[Asia Economy Reporter Naju-seok] Although oil-producing countries such as Saudi Arabia and Russia have decided to implement the largest-ever crude oil production cuts, the oil price market is not stabilizing. Not only is the reduction in supply failing to keep up with the decline in demand, but the already accumulating crude oil inventories make it difficult to predict price stabilization.

On the 13th (local time), despite the news that OPEC+ (the Organization of the Petroleum Exporting Countries (OPEC) member countries and non-OPEC allies) will cut daily crude oil production by 9.7 million barrels starting next month, international oil prices showed a downward trend. At the New York Mercantile Exchange (NYMEX), West Texas Intermediate (WTI) crude oil closed at $22.41 per barrel, down $0.35 (1.5%) from the previous trading day.

Even as countries imposed lockdown measures due to the novel coronavirus disease (COVID-19), causing a sharp drop in oil demand, Saudi Arabia instead increased production, engaging in a price war. While the recent production cut decision marks an end to the price war and is a point to consider for market stabilization, concerns remain that supply and demand will not be balanced.

The primary issue is that crude oil already released into the market due to the price war and other factors has accumulated, making it difficult to resolve the oversupply situation. Although the production cut agreement has bought some time, the moment when all crude oil storage capacity is full is not far off. Edward Morse, head of commodity research at Citigroup in the U.S., stated, "The real effect of the production cuts will impact the second half of this year, potentially raising oil prices to around $40 per barrel," but also pointed out, "From mid-last month to late next month, crude oil inventories will accumulate, causing prices to fall into single digits." This indicates that the timing of the production cuts was late.

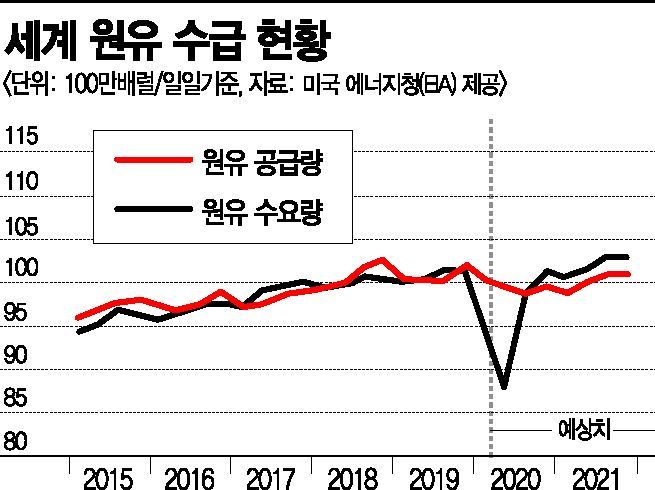

More fundamentally, the decline in demand exceeds the scale of supply reduction. Inside and outside the market, it is estimated that global crude oil demand has decreased by 30 million barrels per day. Therefore, a production cut of 9.7 million barrels per day is insufficient.

Some estimate the actual production cut to be around 7 million barrels per day. Consulting firm Energy Aspect estimated that based on the first quarter of this year, the actual production cut is approximately 7 million barrels per day.

On the other hand, there are forecasts that the production cut scale could increase further. U.S. President Donald Trump mentioned on Twitter that "the production cut under consideration by OPEC+ is not the generally reported 10 million barrels per day, but 20 million barrels per day."

Alexander Novak, Russian Minister of Energy, also stated in an interview with a Russian TV channel that "the total production cut by major oil-producing countries in May and June will reach 15 to 20 million barrels per day." He added that countries not participating in OPEC+, such as the U.S. and Norway, have also expressed intentions to cut production.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.