Rising Gold Gifts Amid COVID-19 Crisis

Value Increase and Social Distancing Impact

'Gift Service' Sees Growth in Gold Product Sales

Popularity Expected to Continue Due to Currency Depreciation

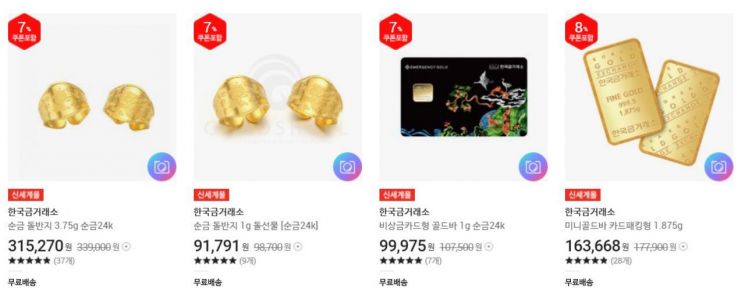

SSG.com analyzed the top 100 best-selling products in the 'Gift' section during March and found that 'Dolbanji' ranked within the top 5. The photo shows gold-related products sold on SSG.com.

SSG.com analyzed the top 100 best-selling products in the 'Gift' section during March and found that 'Dolbanji' ranked within the top 5. The photo shows gold-related products sold on SSG.com.

[Asia Economy Reporter Seungjin Lee] Pure gold baby rings, which had been forgotten for a while, are gaining popularity due to the novel coronavirus infection (COVID-19). This is because more people are choosing to conveniently gift baby rings through various apps instead of attending first birthday parties in person due to social distancing measures. The steady rise in gold prices influenced by COVID-19 has increased their value as gifts, and the convergence of the spread of untact (contactless) culture and the development of online commerce is seen as the reason behind this trend.

On the 14th, SSG.com analyzed the top 100 products sold in the 'Gift' section during March and found that a gold baby ring weighing one don (3.75g) ranked within the top 5. According to SSG.com, gold rings and gold-related products had not entered the top 100 gift rankings in recent years. This clearly reflects the changed status of gold's 'value' recently.

Gold, considered a safe asset, had lost popularity as a first birthday gift in the past due to several sharp price drops. Instead, trends shifted toward gifting baby products and home appliances, but with the recent surge in gold prices, gold has regained its position as a popular gift. Especially with the spread of contactless culture due to COVID-19, more people are using 'Gift' services that allow gifting with just a few clicks.

Office worker Kim Ji-hye (30, pseudonym) recently chose a gold ring as a gift for a colleague's first birthday party for these reasons. Kim said, "It was my first time giving a first birthday gift, so I searched a lot online, and most opinions suggested gifting a gold ring since gold prices keep rising." She added, "However, since it was burdensome to meet in person due to working from home, I used an online 'Gift' service to send the present."

As gold is once again regarded as a safe asset, the number of consumers attempting financial investment through gold is also increasing. As of April, sales of gold-related products listed on KakaoTalk's 'Gift' service have increased by more than 50% compared to the previous year.

Among these, consumers purchasing 1g gold in the form of an emergency fund card are particularly increasing. Since it can be purchased for around 100,000 won, it is not a significant financial burden, making it popular among office workers and housewives who want to hold gold as an emergency fund. Housewife Seong Ju-young (31, pseudonym) explained, "The gold ring I received as a gift for my daughter's first birthday last year has increased in price by more than half in one year," adding, "I recently purchased gold in card form because I believe gold prices will continue to rise in the long term."

The popularity of gold is expected to continue for the time being. This is due to growing concerns that the value of currencies such as the dollar will decline as the U.S. embarks on quantitative easing policies and central banks of various countries also inject money. Additionally, pessimistic economic forecasts due to the prolonged COVID-19 pandemic are continuing, so the preference for safe assets centered on gold is expected to persist.

Meanwhile, according to the Korea Exchange, on the 13th, the price of 1g of 1kg gold spot in the KRX gold market closed at 66,150 won, up 1.24% from the previous trading day. This marked the highest gold price since the opening of the KRX gold market in March 2014. International gold prices also surged, with the COMEX June delivery gold futures price in New York reaching $1,736.20 per ounce.

Gold prices rose earlier this year but plunged after COVID-19. This was due to asset holders selling gold to secure cash. However, as the U.S. and other central banks worldwide engaged in quantitative easing due to COVID-19, investors concerned about currency depreciation turned to gold, pushing prices back up. In the market, gold and silver are gaining attention as investment destinations that can avoid the decline in the dollar's value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)