Shale Companies' Debt to Repay Over 5 Years Reaches $86 Billion

Saudi-Russia Chicken Game Drives Oil Prices from $63 to $22

Energy Industry Shaken by Ultra-Low Oil Prices, US Economy Wobbles

Concerns Over Financial Crisis from Energy Companies' Debt Affecting Major Banks

[Asia Economy Reporter Kwon Jaehee] Since the first North American shale company, Whiting Petroleum, filed for bankruptcy protection on the 1st, shale companies have all turned into 'Fallen Angels.' Fallen Angels refer to companies with high credit ratings that have been downgraded due to temporary difficulties.

According to the corporate credit rating trends provided by credit rating agency Standard & Poor's (S&P) on the 13th (local time), 14 shale companies had their ratings downgraded between the 6th and 10th of this month, all falling below investment grade to 'junk rating (BB+)' or lower. Bloomberg reported at the end of last month that since 2016, more than 50% of corporate bonds issued by US energy companies were junk-rated, and the credit conditions in the industry have worsened further since then.

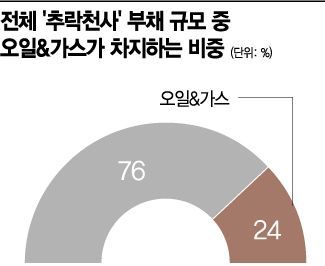

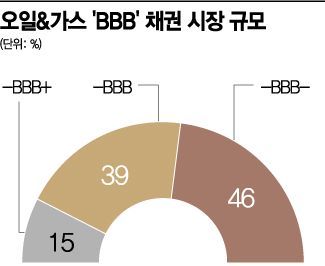

In a recent report titled 'Recession Preparedness for Increasing BBB-Rated Fallen Angels,' S&P classified 24% of companies categorized as Fallen Angels as energy companies. Among BBB-rated corporate bonds, about 46% were at 'BBB-', just above junk status. Only 15% were at the relatively higher 'BBB+' level. Notably, the debt shale companies must repay from 2020 to 2024 amounts to $86 billion (approximately 107 trillion KRW). Occidental Petroleum, an oil development company including shale gas, holds the largest debt at $44 billion (approximately 53 trillion KRW). The argument that a financial crisis could occur if these corporate bonds plunge en masse to junk status is gaining credibility.

◆ Unable to Survive Even a Month Amid Ultra-Low Oil Prices = The US shale industry has steadily grown over the past five years despite relatively high production costs. This was possible because international oil prices remained above $50 per barrel, ensuring profitability. Thanks to abundant shale gas reserves, the US became a net oil exporter for the first time in 70 years starting last year. It also joined Russia and Saudi Arabia as one of the world's top three oil producers. However, this success attracted envy from other oil-producing countries.

A clear example was the failed production cuts by Russia and Saudi Arabia in February and March. Oil-producing countries, including OPEC, have been pushing for production cuts to keep international oil prices around $50 to $60 per barrel, but the US shale industry increased its market share, becoming a thorn in their side.

Ultimately, at the end of February, Russia declared it would leave the production cut alliance, triggering a 'chicken game' between Saudi Arabia and Russia. International oil prices plunged from $63 per barrel at the beginning of this year to $22 per barrel (WTI), ushering in an era of ultra-low oil prices.

Low oil prices benefit the US, which has high energy demand, but they hit shale companies directly. Considering that shale companies' break-even point is at least $30 per barrel, the damage caused by the Russia-Saudi chicken game took less than a month. Although oil-producing countries recently agreed to historic production cuts, it is expected to take considerable time for shale companies to restore their credit.

◆ Elevated Status Shakes US Economy = The chain bankruptcies of shale companies were anticipated. Extracting oil from shale requires drilling wide and deep because the oil is trapped in sand. Unlike conventional oil fields, production costs are inevitably high. To reduce the chronic weakness of drilling costs, companies raised funds and expanded technological investments amid the shale boom since 2010, competing to improve production efficiency. This ultimately increased risks in the corporate bond market.

The growth of the shale industry raises concerns about a critical blow to the US economy. Since the 2008 financial crisis, shale companies have become a core industry in the US. Corporate-friendly policies such as corporate tax cuts under the Barack Obama administration decisively contributed to the shale industry's growth. As a result, shale companies accounted for 10% of the US Gross Domestic Product (GDP) as of last year.

The shale companies' crisis translates into fear on Wall Street. According to CNBC, major Wall Street banks have lent about 7-15% of their capital to energy companies. BOK Financial in Oklahoma, the origin of shale, has lent more than 100% of its capital and about 18% of its total loans to the energy sector, indicating higher risk. Additionally, more than ten small and medium US banks have invested over 25% of their capital in the energy sector. The number of shale company bankruptcies has already increased from 24 in 2017 to 28 in 2018 and 42 last year, with dominant forecasts expecting even more bankruptcies this year.

The New York Times (NYT) reported that as the number of Fallen Angels increases, Wall Street financial firms such as JPMorgan, Citigroup, and Goldman Sachs are refusing long-term loans to companies and only allowing short-term loans of less than three years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.