Among the Top 15 Google Play Revenue Leaders Centered on 3N, an Impressive 12 Titles

Seize Dominance from China... Competing in Q2 Based on Long-Running Games

[Asia Economy Reporter Jin-gyu Lee] Domestic mobile games have dominated the top ranks in Google Play revenue. This is seen as a reclaiming of market leadership that had been lost to Chinese mobile games for a while. The success of the three major game companies known as the 3N (Nexon, Netmarble, NCSoft) and their blockbuster mobile titles played a key role. This momentum is expected to continue into the second quarter with new mobile releases based on long-standing PC games.

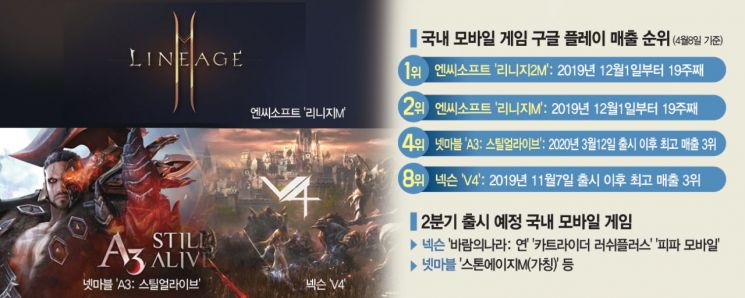

◆ 12 domestic games in the top 15 by revenue = According to industry sources on the 9th, as of the 8th, 12 domestic mobile games occupied spots in the top 15 on Google Play revenue rankings, led by NCSoft’s 'Lineage 2M' and 'Lineage M'. In contrast, only three Chinese mobile games were present, marking a turnaround from earlier this year when Chinese games from companies like Lilith Games had taken over the market. Domestic games have regained their pride. Following the success of Lineage 2M and Nexon’s 'V4', which have upheld the honor of Korean mobile games since late last year, Netmarble’s 'A3: Still Alive', launched last month, also achieved consecutive success, reversing the market trend. The Lineage titles have held steady at first and second place for over four months, while A3: Still Alive recently climbed to third place in revenue before ranking fourth on the 8th. In the first quarter, Lineage 2M recorded daily revenues in the 4 billion KRW range, and A3: Still Alive earned between 500 million and 800 million KRW daily, serving as strong cash cows. Netmarble’s 'Blade & Soul Revolution', released in December 2018, ranked seventh in revenue, and 'Lineage 2 Revolution', which uses the 'Lineage 2' intellectual property (IP), ranked ninth. V4, which has consistently maintained top revenue rankings since its release in November last year, ranked eighth.

However, experts point out that the popularity of domestic games is heavily concentrated in the MMORPG (Massively Multiplayer Online Role-Playing Game) genre, and caution against complacency with the current rankings. Professor Wi Jeong-hyun of Chung-Ang University, who serves as president of the Korea Game Society, said, "In terms of genre diversification and global scale, Chinese game companies have recently shown much stronger development ambitions compared to domestic companies. If Korean gamers grow tired of the probability-based item systems like those in the existing Lineage games, market leadership could quickly shift back to Chinese games."

◆ Competing with long-standing games in Q2 = The industry plans to continue this trend in the second quarter by releasing mobile games based on long-standing PC titles. Nexon is currently finalizing work on 'The Kingdom of the Winds: Yeon', aiming for a Q2 release. 'The Kingdom of the Winds: Yeon' is based on Nexon’s iconic long-running game 'The Kingdom of the Winds', which was first introduced in Korea in 1996, and has generated high expectations among domestic gamers even before its launch. Nexon will also release 'KartRider Rush+', a mobile game based on the IP of the popular racing game 'KartRider', originally launched in 2004. Additionally, Nexon will launch 'FIFA Mobile'. Last month, Nexon signed a publishing agreement with EA for FIFA Mobile in Korea and has been conducting a closed beta test (CBT) since the 3rd. Netmarble plans to introduce 'StoneAge M' (tentative title) to domestic and international markets in Q2. This game is based on Netmarble’s PC game 'StoneAge' IP. Released in 1999, StoneAge has over 200 million registered users worldwide. An industry insider said, "Long-standing games have proven their market viability through extended service periods, so expectations for new mobile titles based on these IPs are naturally high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.