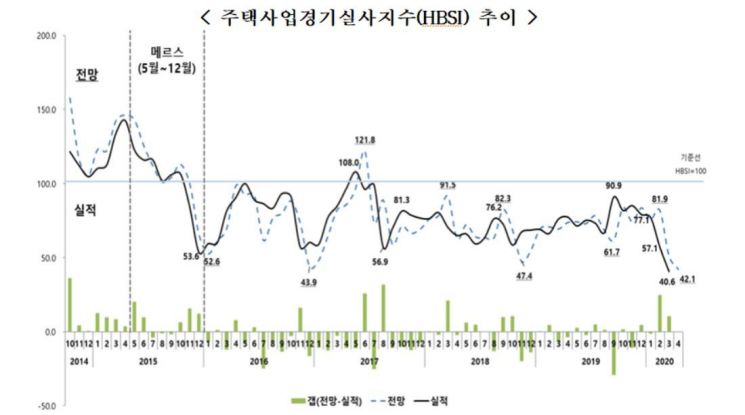

April Nationwide HBSI Forecast at 42.1... Below 50 Threshold

Seoul and Ulsan Forecasts Fall Below 60... Daegu at 27.0

Funding (59.7) Records Lowest Forecast in Last 3 Years

[Asia Economy Reporter Yuri Kim] As the novel coronavirus disease (COVID-19) crisis continues, the nationwide housing business sentiment index recorded the worst performance since the related survey began.

According to the Korea Housing Industry Research Institute on the 7th, the nationwide Housing Business Survey Index (HBSI) forecast for April dropped 8.9 points from the previous month to 42.1, falling below the 50-point mark. Last month's HBSI actual figure showed a 16.5-point decrease from the previous month, registering 40.6. The Korea Housing Industry Research Institute explained that as the impact of COVID-19 has persisted for two months, the nationwide housing business sentiment index recorded the lowest forecast and actual figures since the survey began.

HBSI is an index that comprehensively assesses the housing business sentiment from the supplier's (construction companies') perspective, based on a survey of about 500 member companies affiliated with the Korea Housing Association·and the Korea Housing Builders Association. If the forecast exceeds the baseline of 100, it means more construction companies expect the market to improve than those who do not; if it falls below 100, it indicates the opposite.

By region, the HBSI forecast fell below 60 in Seoul (59.6) and Ulsan (54.5), and remained in the 40s for Busan (42.8) and Daegu (44.7). Daegu, the region most affected by the COVID-19 outbreak, recorded the lowest nationwide HBSI actual figure of 27.0 since the survey began last month.

Kim Deok-rye, head of the Housing Policy Research Office at the Korea Housing Industry Research Institute, said, "As the severe COVID-19 situation continues following last month, the overall economic conditions are deteriorating, inevitably increasing uncertainty and risks in the housing supply market. It is expected that it will take a considerable amount of time to normalize the supply market."

Not only difficulties in housing construction stages such as pre-sale, completion, and move-in but also challenges in financing due to macroeconomic risks and uncertainties in the real estate market are anticipated. This month, the forecast indices for material supply, financing, and labor supply were 74.7, 59.7, and 81.5, respectively. In particular, the financing forecast (59.7) sharply declined by 16.3 points from the previous month, marking the lowest level in the past three years.

The Korea Housing Industry Research Institute judged that due to the impact of COVID-19, increased macroeconomic risks, and negative outlooks on the real estate market, financial institutions have recently tightened project financing (PF) loan standards, making it more difficult for developers to secure funding. They analyzed that securing smooth corporate financing channels is necessary to prevent worsening corporate insolvency due to financing difficulties.

Kim said, "The government should thoroughly examine the impact of COVID-19 across the entire housing market and strengthen monitoring of the housing market environment to prevent future market failures. Developers also need to prepare mid- to long-term crisis management measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)