[Asia Economy Reporter Oh Ju-yeon] The Korea Exchange announced on the 7th that, due to the widening divergence rate between the indicative value and market price of exchange-traded notes (ETNs) related to West Texas Intermediate (WTI) crude oil futures, it plans to temporarily suspend trading of stocks subject to trading suspension criteria starting from the 8th.

Accordingly, stocks with a divergence rate exceeding 30% for five consecutive trading days, calculated based on the real-time indicative value at the close of the regular market, will have their trading suspended for one day the following day.

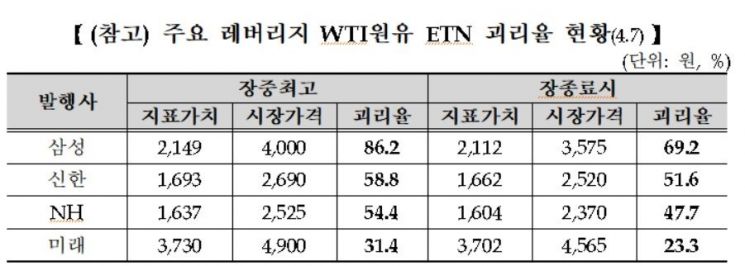

For example, the Samsung Leverage WTI Crude Oil ETN recorded a divergence rate of 69.2% at the close of trading on that day, and at one point during the session, it surged to 86.2%.

The widening divergence rate of ETNs related to crude oil futures is due to a sharp increase in demand for these products, as investors anticipate a rise in international oil prices following the recent steep decline. The market price exceeded the indicative value because liquidity supply could not keep up with the increased demand.

The exchange stated, "If investors purchase ETNs at prices higher than the indicative value, losses may occur during the process of market prices converging to the indicative value, so special caution is required when investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.