Corporate Credit Downgrade Spurs Bold Measures

Purchase of Secured Loan Claims Included

Expanding Role as Market's Largest Lender

Chairman Powell Ventures into Uncharted Territory Unexplored by Greenspan, Volcker, Bernanke

Junk Bonds and Gold Rally

[Asia Economy New York=Correspondent Baek Jong-min] Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), has stepped into uncharted territory that even historic former chairmen who navigated major U.S. economic crises?such as Paul Volcker, Alan Greenspan, and Ben Bernanke?had never experienced.

The $2.3 trillion (approximately 2,800 trillion KRW) liquidity injection announced by the Fed on the 9th (local time) is being evaluated as an unprecedented measure. It also reflects a resolute determination to prevent a larger crisis by preemptively blocking the spread of the crisis, which began in the real economy, from spilling over into the financial markets.

The market has responded positively to the Fed’s decision to purchase even junk bonds. Antonio Weiss, a senior fellow at Harvard Kennedy School who served as a Treasury official during the Barack Obama administration, said, "The breadth and diversity of the policy are significant," and praised it as "truly creative and decisive." He added, "The Fed is playing a better role in modern history than any previous Fed."

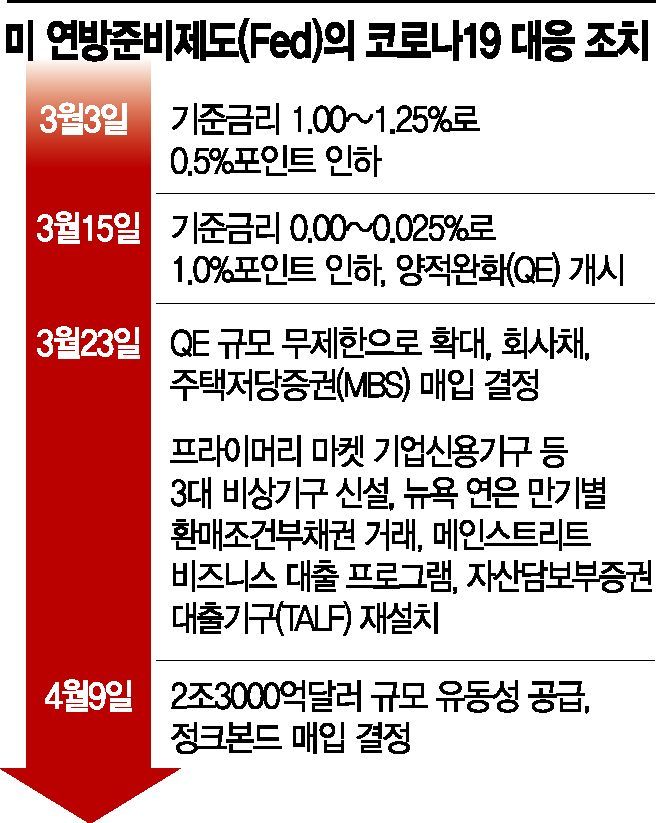

Powell’s proactive actions, taken preemptively as the crisis caused by the novel coronavirus disease (COVID-19) intensified, were reaffirmed. Last month, Powell convened two unscheduled Federal Open Market Committee (FOMC) meetings, slashed the benchmark interest rate to 0.00?0.25%, and implemented unlimited quantitative easing (QE), faithfully fulfilling the role of the market’s lender of last resort.

Most of Powell’s decisions were made around events expected to severely impact the market. On this day, news broke that 6.6 million new unemployment claims had been filed in the U.S. last week, and investment bank JP Morgan warned that the U.S. economy could contract by up to 40% in the second quarter.

Some voices expressed concerns about 'moral hazard' over the decision to purchase bonds of companies downgraded to junk status due to credit rating downgrades, but the argument that any policy is necessary in a crisis gained more traction. On this day, the Fed also unveiled plans to purchase commercial mortgage-backed securities (CMBS) and collateralized loan obligations (CLOs) along with junk bonds.

Mark Bitner, chief economist at Wells Fargo, said, "This measure comes amid many companies’ ratings falling under heavy debt," and evaluated it as "focusing more on fallen angels than on devils."

Purchasing municipal bonds to support local governments is in a similar vein. New York City, which has recorded 87,000 infections, is expected to face a budget deficit of $10 billion to $15 billion this year.

Chairman Powell is also actively communicating with the market. On the 25th of last month, he appeared on a broadcast emphasizing that there is sufficient ammunition, and on this day, he declared a strong commitment to maintaining zero interest rates for a considerable period through a virtual seminar to support economic recovery.

Economic media outlet CNBC said, "By including junk bonds on its shopping list, the Fed has fired a much bigger bazooka," calling it "very impressive and the most aggressive."

On this day, the U.S. stock market rose over 1%, escaping the fear of massive unemployment. The S&P 500 index showed its largest weekly gain since 1947. Bloomberg reported that junk bonds experienced their biggest rally since 1988. The spread, which refers to the difference between junk bond yields and U.S. Treasury yields, fell to its lowest level since March 13. Meanwhile, gold prices rose 4% to trade around $1,740 per ounce, approaching an all-time high again as a reaction to the massive liquidity injection.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.