Preparing for COVID-19 Spread and Potential Role as a Catalyst for CBDC

[Asia Economy Reporter Eunbyeol Kim] The Bank of Korea announced on the 6th that it will build and test a pilot system for a central bank digital currency (CBDC). This move comes as analyses suggest that the future payment environment could change rapidly due to the recent spread of the novel coronavirus disease (COVID-19) and advancements in digital technology, prompting Korea to prepare countermeasures.

The Bank of Korea stated, "From this year through next year, we will proactively review the technical and legal requirements for CBDC introduction and conduct research to build and test a pilot system. While there is currently little need to issue a CBDC in the near future, we will respond swiftly if domestic or international conditions change significantly."

In February this year, the Bank of Korea established a Digital Currency Research Team and a Technical Unit within the Financial Settlement Bureau to conduct CBDC-related research. It also plans to operate a technical and legal advisory group composed of internal and external experts and form a task force (TF).

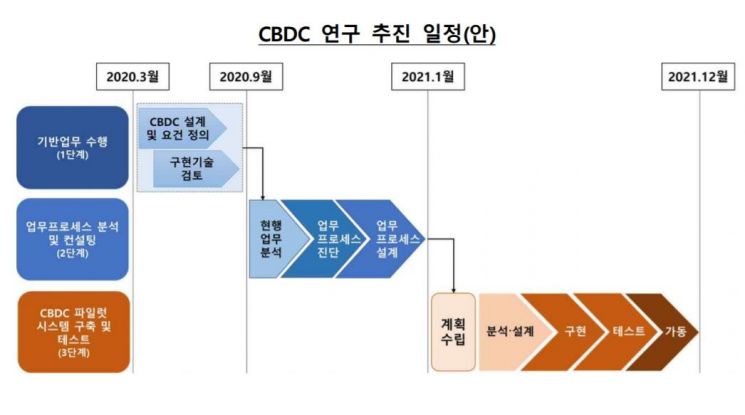

Initially, the Bank of Korea plans to define the design and requirements of the CBDC, review implementation technologies, and then diagnose and design business processes. Starting January next year, it will begin building and testing the pilot system in earnest to verify whether the CBDC system operates normally within a limited environment. During the technology review phase, anticipated legal issues will also be examined, and plans to amend related laws, including the Bank of Korea Act, will be prepared.

Until now, countries that have pursued CBDC trial issuance have mainly been developing countries such as Ecuador and Uruguay. However, recently, countries like Sweden and China have begun preparing to issue CBDCs in response to decreased cash usage and the emergence of private digital currencies.

Countries such as the United States and Japan, which had previously stated they had no plans to issue CBDCs in the near future, have also shifted their stance to strengthen related research. Six central banks?including Canada, the United Kingdom, Japan, the EU, Sweden, and Switzerland?formed a CBDC research group in January.

The Bank of Korea’s active engagement in CBDC research appears to be related not only to recent trends but also to analyses suggesting that COVID-19 will act as a catalyst for issuing CBDCs and digital currencies.

In the United States, after the outbreak of COVID-19, 30% of consumers began using cards and smartphones equipped with NFC (Near Field Communication) technology, commonly used for transportation cards domestically, for payments. In Germany, the share of contactless payments among total card transactions exceeded 50%, increasing by more than 15 percentage points compared to before COVID-19. In China, the population using the internet and smart devices for service transactions has rapidly increased. Recently, the Bank for International Settlements (BIS) also emphasized that "the spread of COVID-19 may accelerate the emergence of central bank-operated payment infrastructures with high resilience and accessibility, including CBDCs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)