[Asia Economy Reporter Kim Hyo-jin] It has been identified that financial complaints in the banking sector increased last year due to incidents such as the incomplete sales of overseas interest rate-linked derivative-linked funds (DLF) and the suspension of redemptions by Lime Asset Management. In terms of overall proportion, complaints in the insurance sector remained the highest.

On the 20th, the Financial Supervisory Service (FSS) announced the '2019 Financial Complaints and Financial Counseling Trends' report containing these details.

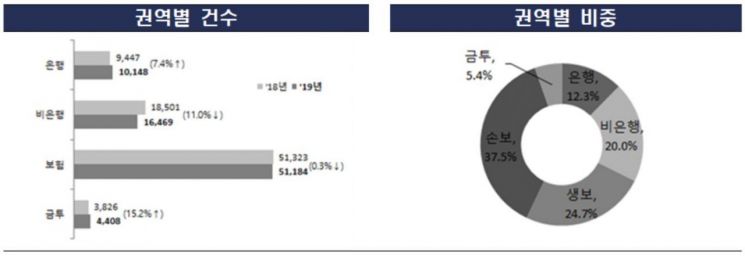

Last year, the total number of financial complaints, financial counseling, and heir inquiries amounted to 729,794 cases, a 5.7% (43,915 cases) decrease compared to the previous year (773,709 cases). Financial complaints and financial counseling decreased by 1.1% and 10.8%, respectively, while heir inquiries increased by 6.1%. By sector, complaints in the banking sector increased by 7.4% to 11,148 cases compared to 9,447 cases the previous year.

The FSS analyzed that this was due to large-scale consumer damages caused by incomplete sales of DLF and suspension of Lime fund redemptions.

Complaints in the financial investment sector also increased by 15.2% to 4,408 cases compared to 3,826 cases the previous year. Complaints against securities companies rose by 22.2%, accounting for the largest share at 62.3%, which was attributed to numerous complaints arising from stock trading system failures.

Complaints in the non-banking sector, including card companies, loan businesses, credit information companies, and mutual savings banks, decreased by 11.0% to 16,469 cases compared to 18,501 cases the previous year. This was largely due to a base effect from the sharp increase in P2P investment damage complaints in 2018, which led to a significant decrease in loan business complaints. Among industries, card companies accounted for the highest proportion at 36.9%.

Looking at the overall complaints by sector, the insurance sector accounted for the largest share at 62.3%. Life insurance accounted for 24.7%, and non-life insurance for 37.5%. Complaints against life insurance companies decreased by 5.4% to 20,338 cases compared to the previous year, while complaints against non-life insurance companies increased by 3.5% to 30,846 cases.

In the case of life insurance companies, complaints related to insurance solicitation types, such as incomplete sales of whole life insurance, increased by 13.3%. For non-life insurance companies, complaints related to insurance claim calculation and payment were the most frequent at 43.1%. The insurance sector also accounted for the largest share of complaints at 61.7% in 2018.

By age group, the 30s accounted for the highest proportion of financial complaints at 30.1%, followed by the 40s (25.1%), 50s (19.5%), 20s (13.2%), and 60s (9.7%).

Last year, the number of processed financial complaints was 79,729 cases, a 2.0% increase compared to the previous year. The average processing period for financial complaints was 24.8 days, which was 6.6 days longer than the previous year due to the occurrence of large-scale dispute complaints such as DLF. The complaint acceptance rate averaged 36.4%, a 0.4 percentage point increase from the previous year.

An FSS official stated, "Problems arising from the design and sales process of specific financial products caused consumer damages and dissatisfaction, leading to an increase in complaints," adding, "We plan to strengthen monitoring at each stage of financial product design, solicitation, and sales, and activate consumer alerts for products with high consumer damage risks."

The FSS official also said, "Although most insurance product complaints were similar to or decreased compared to the previous year, complaints related to whole life and variable insurance increased significantly," and added, "We will guide insurance companies to thoroughly implement monitoring (happy calls) during the product sales process and conduct complete sales education for solicitation organizations such as insurance planners with high incomplete sales rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.