Private Equity Fund 'JC Partners' as a Preliminary Bidder... Interest in Whether It Will Also Resolve the Sale of Daewoo Construction and Daewoo Shipbuilding

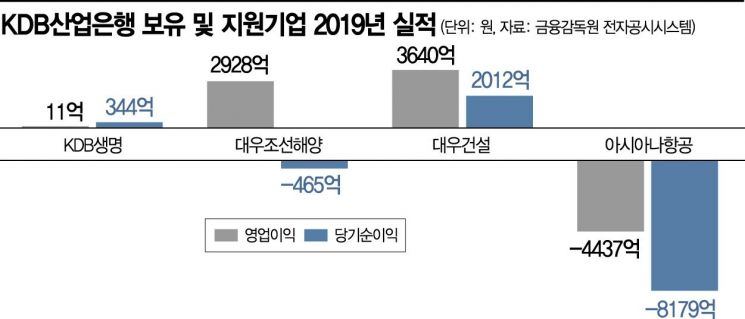

[Asia Economy Reporter Kangwook Cho] Lee Dong-geol, Chairman of KDB Industrial Bank, is unraveling the long-standing challenges starting with KDB Life Insurance. KDB Life Insurance, which had its sale fail three times over the past 10 years, is now highly likely to find a new owner after a fourth attempt. With Lee’s term expiring in September, attention is focused on how he will resolve pending tasks such as the sales of Daewoo Construction and Daewoo Shipbuilding & Marine Engineering during his remaining tenure.

On the 13th, according to sources from the Industrial Bank and the financial sector, mid-sized private equity fund (PEF) JC Partners recently completed due diligence and management interviews regarding KDB Life Insurance.

An Industrial Bank official said, "Among the preliminary bidders, JC Partners was the first to conduct and complete due diligence," adding, "Following the main bidding, the preferred negotiator will be selected, but due to the spread of COVID-19, the schedule has not yet been determined."

Industry insiders believe that the Industrial Bank, which holds KDB Life Insurance, and Kansas Asset Management are likely to select JC Partners as the preferred bidder for KDB Life Insurance acquisition. JC Partners plans to purchase 92.73% of KDB Life Insurance’s shares for about 200 billion KRW and then inject an additional 300 billion KRW through a paid-in capital increase. Combined, the purchase funds would total approximately 500 billion KRW. Furthermore, JC Partners is reported to have presented a blueprint to transform KDB Life Insurance into a co-reinsurance company in collaboration with the reinsurance division of the U.S. PEF Carlyle.

KDB Life Insurance has been considered a "painful finger" for the Industrial Bank. After taking over the company during Kumho Group’s restructuring in 2010, the bank initially planned to resell it within five years, but all three sale attempts failed. During this process, its business capability weakened, and financial soundness deteriorated significantly. Since his appointment in September 2017, Chairman Lee has focused on normalization efforts, hiring insurance expert Professor Jung Jae-wook from Sejong University’s Business Administration Department as KDB Life Insurance’s president in February 2018. This effort resulted in KDB Life Insurance, which had recorded losses for three consecutive years since 2016, turning a profit with a net income of 34.4 billion KRW on a consolidated basis last year.

In the financial sector, Lee’s flexible stance on the sale price is cited as a key reason for the imminent resolution of this decade-long issue. In the October 2022 National Assembly audit, Lee stated, "The market values the sale price of KDB Life Insurance’s old shares between 200 billion and 800 billion KRW." He also explained, "I believe selling is more helpful and minimizes costs rather than holding out for a higher price," signaling a willingness to be flexible on price adjustments in the market.

However, if the sale price is decided as proposed by JC Partners, concerns about a fire-sale price are inevitable. Previously, the Industrial Bank spent 650 billion KRW solely on acquiring KDB Life Insurance. Including paid-in capital increases and other investments, the total funds poured into KDB Life Insurance are estimated to reach 1.25 trillion KRW.

Even after the KDB Life Insurance acquisition is finalized, Chairman Lee faces numerous challenges. In 2018, the Industrial Bank accelerated the sale of Daewoo Construction by selecting Hoban Construction as the preferred bidder, but the deal fell through when Hoban Construction withdrew. In March last year, a final contract was signed with Hyundai Heavy Industries Group for the acquisition of Daewoo Shipbuilding & Marine Engineering, but the merger review results have yet to be announced. The merger review is conducted in six countries where the two companies generate significant sales: Korea, the EU, Japan, China, Singapore, and Kazakhstan. If any one country opposes, the acquisition will be canceled. So far, only Kazakhstan has approved the merger.

The ongoing sale of Asiana Airlines is also facing difficulties. Recently, the aviation industry has plunged into an unprecedented recession, leading to extreme rumors that HDC Hyundai Development Company might abandon the acquisition of Asiana Airlines. HDC Hyundai Development is reportedly engaged in behind-the-scenes negotiations to change acquisition conditions, including requesting additional loans from the Industrial Bank and deferral of existing Asiana Airlines loan repayments. The Industrial Bank is also central to supporting Doosan Heavy Industries and Ssangyong Motor, both struggling financially.

Since his appointment, Chairman Lee has been actively pursuing corporate privatization, stating in March last year, "I am proceeding with the sale of Daewoo Shipbuilding & Marine Engineering with the determination to step down as chairman." Accordingly, the market anticipates that the sale of KDB Life Insurance could be a positive signal to untangle the complicated issues. However, due to the impact of the COVID-19 pandemic worsening corporate performance, unless Lee is reappointed, it is widely expected that resolving the accumulated tasks by the end of his term in September will be difficult.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.