loans can be obtained at interest rates of 3-4% with a limit of 10 million won. Considering the 'loan bottleneck' that occurred when demand for the first loan concentrated on SEMAS and others, the loan application window has been unified to six commercial banks: Shinhan, Kookmin, Woori, Hana, Industrial Bank of Korea, and NongHyup. These banks will execute loans based on guarantees from the Korea Credit Guarantee Fund. Procedures such as loan application, reception, and guarantee screening will be handled in a one-stop process.

Although pre-applications will be accepted from the 18th, the full loan processing, including screening, will begin on the 25th. A representative from a commercial bank said, "We do not expect the bottleneck seen during the first loan," but added, "Considering the usual execution process of guaranteed loans, actual full-scale loan disbursement will likely be possible starting next month."

The Financial Services Commission has stated that it will strive to ensure that loans are disbursed to small business owners in need as early as this month.

Meanwhile, as COVID-19 prolongs, the number of people seeking policy financial products for low-income earners has increased. The government's emergency loan support measures have restrictions on eligibility, which is interpreted as the reason why many have relied on low-income financial services.

According to the Korea Inclusive Finance Agency, the supply scale of low-income financial products such as Microfinance, Worker’s Sunshine Loan, and Sunshine Loan 17 in March was 403.8 billion won, an increase of about 18% compared to the previous month (341.5 billion won). It is expected that demand for low-income financial services will grow further once the first round of emergency loans for small business owners is fully exhausted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.