IBK, NongHyup, and Commercial Banks Implement 1.5% Annual Interest Rate Loans for One Week

Still Concentrated on KODIT-Guaranteed Loans... Insufficient Staff Faces Burden of Processing Already Submitted Documents

Amid the deepening struggles of small business owners due to the impact of COVID-19, merchants are waiting for customers on the kitchen street in Hwanghak-dong, Seoul, on the 30th of last month. Photo by Moon Honam munonam@

Amid the deepening struggles of small business owners due to the impact of COVID-19, merchants are waiting for customers on the kitchen street in Hwanghak-dong, Seoul, on the 30th of last month. Photo by Moon Honam munonam@

[Asia Economy Reporter Kim Hyo-jin] It has been revealed that small business owners, who were the first to be hit hardest by the novel coronavirus infection (COVID-19), are still facing difficulties in obtaining loans. This is interpreted as the concentration phenomenon on loans guaranteed by regional credit guarantee foundations (Jishinbo) not being resolved, and ultra-low interest rate secondary guarantee loans from banks failing to have the effect of dispersing demand.

According to the government and financial authorities as of the 7th, loans executed through COVID-19 special guarantees from 16 Jishinbo nationwide have been tallied at 1.83 trillion KRW. Jishinbo still bears more than 80% of the new funding support for small business owners related to COVID-19.

Summarizing explanations from the Korea Credit Guarantee Foundation and some Jishinbo, since mid-last month, applications for COVID-19 related guaranteed loans amounting to 600 billion to 700 billion KRW per day have been flooding in.

It takes about three weeks, or as fast as two weeks, to execute the loan. Compared to early to mid-last month when waiting times were up to about two months, the wait has significantly decreased, but in some regions, it is still reported that one must wait more than a month.

A Jishinbo official said, "There is a view that the daily application volume may have peaked," adding, "Even so, it is unlikely that applications will suddenly and rapidly decrease, so this trend is expected to continue for the time being."

The problem lies in the backlog of applications that have not yet moved on to the full 'reception and processing' procedures. A Korea Credit Guarantee Foundation official explained, "Once the data is entered into the system and the application reaches the review stage, the guarantee certificate can be issued within a week, but the time taken to reach this stage is quite long."

Since the COVID-19 outbreak, the Korea Credit Guarantee Foundation has hired 179 short-term personnel with relevant experience and distributed them across the nationwide Jishinbo, while the Jishinbo themselves have hired 1,007 short-term personnel. Banks nationwide have also dispatched 227 support staff to assist.

Due to the structure of the Jishinbo’s IT system, it is not easy for these personnel to be deeply involved in the core review process of issuing guarantee certificates. Although banks handle a significant portion of non-review tasks such as application and reception on a consignment basis, there are limitations.

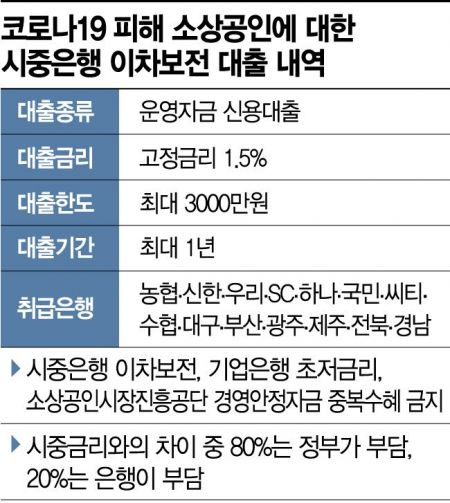

As part of the ultra-low interest financial support package for small business owners, the secondary guarantee loans with an annual interest rate of 1.5%, handled by commercial banks since the 1st, have yet to show an effect in dispersing demand. The secondary guarantee loans executed by the five major commercial banks?Shinhan, KB Kookmin, Hana, Woori, and NH Nonghyup?from the 1st to the 7th amount to only about 200 billion KRW.

There is a large disparity, with some banks executing nearly 100 billion KRW in loans, while others have only executed around 10 billion KRW. This is analyzed to be due to banks applying their own credit ratings, resulting in many cases where applicants who meet the loan eligibility (grades 1 to 3) according to credit rating agencies were rejected.

To resolve this issue, financial authorities have allowed those with NICE credit ratings of grades 1 to 3 to be eligible for secondary guarantee loans starting from the previous day. At IBK Industrial Bank, ultra-low interest loans are available for grades 1 to 6, but from the 1st to the 6th, 57,000 applications flooded in, raising concerns about delays in loan execution due to overload.

A financial sector official said, "From the perspective of efficiency and speed in COVID-19 related support, commercial banks need to share the burden more actively," adding, "Although authorities have issued guidelines regarding the application of credit ratings, blind spots may arise, so monitoring will be necessary going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.