As Applications Concentrate on Prime Companies, Struggling Firms Face Dead Ends

Banking Sector Shares Government Policy but Fears Being Blamed for Insolvency

[Asia Economy Reporters Kangwook Cho, Hyojin Kim] Since the outbreak of the novel coronavirus disease (COVID-19), the government has announced five rounds of measures, offering support plans worth hundreds of trillions of won. However, companies continue to suffer from a cash shortage, which is interpreted as a phenomenon of the rich getting richer and the poor getting poorer. Bank support is concentrated only on companies with high credit ratings, while funds are not being released to companies with low to medium credit ratings that are actually pushed to the brink. Due to the impact of COVID-19, the scale of corporate bond issuance has halved compared to last year, worsening funding conditions. The industrial sector is increasingly concerned that small and medium-sized enterprises with low credit ratings are being driven to the brink of collapse. There are even concerns that the surge in potentially insolvent companies, caused by a real economy shock exceeding expectations and growing deflation fears, could act as a vicious cycle linking the real economy and financial markets, potentially triggering a financial crisis.

◆ Tightening of the capital market worst since the financial crisis = According to the Bank of Korea, the Business Survey Index (BSI) for March fell 11 points from the previous month to 54. This is the largest drop ever and the lowest figure since February 2009 (52), when the financial crisis was at its peak. The index being below the baseline of 100 means that more companies are pessimistic than optimistic. Since the Bank of Korea began compiling related statistics in January 2003, this is the first time the index has dropped by 11 points.

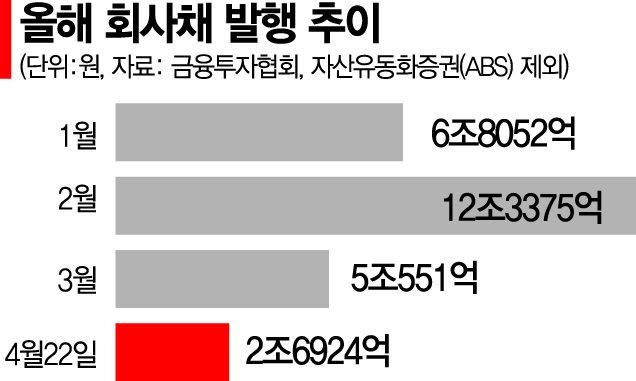

Moreover, the total amount of corporate bonds maturing between April and December is 20.6 trillion won, and commercial paper (CP) amounts to 15.4 trillion won, totaling 36 trillion won. Of this, 20.3 trillion won matures in the second quarter, including 8.9 trillion won in corporate bonds and 11.4 trillion won in CP. To repay maturing corporate bonds immediately, companies must issue new bonds. However, the issuance volume in April was 2.7 trillion won, half of the same period last year, and with the capital market tightening, companies’ funding difficulties have intensified, making each day feel like walking on thin ice.

Facing difficulties in issuing corporate bonds, even large companies have increased their overdraft loans, known as "minus accounts," to secure cash. The problem is that the longer the COVID-19 crisis continues, the faster non-prime companies will be pushed into critical situations.

Professor Sangbong Kim of Hansung University’s Department of Economics said, "Prime companies have the capacity to raise funds through the corporate bond market, but the problem lies with non-prime companies rated BBB or below. These companies need rapid financial support, but it takes time to assess the extent of their problems, which delays funding."

◆ Government urges fund release... Banks say "concerned about defaults" = The government is indirectly and directly pressuring banks to support companies by relaxing various soundness-related regulations and introducing immunity measures against defaults. First, to ease the burden of overseas borrowing by financial companies, the foreign currency soundness charge has been exempted for three months starting this month. An immunity system has also been implemented. The "Regulations on Financial Institution Inspections and Sanctions" were amended to encourage active support for companies affected by COVID-19, stipulating that unless there are significant procedural defects, banks will not be held responsible for loans and resulting defaults.

However, while the banking sector sympathizes with the government’s stance that banks must play as large a role as possible amid the prolonged and entrenched COVID-19 crisis domestically and internationally, they are concerned because responsibility for defaults cannot be shared with anyone else.

An official in the credit department of a commercial bank lamented, "Which bank officer would later be able to say ‘don’t hold me responsible’ by citing the government’s immunity measures when defaults occur?"

A senior executive at another commercial bank said, "Companies that used to avoid banks due to high interest rates suddenly rely heavily on banks as the corporate bond market deteriorates." He added, "Especially for companies rapidly falling into insolvency due to COVID-19, they prepare self-rescue plans and seek additional loans, but how many times have such plans by insolvent companies ended up falling apart halfway?"

Banks say it is already difficult enough to minimize the expected "COVID shock" starting in the second quarter. This is because the impact of the Bank of Korea’s "big cut" (large interest rate reduction) is being fully reflected, increasing downward pressure on net interest margins (NIM), and domestic economic contraction is expected to deliver a direct blow.

Professor Duyong Yang of Kyung Hee University’s International Studies Department said, "The government and the National Assembly should take a more proactive stance and allow the Bank of Korea to directly purchase corporate bonds." He added, "Ultimately, it is a choice between moral hazard and timely funding to prevent corporate bankruptcies. The U.S. is implementing bold and aggressive policies because the situation there is more serious than ours."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.