San-eun Issues $500 Million Bonds and KEXIM Foreign Currency Bonds... Proactive Foreign Currency Liquidity Secured

[Asia Economy Reporter Kangwook Cho] Korea Development Bank (KDB) has successfully issued $500 million (approximately 600 billion KRW) worth of dollar-denominated bonds. This marks the first issuance of dollar bonds by a domestic financial institution since the COVID-19 pandemic began in earnest. The Export-Import Bank of Korea is also expected to issue foreign currency bonds soon. Despite growing uncertainties in the global financial market, the proactive foreign currency liquidity securing efforts by policy banks are expected to ease the burden on domestic companies seeking overseas funding in the future.

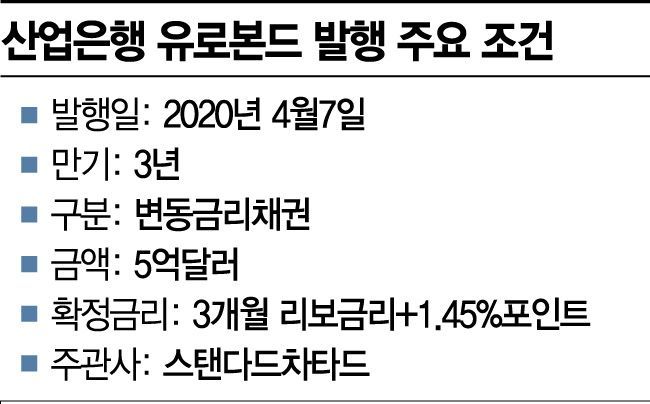

According to financial sources on the 8th, KDB issued a total of $500 million in Eurobonds targeting investors in Asia and Europe the previous day. The dollar bonds have a 3-year maturity with a floating interest rate structure. The initial guideline spread offered to local investors was 1.80%, and the original target amount was $300 million. However, with strong participation not only from Singapore and Hong Kong but also from European and Middle Eastern institutions, total orders reached $2.31 billion, with 96 investors participating. As a result, KDB increased the issuance size by $200 million from the original target to $500 million and lowered the spread from 1.80% to 1.45%, achieving a 0.35 percentage point reduction.

A KDB official explained, "We attracted orders approximately 4.6 times the issuance amount, increasing the issuance by $200 million from the initial target of $300 million. Based on solid investor demand, the issuance yield was also set at a level 0.35 percentage points lower than the initially proposed guideline of 1.80%."

Dollar-denominated public bond issuance by domestic financial institutions had been halted since February 10, when KDB issued $1.5 billion in global bonds as the COVID-19 crisis intensified. As a policy bank with a strong credit rating (AA) and market position, KDB plays a benchmark role in the overseas bond market. In particular, KDB's successful dollar bond issuance has raised expectations that other financial institutions and companies may also succeed in issuing dollar bonds.

Another policy bank, the Export-Import Bank of Korea, is also preparing to issue foreign currency bonds soon. Although the specific schedule and issuance size have not been finalized, it has been confirmed that the bank is monitoring market trends through underwriters to find better conditions.

An official from the Export-Import Bank said, "We are currently closely examining market conditions to find favorable issuance terms. As a policy bank, we must provide guidance or benchmarks for other financial institutions and companies, so we have to approach this cautiously."

Some argue that KDB's successful dollar bond issuance could accelerate foreign currency bond issuance not only by the Export-Import Bank but also by domestic commercial banks and companies. The success of a policy bank in raising foreign currency funds is significant as it confirms strong investor demand for Korean bonds in overseas financial markets.

A financial industry insider said, "With the success of policy banks in issuing foreign currency bonds, other financial institutions and companies will be able to re-enter the overseas bond market. Securing foreign currency liquidity through this will also ease support for domestic companies by domestic financial institutions in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.