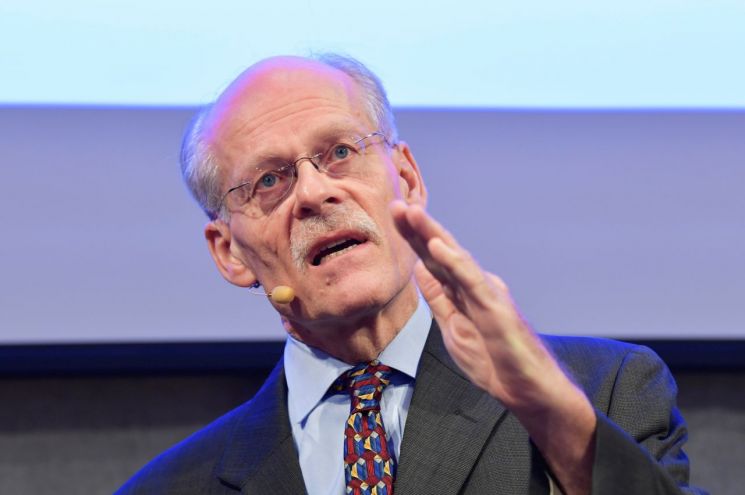

[Asia Economy Reporter Jeong Hyunjin] Stefan Ingves, Governor of Sweden's central bank Riksbank, said on the 28th (local time) that lowering interest rates is not appropriate as a measure to respond to the novel coronavirus disease (COVID-19) crisis. Riksbank is the first central bank among major countries to stop the negative interest rate policy experiment.

According to major foreign media, Riksbank froze the benchmark interest rate at 'zero (0)' level on the day and forecasted that the current level will be maintained until next year. Governor Ingves stated that his goal is to ensure that financial markets and credit supply function properly so that purchases of government bonds, commercial papers (CP), loans, and municipal bonds can be appropriately conducted.

Governor Ingves said, "The core issue is not the policy interest rate," adding, "We are stable at the zero level. At this point, the key is to ensure stability. Without stability, the market will freeze, and if the market freezes, what you do with the policy interest rate may not even become an issue."

Riksbank ended its five-year negative interest rate experiment at the end of last year and returned to zero interest rates. Riksbank explained that although it expected Sweden's economic growth rate to decline by 7-10% this year due to the impact of COVID-19, it chose zero interest rates to avoid the negative effects of negative interest rates.

Governor Ingves explained that setting 'zero' as a new effective lower bound for the policy interest rate, as some economists have suggested, is not the case. He emphasized, "We do not know what will happen in the future. The Swedish economy will be significantly hit, and we will do our best to mitigate the shock. We will move forward, and everything is on the table."

Riksbank's future interest rate outlook includes the possibility of both rate hikes and cuts. Governor Ingves said the central bank is prepared to expand the quantitative easing (QE) program if necessary, stating, "If the situation worsens, we are thinking of increasing it significantly beyond the current scale." However, when asked whether Sweden's economic impact might be less than that of other countries, he replied, "I don't know," adding, "There is still too much we do not know."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.