[Asia Economy Reporter Changhwan Lee] An analysis has emerged that the recent trend of low growth in South Korea, which falls below the potential growth rate, has become entrenched due to a decline in the contribution of total factor productivity (TFP) growth. It is argued that TFP must be increased by creating a business-friendly environment through regulatory reform and accelerating innovation. Total factor productivity is a measure of the efficiency of various production factors such as labor, capital, and land.

The Korea Economic Research Institute (KERI) released a report titled "Analysis of Factors Weakening Growth Potential" on the 26th, stating this. The trend of actual growth rates falling below potential growth rates has been clearly shown in medium-term trend analyses conducted every five years since the 1990s.

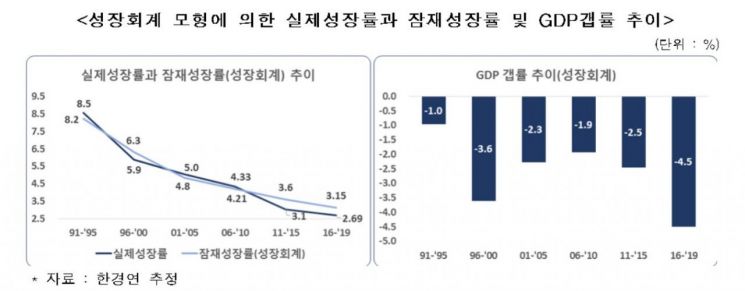

Using a growth accounting model to estimate potential growth rates, the report explained that for the first time since the 1996?2000 period, which experienced the foreign exchange crisis, the actual growth rate was below the potential growth rate for two consecutive periods: 2011?2015 and 2016?2019. This indicates that the recent low growth trend has become entrenched.

In particular, the GDP gap rate in the late 2010s (2016?2019) was -4.5%, which was even larger than the -3.6% during the 1996?2000 foreign exchange crisis period. The GDP gap rate shows the difference between actual GDP and potential GDP.

South Korea's sharp decline in growth rate was also clearly evident in international comparisons. Compared to 2011, among 34 OECD countries in 2019, South Korea's rankings dropped by 8 places from 7th to 15th in economic growth rate, by 7 places from 3rd to 10th in potential growth rate, and plummeted by 29 places from 1st to 30th in GDP gap rate.

This sharp decline in South Korea's growth rate contrasts with the case of Ireland. Ireland created a business-friendly environment through structural reforms such as lowering corporate tax rates and signing social solidarity agreements for labor-management stability, which dramatically increased foreign investment. As a result, during the same period (2011 compared to 2019), Ireland's rankings among 34 OECD countries jumped 29 places from 30th to 1st in economic growth rate, 18 places from 19th to 1st in potential growth rate, and 29 places from 31st to 2nd in GDP gap rate.

KERI explained that the recent growth slowdown in South Korea is due to a decline in the contribution of total factor productivity growth. The economic growth rate, which peaked at an average of 9.5% in the 1980s, fell to an average of 3.0% in the 2010s.

When KERI calculated the growth contributions of labor, capital, and total factor productivity, it found that the contribution rate of total factor productivity declined from 41.8% in the 2000s to 24.8% in the 2010s, identifying this as a major cause of the growth slowdown. The contribution rate of total factor productivity was around 40% from the 1980s through the 2000s but sharply dropped to about 25% in the 2010s.

KERI emphasized that to increase the growth potential of the Korean economy, it is necessary to focus on increasing total factor productivity among the growth determinants such as labor, capital, and total factor productivity. This is because, at the stage where economic development has reached an advanced country level, it is difficult to sustain growth by continuously increasing labor and capital inputs.

KERI explained that increasing labor input has limitations in a situation where the working-age population is decreasing due to low birth rates and aging. Although female labor force participation has increased, this alone is insufficient to offset the overall decline in the working-age population and the rapid reduction in working hours due to the 52-hour workweek system.

KERI also pointed out difficulties in increasing capital input. As capital accumulates, the marginal productivity of capital decreases, and incentives for capital input have weakened due to corporate tax rate increases and reduced tax incentives.

KERI highlighted the need for regulatory reform related to businesses to increase total factor productivity. Business regulatory reform can raise total factor productivity while also contributing to increased labor and capital inputs by making the labor market more flexible and reducing investment costs.

Choo Kwang-ho, Director of Economic Policy at KERI, said, "Due to the recent weakening of the economic structure, the low growth trend below the potential growth rate continues, and the growth rate in the first quarter of this year recorded -1.4% quarter-on-quarter, raising concerns about negative growth this year due to COVID-19." He added, "We must raise the growth rate through technological innovation, regulatory reform, and the advancement of legal and institutional frameworks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)