No Measures Discussed at This Week's Emergency Economic Meeting

Priority Focus on Support for Vulnerable Groups and Consumption Stimulus

Ongoing Controversy Over Livelihood Measures and Delays in Industrial Policy Discussions

Due to the impact of COVID-19, the in-flight meal preparation area inside Korean Air's catering center was quiet on the 2nd as the airline industry suffers significant losses. Photo by Moon Ho-nam munonam@

Due to the impact of COVID-19, the in-flight meal preparation area inside Korean Air's catering center was quiet on the 2nd as the airline industry suffers significant losses. Photo by Moon Ho-nam munonam@

[Sejong=Asia Economy Reporters Kim Hyun-jung, Jang Se-hee, Yoo Je-hoon] As the COVID-19 pandemic prolongs, core industries such as machinery, energy, aviation, shipbuilding, and automobiles are pushed to the brink, yet the government’s related countermeasures are delayed. Due to ongoing discord over support measures prioritized for vulnerable groups and consumption revitalization, support for these key industries, which are the lifeblood of our economy, is being postponed. At this week’s scheduled emergency economic meeting, the government plans to announce only a 'tangible support plan' aimed at ensuring money circulates directly to the fingertips and feet of the market.

According to the government on the 6th, the 4th emergency economic meeting chaired by President Moon Jae-in this week will review and announce fiscal support and consumption stimulation measures targeting vulnerable groups such as self-employed and small business owners, without preparing support measures for core industries. A senior official from the Ministry of Economy and Finance explained, "Problems faced by core industries or related companies cannot be solved solely by unconditional fiscal support," adding, "This time, the focus will be on measures to boost consumption."

The government agrees on the need to support core industries endangered by the COVID-19 crisis but finds it difficult to immediately present countermeasures. Since large-scale fiscal resources are required, careful consideration must be given to ensuing soundness risks and fairness controversies. The lack of significant support discussions following KDB Industrial Bank and Export-Import Bank’s decision to inject 1 trillion won in emergency funds into Doosan Heavy Industries is in line with this reasoning.

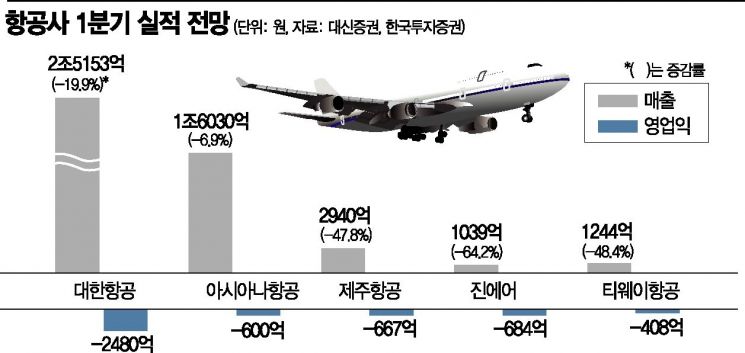

Meanwhile, as the government’s judgment delays, the number of companies needing life support keeps increasing. The aviation industry, which was the starting point, is experiencing liquidity crises as operating rates have fallen to around 10% for both low-cost carriers (LCCs) and major airlines. Even Korean Air, the industry leader, is set to introduce a six-month rotational paid leave system for all employees next week. Although it recently succeeded in issuing 622.8 billion won in asset-backed securities (ABS), the amount of borrowings to be repaid or refinanced within the year reaches 4 trillion won. Asiana Airlines, which recorded a debt ratio of 1386% last year and is partially capital impaired, must also repay or refinance about 1.17 trillion won within the year.

The refining industry is also pushed to the limit due to demand contraction. The market expects the four domestic refiners?SK Innovation, GS Caltex, Hyundai Oilbank, and S-OIL?to post operating losses of up to 2 trillion won in the first quarter of this year. They are responding with production cuts and restructuring but continuously appear on the April crisis watchlist.

Regarding this, Professor Sung Tae-yoon of Yonsei University’s Department of Economics advised, "It is difficult to provide financial support to all core industries and companies struggling after the COVID-19 crisis," adding, "It is necessary to distinguish whether the competitiveness that was originally weak or problematic was exposed by this crisis, or if normal companies are suffering due to COVID-19, and then proceed with selective financial and credit support and liquidity assistance." He further stated, "Policy financial institutions should buy bonds in the market and provide refinancing through financial institutions to prevent companies from falling into insolvency or default, thereby putting out urgent fires."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.