[Asia Economy Reporter Jeong Hyunjin] The scale of overseas capital outflows from emerging markets in the first quarter of this year due to the novel coronavirus infection (COVID-19) crisis has been recorded at an all-time high. As a result, the total amount of foreign capital within emerging markets, including new inflows, is expected to remain at $444 billion (approximately 538.8 trillion KRW), less than half of last year's level.

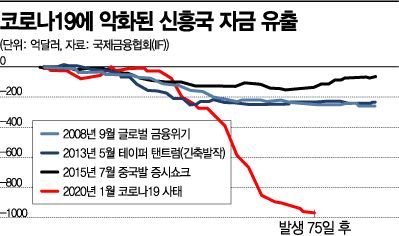

The Institute of International Finance (IIF) stated on the 8th (local time) in its "Emerging Market Capital Flow Outlook" report, "An examination of daily data on non-resident portfolio flows shows that the first quarter saw the largest capital outflow ever from emerging markets," adding, "This surpasses the levels seen during the 2008-2009 global financial crisis."

According to the report, from January 21 to the end of March, a total of $97 billion was withdrawn from emerging market stock and bond markets, with $72 billion and $25 billion respectively. This amount exceeds those during previous crises such as the global financial crisis, the May 2013 taper tantrum, and the July 2015 China-led stock market shock. The report particularly noted that in March alone, $83 billion flowed out of emerging markets due to the COVID-19 crisis and the decline in oil prices.

The IIF forecasted that as movement restrictions are lifted in various countries and with the support of monetary policies, foreign capital flows within emerging markets, led by Asia, will recover in the second half of this year. However, due to the severe global economic impact, increased risk aversion, and falling oil prices, the recovery scale is expected to be significantly reduced to $444 billion compared to last year's $937 billion.

Most emerging markets are expected to face situations requiring measures such as deploying foreign exchange reserves due to capital outflows and sharp currency depreciation. The IIF predicted, "Within a few months, many countries will lack the capacity to implement policies to counteract their economic slowdowns and will likely request multinational support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.