Banks Have Used Their Own Credit Ratings

Loan Limits Reduced or Rejected for Small Business Owners

From the 8th, External CB Company Ratings Will Be Compared and Applied

[Asia Economy Reporter Kwon Haeyoung] Starting from the 8th, banks will use the more favorable credit rating between their own internal credit rating and the external credit rating from credit bureaus (CB) when providing the annual 1.5% ultra-low interest rate secondary loan support to small business owners. This is expected to facilitate smoother funding for small business owners who urgently need funds due to damages caused by the spread of the novel coronavirus infection (COVID-19) but have had to turn away due to high bank thresholds.

According to the financial sector, on the afternoon of the 7th, the Financial Services Commission sent an official letter to banks ordering that small business owners who meet grades 1 to 3 based on the external CB credit rating be supplied with the ultra-low interest rate secondary loan support even if they fall short of the bank’s internally calculated credit rating. The external CB rating was standardized to NICE Credit Rating.

A Financial Services Commission official stated, "There have been cases where loans were possible based on the external CB credit rating but were rejected or had reduced limits because the internal bank credit rating was insufficient," adding, "We requested this to unify the varying credit rating standards across banks to reduce confusion and expand financial support for small business owners."

Following the Financial Services Commission’s recommendation, from this day forward, banks must execute loans to small business owners who meet grades 1 to 3 according to NICE Credit Rating regardless of their internal credit rating. Even if the CB rating falls below grade 3, loans can be granted if the bank’s internal credit rating meets the criteria. This effectively lowers the bank loan threshold for small business owners affected by COVID-19.

Until now, there have been numerous complaints from small business owners at bank branches regarding the ultra-low interest rate secondary loan support. Although the government announced that borrowers with credit ratings from 1 to 3 are eligible, it was unclear which institution’s criteria applied. Many cases occurred where borrowers checked their CB credit rating and found it to be grade 3, but were denied loans at the bank because the bank’s internal rating was grade 4 or lower. Banks calculate their own credit ratings based on accumulated financial transaction history in addition to CB evaluations, so internal ratings often differ from CB ratings. For non-primary customers, the bank’s internal credit rating is generally lower than the CB rating.

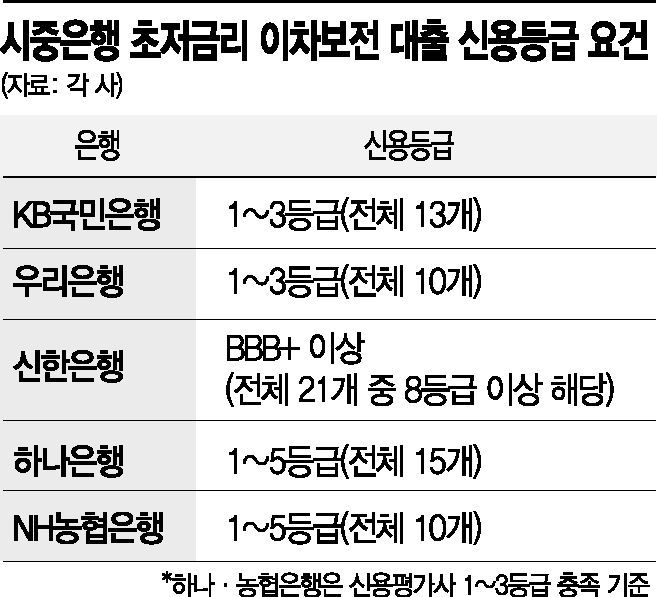

Loan eligibility can also vary depending on which bank is approached. Looking at the ultra-low interest rate secondary loan credit rating requirements, there are differences by bank. KB Kookmin Bank requires grades 1 to 3 out of 13 total grades, Woori Bank requires grades 1 to 3 out of 10 grades. Shinhan Bank targets those with BBB+ or higher, which corresponds to grade 8 or above out of 21 total grades. Hana Bank and NH Nonghyup Bank both base eligibility on CB credit ratings of grades 1 to 3, but internally Hana Bank supplies loans to grades 1 to 5 out of 15 total grades, and Nonghyup Bank to grades 1 to 5 out of 10 grades.

However, some voices express concerns that since loan limits are fixed, this could lead to reverse discrimination against non-primary customers, and borrowers who fall below the internal credit rating upon interest rate reassessment after the one-year maturity may face disadvantages.

A bank official said, "The ultra-low interest rate secondary loans from commercial banks have a short maturity of one year, and when the maturity comes due and interest rates are recalculated, borrowers who do not meet the bank’s internal criteria may face higher interest rates," adding, "The bank’s internal credit evaluation model is much more sophisticated, so applying external CB standards could increase the risk of defaults."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.