[Asia Economy Reporter Kim Hyo-jin] Four Korean medicine hospitals, including A Korean Medicine Hospital, fabricated false medical records by recording non-reimbursable Korean medicine treatments, which are not covered by indemnity insurance, as non-reimbursable Western medicine treatments. Through this, numerous insurance consumers fraudulently claimed about 120 million KRW in indemnity insurance payments. This is a case of insurance fraud involving collusion between hospitals and insurance consumers using indemnity insurance.

There was also a case where seven people colluded by renting a rental car, dividing roles as perpetrator and victim, and deliberately causing accidents, fraudulently claiming 220 million KRW from nine insurance companies. In the case of B Company, a foreign car parts supplier, they manipulated records to appear as if they supplied parts not actually provided to repair shops, embezzling about 1.1 billion KRW from 11 insurance companies.

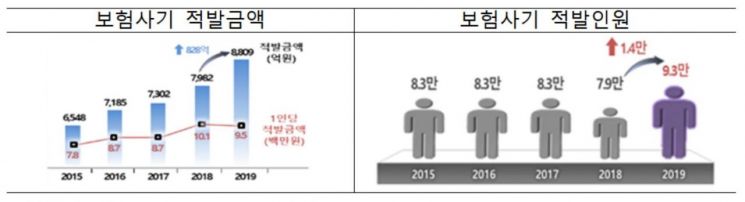

On the 8th, the Financial Supervisory Service (FSS) announced that it detected a total of 92,538 insurance fraud cases last year, including these examples. The amount detected was 880.9 billion KRW, marking an increase of 16.9% and 10.4% respectively compared to the previous year, reaching an all-time high. The number of detected cases had been declining since 2015 but increased again last year.

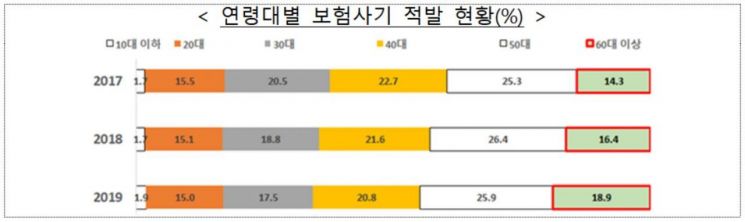

By occupation, insurance fraud among company employees was the highest at 18.4%, followed by full-time homemakers (10.8%), unemployed/daily workers (9.5%), and students (4.1%). By age group, the detection rate was highest among middle-aged individuals in their 40s and 50s at 46.7%. The FSS identified a trend of increasing insurance fraud among the elderly aged 60 and above.

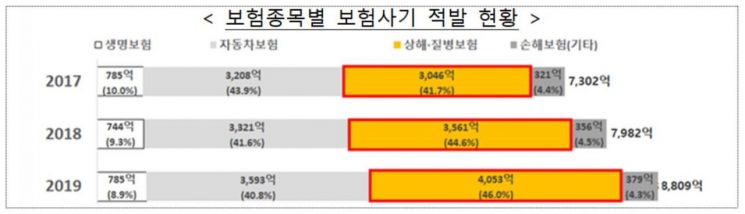

By insurance type, the proportion of insurance fraud involving non-life insurance was high at 91.1%. Among non-life insurance, fraud related to accident and illness insurance products showed an increasing trend. Among those detected, 67.2% were male and 32.8% were female.

Among the insurance fraud cases detected last year, 82% involved relatively small amounts, with an average detected amount per person under 9.5 million KRW. The FSS analyzed that 'livelihood-type insurance fraud,' which exaggerates or distorts facts about injuries, illnesses, or car accidents to claim insurance money, has increased.

The FSS plans to strengthen investigations through cooperation with investigative agencies and the National Health Insurance Service to establish a sound insurance market order and prevent public harm such as financial leakage in private insurance and health insurance caused by insurance fraud. Additionally, the FSS will continuously promote improvements in systems and work practices to prevent insurance fraud, as well as education and publicity activities for prevention.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)