Korea Institute of Finance Report... "Governments Worldwide Must Actively Fulfill Role as Lenders of Last Resort"

[Asia Economy Reporter Kwon Haeyoung] The Korea Institute of Finance has pointed out that governments around the world must actively fulfill their role as the ultimate lender to prevent a global financial crisis triggered by corporate debt due to the novel coronavirus infection (COVID-19). It also stated that the legal framework should be preemptively organized to enable the ultimate lender to perform its role. This appears to be an indirect call for the Bank of Korea to take a more active role.

On the 4th, the Korea Institute of Finance diagnosed in its report titled "COVID-19 Crisis and the Possibility of Transmission of a Global Financial Crisis Triggered by Corporate Debt" that the global corporate debt market, with an outstanding issuance amount of about 74 trillion won, is a potential factor that could deepen instability in the financial system.

The Korea Institute of Finance's analysis indicates that the current borrowing scale of global corporations is excessive. According to the Institute of International Finance, global corporate debt excluding financial companies rose from 84% of the world's gross domestic product (GDP) in 2009 to 92% in 2019. In the United States, two-thirds of corporate bond issuance consists of junk bonds rated BB or lower or investment-grade bonds rated BBB.

The Korea Institute of Finance stated, "Globally, companies have continuously expanded borrowing since the recovery from the 2009 global financial crisis, and underwriting standards for loans and corporate bonds have also weakened," adding, "The spread of COVID-19 and the shock of the sharp drop in international oil prices raise concerns that this excessive borrowing phase could lead to a liquidity crunch."

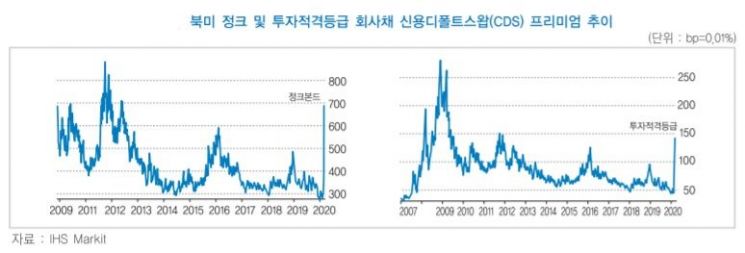

In particular, 7% of the outstanding global corporate bond issuance was issued by COVID-19 sensitive industries such as airlines and hotels, which have suffered severe economic damage due to COVID-19. U.S. energy sector companies, hit by the plunge in international oil prices, also account for 8% of the global corporate bond outstanding. There is speculation that the credit rating downgrades of COVID-19 sensitive industries could lead to defaults and make refinancing and new issuance through the corporate bond market impossible. The junk bond CDS premium reached 688 basis points as of the 12th of last month, the highest since June 2012, and the investment-grade corporate bond credit default swap (CDS) premium recorded 140 basis points, the highest since December 2011.

Going forward, the Korea Institute of Finance emphasized the need for policy responses from governments worldwide to proactively block liquidity crunches and the paralysis of the corporate debt market. Domestically, the Bank of Korea hinted at the possibility of direct lending to securities firms. Opinions are still being raised that the Bank of Korea should directly purchase corporate bonds and commercial paper (CP), similar to the central banks of the United States and Japan.

The Korea Institute of Finance stressed, "The focus needs to be on financial authorities and monetary authorities actively performing their roles as the ultimate market makers providing urgent market liquidity and as the ultimate lenders providing emergency funding," adding, "To effectively perform these roles in the event of shocks to the financial market or the real economy, the legal framework related to detailed policy measures must be preemptively organized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)