Samsung Electronics Q1 Operating Profit 6.4 Trillion KRW, Results Exceed Expectations

Strong Memory Semiconductor Demand Despite COVID-19

[Asia Economy Reporter Changhwan Lee] Samsung Electronics' first-quarter earnings exceeded market expectations thanks to the solid performance of its semiconductor division despite the impact of the novel coronavirus disease (COVID-19).

Memory semiconductors saw price increases even as global consumption sharply contracted due to COVID-19. Experts attribute the rise in semiconductor demand to the expansion of data centers driven by increased remote work and video conferencing during the pandemic.

The exchange rate effect also appears to have played a role. The won-dollar exchange rate rose in the first quarter amid concerns over an economic downturn caused by COVID-19, improving export conditions.

However, the decline in consumer spending negatively affected the performance of the smartphone, home appliance, and display businesses. With the COVID-19 impact intensifying in major consumer markets such as North America and Europe after March, there are concerns that second-quarter earnings may fall short of market expectations.

◆ Semiconductor Division Holds Operating Profit at 6 Trillion Won = Before Samsung Electronics announced its first-quarter results, the financial investment sector's consensus for Samsung's provisional operating profit was around 6.09 trillion won. However, on the 7th, Samsung Electronics reported earnings of 6.4 trillion won, exceeding the consensus by 310 billion won.

The operating profit surpassing expectations is attributed to the strong performance of the DS (semiconductor) division. Typically, Samsung Electronics' semiconductor business accounts for more than half of its total operating profit. Despite COVID-19, memory semiconductor prices have steadily risen this year.

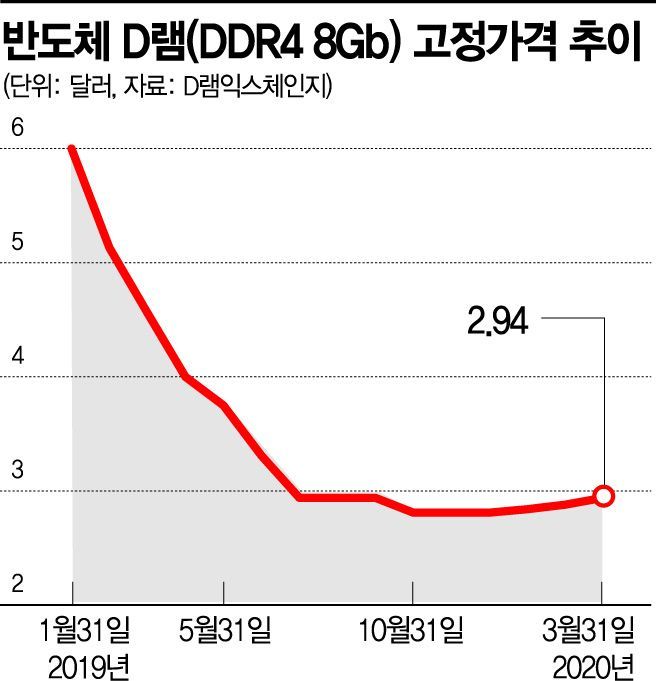

According to market research firm DRAMeXchange, the fixed transaction price of DDR4 8-gigabit (Gb) DRAM products, mainly used in PCs, averaged $2.94 in March, up 2.1% from February.

The fixed price of DDR4 8Gb DRAM rebounded to $2.84 in January after 13 months, then rose to $2.88 in February and continued its upward trend for three consecutive months through March. The rate of increase expanded from the 1% range in February to the 2% range in March.

The rise in semiconductor demand is due to increased remote work and online activities amid virus spread, as well as semiconductor inventory buildup by server and PC manufacturers. With limited supply and growing demand, product prices increased.

With semiconductor prices rising and exchange rate effects supporting, Samsung Electronics' DS division's first-quarter operating profit is estimated to have reached between 3.8 trillion and 3.9 trillion won, an increase of over 10% compared to the previous quarter's 3.44 trillion won.

Dongwon Kim, a researcher at KB Securities, explained, "The increase in remote work and video conferencing due to COVID-19 has led to increased internet data traffic and demand for new server expansions," adding, "Semiconductor demand is rising while supply remains limited, causing semiconductor prices to increase."

However, it is estimated that other divisions, excluding semiconductors, experienced a decline in performance. In particular, the smartphone business is believed to have been sluggish. The financial investment sector reports that sales of the Galaxy S20, released by Samsung last month, are significantly lower than those of its predecessor, the Galaxy S10.

Consumer sentiment has frozen, likely causing a decline in the CE (consumer electronics) division's performance as well. The postponement of major sporting events such as the Tokyo Olympics and Euro 2020 due to COVID-19 has inevitably led to decreased TV sales.

With smartphone and TV sales declining, the display business also suffered. A significant portion of display earnings comes from Samsung Electronics' smartphone OLED (organic light-emitting diode) and TV panels, and with weak product demand, the division is estimated to have turned to a loss.

◆ COVID-19 Impact Intensifies, Second-Quarter Earnings at Risk = Inside and outside Samsung Electronics, there is significant concern over a slowdown in second-quarter earnings. COVID-19 has spread rapidly in Samsung's major markets of North America and Europe since March, causing a sharp drop in consumption.

With continued weakness in the smartphone business, the connected display division is also expected to face ongoing negative impacts, likely resulting in continued losses. TV demand is also expected to remain weak in the second quarter due to the postponement of major sporting events. However, the semiconductor division is projected to deliver results meeting market expectations, supported by steady server demand in the second quarter.

An industry official said, "Although Samsung Electronics posted relatively strong first-quarter results, the business environment in the second quarter, when COVID-19 began to significantly affect major markets such as North America and Europe, is difficult to predict," adding, "There is a possibility of weaker results compared to the first quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)