[Asia Economy Reporter Seulgina Cho] KT, the telecommunications industry leader in sales, was found to have spent less than 1 won on research and development (R&D) for every 100 won earned last year. SK Telecom and LG Uplus were equally stingy with their R&D investments, leading to criticism that the three major telecom companies are neglecting preparations for future growth. This raises concerns as it not only hampers proactive responses in the era of the Fourth Industrial Revolution, including artificial intelligence (AI), but also leads to a decline in the quality of telecommunication services and loss of growth momentum.

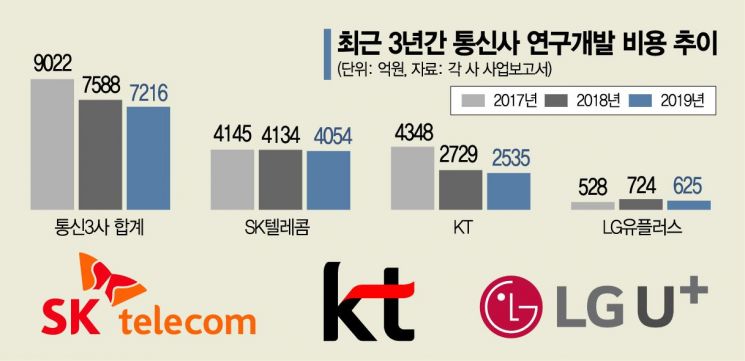

◆ Further Decrease in R&D Expenses = An analysis of the business reports of the three telecom companies by Asia Economy on the 10th revealed that last year, the total R&D expenses (including subsidiaries and before deducting government subsidies) of KT, SK Telecom, and LG Uplus amounted to 721.68 billion won, a 4.91% (37.267 billion won) decrease compared to the previous year. This marks a decline for two consecutive years.

By company, SK Telecom spent 405.497 billion won on R&D, down 7.983 billion won (-1.93%) from the previous year. KT and LG Uplus invested 253.521 billion won and 62.59 billion won respectively, representing decreases of 19.42 billion won (-7.12%) and 9.864 billion won (-13.61%) compared to a year earlier. Considering that the combined marketing expenses of the three telecom companies last year were in the 8 trillion won range, comparable to their annual capital expenditures (CAPEX), these R&D investments are extremely insufficient. Despite the companies’ overall calls for detelecommunication and expansion of new growth engines, they have been criticized for not being proactive in R&D.

For KT, the ratio of R&D expenses to sales was only 0.68%, meaning that for every 100 won earned, 0.68 won was spent on R&D. This is 0.07 percentage points lower than the previous year. LG Uplus, the third-largest operator among the three telecom companies, also failed to escape the stigma of being in the '0%' range with a ratio of 0.42%. SK Telecom’s R&D expense ratio was 2.29%, higher than its competitors, but it decreased by 0.16 percentage points compared to the previous year.

◆ Industry Voices "No Capacity Left" = Industry insiders complain that due to the burden of network investments following the commercialization of 5G, there is insufficient capacity for R&D investment. All three telecom companies recorded earnings shocks in 2018, the year before 5G commercialization, due to 5G capital expenditures and cutthroat competition, and their operating profits fell by about 10% last year as well. Amid ongoing 5G investment burdens, pressure from the government and political circles to reduce telecom fees is intensifying. This is why there are complaints that maintaining even the usual level of R&D investment is difficult, let alone expanding it.

In particular, the reduction in R&D investment by telecom companies raises concerns as it will ultimately hinder securing future growth engines. Examining each company’s R&D investment details shows a focus on new growth businesses such as enhancing AI R&D capabilities, securing core technologies, and developing key B2B platforms. An industry official said, "R&D investment is important for securing growth engines," adding, "Ultimately, it can only lead to a decline in competitiveness and service quality."

This year, the telecommunications companies’ performance, which was initially expected to improve, has been clouded by the COVID-19 pandemic. The slower-than-expected acquisition of 5G subscribers and a sharp drop in roaming revenue are expected to cause the three telecom companies’ operating profits in the first quarter to decline by double digits compared to the previous year. The three companies have also prepared scenarios under an emergency management system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.