[Asia Economy Reporter Naju-seok] Despite the largest-ever production cut agreement, international oil prices continue to fall relentlessly. Due to the decrease in demand caused by the novel coronavirus infection (COVID-19), crude oil inventories are accumulating, causing international oil prices to drop to their lowest level in 18 years.

On the 15th (local time) at the New York Mercantile Exchange, May delivery West Texas Intermediate (WTI) crude oil closed at $19.87, down 1.2% ($0.24) from the previous trading day. Following a 10.3% ($2.3) plunge to $20.11 on the 14th, prices fell again. This marks the lowest level for WTI since February 2002 ($19.64). At the London ICE Futures Exchange, June Brent crude also dropped 6.45% ($1.91) to close at $27.69.

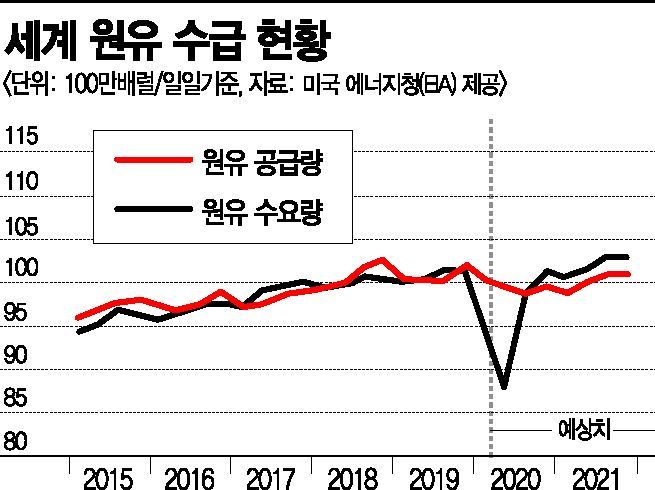

The oil market was dominated by demand shock and concerns over inventory buildup. The International Energy Agency (IEA) forecasted that the energy market would face an unprecedented shock this year due to COVID-19. The IEA estimated that oil demand this month would decrease by an average of 29 million barrels per day compared to last year. The demand contraction is expected to continue, with oil demand projected to be down by an average of 23.1 million barrels per day throughout the second quarter. Considering that production cuts will begin next month, crude oil inventories are structurally bound to keep increasing.

Although the Group of Twenty (G20), including South Korea, the United States, China, and India, agreed to expand strategic petroleum reserves, no concrete plans have yet been announced, which also had a negative impact. The IEA stated in its report, "We are still waiting for each country's plans regarding strategic reserve acquisition measures." The IEA added, "OPEC+ (the Organization of the Petroleum Exporting Countries (OPEC) member countries and non-OPEC allies) made a historic decision to cut production by 9.7 million barrels per day, preventing the situation from becoming even more severe," but also warned, "With daily crude oil inventories increasing by 12 million barrels in the first half of this year, the oil-related industries such as transportation, pipelines, and storage tanks are still at risk of being overwhelmed."

The lack of progress in production cut discussions within the United States was also a negative factor. The Texas Railroad Commission, which determines crude oil production levels in Texas, held about 10 hours of discussions on production cuts but failed to reach an agreement. The commission held a public hearing to discuss limiting crude oil production, but due to significant differences in opinions among companies, no concrete consensus was reached. Small and medium-sized oil producers supported the cuts, but large companies with financial capacity strongly opposed them.

On the other hand, the confirmation that U.S. crude oil inventories, excluding strategic reserves, increased also acted as a negative factor. The U.S. Energy Information Administration announced that as of the 10th, U.S. crude oil inventories rose by 19.2 million barrels. This figure greatly exceeded the market expectation of 12.02 million barrels. Crude oil is accumulating without being refined.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)