[Asia Economy Reporter Yuri Kim] After the government announced the December 16 real estate measures last year, the balloon effect in transactions across the Seoul metropolitan area was concentrated on apartments priced below 600 million KRW. This is interpreted as a result of investors, burdened by increased holding taxes on high-priced homes and strengthened source of funds investigations, turning their attention to mid- to low-priced housing.

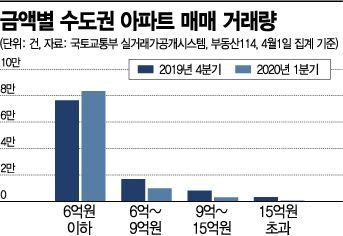

According to the Ministry of Land, Infrastructure and Transport's actual transaction price system and Real Estate 114 on the 3rd, the number of apartment sales transactions priced below 600 million KRW in Seoul, Incheon, and Gyeonggi Province in the first quarter of this year was 83,328, an increase of 9.12% compared to 76,362 in the fourth quarter of last year. Considering that the total transaction volume in the first quarter was 98,047, down from 104,796 in the previous quarter, the proportion of mid- to low-priced apartments below 600 million KRW in total transactions increased noticeably.

On the other hand, during the same period, transactions for apartments priced between 600 million KRW and 900 million KRW were 10,903, a 35.30% decrease compared to 16,853 in the previous quarter, and transactions for apartments priced between 900 million KRW and 1.5 billion KRW also sharply declined by 62.48% to 3,101 from 8,265 in the previous quarter. Transactions for apartments priced above 1.5 billion KRW were only 715, a 78.43% decrease compared to 3,316 in the previous quarter.

The volume of apartment sales transactions in the Seoul metropolitan area in the first quarter of this year was the highest since records began in 2006 for the first quarter. The only other time the first quarter transaction volume exceeded 90,000 was in 2015 (93,348), when the housing market entered a major upward trend. Ultimately, the government's successive measures to suppress housing prices ironically triggered a balloon effect, increasing transaction volumes mainly for mid- to low-priced homes.

By region, transaction volumes in Gyeonggi Province and Incheon increased noticeably. In particular, Incheon saw increased transactions across all areas compared to the fourth quarter of last year. The highest transaction volumes were in Yeonsu-gu (3,511), Namdong-gu (3,423), Seo-gu (3,097), and Bupyeong-gu (2,792). In Yeonsu-gu, which includes Songdo International City, demand surged after the metropolitan area express railroad (GTX)-C line passed the preliminary feasibility study in the second half of last year. This is analyzed as being due to the influx of demand into the existing apartment market alongside the subscription frenzy.

Seoul, where the proportion of high-priced apartments is high, saw 17,357 transactions in the first quarter, a nearly 47% decrease (46.76%) compared to 32,605 in the previous quarter. However, in Seoul, areas with relatively many apartments priced below 600 million KRW such as Nowon (2,362), Guro (1,231), Dobong (1,119), Seongbuk (1,108), and Gangseo (1,021) recorded over 1,000 transactions each.

The attention given to apartments priced below 600 million KRW across the metropolitan area in the first quarter is largely attributed to the impact of the December 16 measures. Due to loan regulations, strengthened transaction verification, and holding tax burdens, the burden of purchasing high-priced apartments increased.

However, experts analyze that transactions for mid- to low-priced apartments are also likely to slow down from the second quarter onward. This is because the weakened buying sentiment caused by the COVID-19 pandemic could spread from the Gangnam 3 districts (Gangnam, Seocho, Songpa) to non-Gangnam areas of Seoul and the entire metropolitan area. In fact, since March, when COVID-19 entered a pandemic phase, the apartment sales market in the metropolitan area has shown a sluggish trend. Kyunghee Yeo, senior researcher at Real Estate 114, predicted, "If urgent sales by multi-homeowners increase in the second quarter due to holding tax and capital gains tax burdens, the price adjustment phase in the metropolitan apartment market will accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.