Starting Operation Today... Capital Call

Payment to KTB Trust Management Mo Fund

Fund Splitting on Sharp Drop Below Certain Level

Specific Detailed Management Plan Not Disclosed

Invested in KOSPI ETF and Index Funds

Large-Cap Stocks with Big Drops like Samjeon and Hyundai Motor

Short Covering Pressure Up... Attention on Short-Selling Stocks

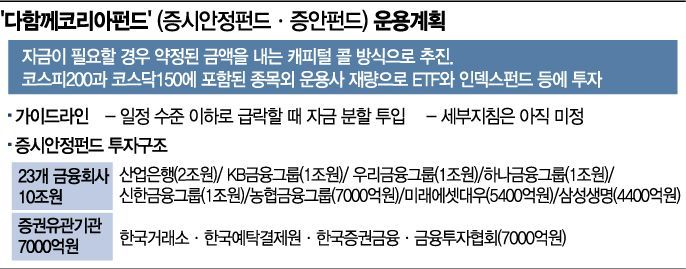

[Asia Economy Reporters Jihwan Park and Minji Lee] The government’s Dahamkke Korea Fund (Securities Market Stabilization Fund, or Stabilization Fund), established with approximately 10.7 trillion KRW to stabilize the financial market, will be fully operational starting on the 9th. The market holds mixed expectations: some anticipate that the fund’s injection will stabilize the stock market, which has experienced increased volatility due to the novel coronavirus disease (COVID-19), while others worry that the fund’s size relative to market capitalization is too small to have a significant effect.

According to the financial investment industry, on this day, 1 trillion KRW out of the total 10 trillion KRW raised for the Stabilization Fund was paid as a capital call to the master fund managed by Korea Investment Trust Management, the lead manager. Korea Investment Trust Management serves as the top-tier manager of the Stabilization Fund and plans to allocate funds to 26 sub-funds managed by asset management companies to execute investments. The overall fund management strategy is overseen by the Investment Management Committee led by Chairman Kang Shin-woo, while the actual management is carried out by Korea Investment Trust Management and the 26 other asset managers.

The Stabilization Fund initially planned to raise 3 trillion KRW in its first phase. However, as the stock market recently turned upward, it is expected that 1 trillion KRW will be operated first, with the remaining 2 trillion KRW injected later. A representative from Korea Investment Trust Management explained, "Last week, the universe of individual managers was finalized."

The broad strategy for fund management is to allocate funds in portions when the index falls sharply below a certain level. This guideline was decided at the first Investment Committee meeting held on the 6th, although detailed operational guidelines have not yet been finalized. Even when operational guidelines are issued, it is unlikely that specific details will be disclosed. A representative from a participating asset management company said, "Considering retail investors’ trend-following trades, details such as at which index level funds will be injected and when injections will stop as the index recovers will not be publicly disclosed."

There are also concerns that the Stabilization Fund may not have a significant impact due to its size. Jung Yong-taek, head of the IBK Investment & Securities Research Center, pointed out, "A Stabilization Fund of 10 trillion KRW alone will not have a large effect on stabilizing actual stock market supply and demand." The current fund size is about 0.9% of the KOSPI market capitalization (1,212.7141 trillion KRW). However, there is also a strong view that the initial policy goals can be sufficiently achieved, as the fund aims more to reduce stock price declines and stabilize the market rather than to change the overall market trend.

If the Stabilization Fund is practically activated, the investment targets are expected to be indices such as KOSPI 200 and KOSPI 150. Additionally, discretionary investments by asset managers may include exchange-traded funds (ETFs) and index funds. Investments will be made at approximately 90% and 10% ratios in market-representative index products such as KOSPI 200 and KOSDAQ 150, respectively, with stocks requiring price stabilization and supply-demand improvement due to excessive declines expected to be included in the fund.

The market expects that among large-cap stocks, those with significant price drops will experience strong price rebounds. Analysts recommend focusing on top KOSPI stocks such as Samsung Electronics, SK Hynix, Hyundai Motor, Samsung SDI, and LG Chem. Attention is also drawn to stocks with heavy short selling, where passive demand is anticipated.

Lee Kyung-soo, a researcher at Hana Financial Investment, explained, "Among the stocks that may be included in the Stabilization Fund, it is worth examining those with heavy short selling and significant short-covering pressure." According to Hana Financial Investment, the short-selling ratio relative to the number of listed shares is currently high for Helixmith (12.5%), HLB (11.2%), SillaJen (9.2%), KMW (9.1%), Celltrion (7%), Hotel Shilla (5.4%), and Mezzion (5.3%), in that order.

Additionally, stocks that can generate stable returns despite foreign selling pressure are also attracting attention. Foreign investors have maintained a selling trend on the Morgan Stanley Capital International Korea (MSCI KOREA) index, and stocks not included in this index are judged to potentially yield relatively stable returns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)