KOSPI Drops Below 1700... Major Global Markets Also Down Around 4%

COVID-19 Economic Shock Materializes, Corporate Earnings Downgrade Begins... Q2 Volatility Expected to Increase

[Asia Economy Reporter Song Hwajeong] As the domestic and global stock markets, which had been rebounding after the plunge caused by the novel coronavirus infection (COVID-19), sharply declined the previous day, there are forecasts that the first rebound since the COVID-19 crisis will soon end. In April, concerns about the economic shock caused by COVID-19 are expected to materialize, leading to increased market volatility.

As of 10:17 a.m. on the 2nd, the KOSPI recorded 1,665.88, down 1.16% (19.58 points) from the previous day. The KOSDAQ fell 1.22% (6.76 points) to 545.08. Both KOSPI and KOSDAQ started the day with gains but showed mixed trends early in the session before turning to a decline of over 1%.

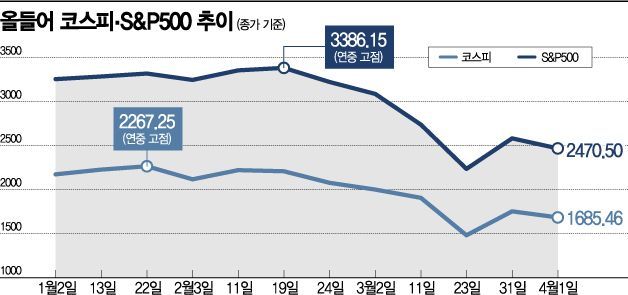

The previous day saw declines of over 3% each. The KOSPI closed at 1,685.46, down 3.94%, falling below the 1,700 level, while the KOSDAQ also dropped 3.03%. Major global stock markets also experienced sharp declines the previous day. The U.S. Dow Jones Industrial Average fell 4.44% to 20,943.51, the S&P 500 dropped 4.41% to 2,470.50, and the Nasdaq fell 4.41% to 7,360.58. Europe also showed weakness around the 4% range. The FTSE 100 index of the London Stock Exchange fell 3.83%, Germany's Frankfurt Stock Exchange DAX index dropped 3.94%, and France's Paris Stock Exchange CAC40 index declined 4.30%. The pan-European Euro Stoxx 50 index also closed down 3.83% at 2,680.30.

With major global stock markets falling simultaneously on the first trading day of the second quarter, concerns about the outlook for the stock market in Q2 are rising again. There is a forecast that the first rebound since the COVID-19 crisis will soon end. Samsung Securities researcher Yoo Seungmin said, "The first rebound in global stock markets will soon end," adding, "The earlier flood of government policies calmed investor sentiment and combined with the perception that the short-term price decline was excessive, causing a sharp rebound. However, this is a bear market rally, and it will take considerable time before a full-fledged upward trend resumes."

Recent rebound patterns in the KOSPI and S&P 500 are analyzed to be similar to those during the 2008 financial crisis. The S&P 500 index plunged 33.9% from its peak and then surged 17.4% in the short term from its low, while the KOSPI also fell 35.6% from its peak before rebounding more than 20%. Researcher Yoo explained, "This is very similar to the rebound pattern during the 2008-2009 financial crisis," adding, "At that time, after a rebound of around 20% from the low, there was a period and price adjustment over two quarters."

Due to the realization of economic shocks caused by COVID-19 and the full-scale downward revision of corporate earnings, it is expected that global stock markets will show high volatility in the second quarter. Although March exports were relatively favorable, decreasing by 0.2% year-on-year, concerns remain that conditions will worsen significantly from April. Shinhan Investment Corp. researcher Kim Chanhee said, "March exports were relatively favorable thanks to demand from developed countries," adding, "Since the epidemic spread in developed countries intensified from mid-March, considering the time lag between export contracts and delivery, the deterioration in demand from developed countries will be fully reflected in April exports." According to the industrial activity trend for February released by Statistics Korea on the 31st of last month, total industrial production decreased by 3.5% compared to the previous month. Retail sales fell by 6.0%, and facility investment dropped by 4.8%. Researcher Yoo said, "Despite strong stimulus policies, the realization of economic shocks in various countries and the full-scale downward revision of corporate earnings will be obstacles to a full recovery of the stock market," adding, "In the coming weeks or months, a phase of very high volatility is expected, during which not only period adjustments but also price corrections below the previous stock price bottom may occur."

However, there are opinions that volatility will ease as government economic stimulus measures are implemented. Park Sohyun, a researcher at Korea Investment & Securities, said, "From the 9th, China plans to lift the Wuhan lockdown and attempt economic normalization, and the Financial Services Commission will inject bond stabilization funds and stock market stabilization funds in April to stabilize the financial market," adding, "Emergency disaster relief funds will soon be distributed to households, so there is ample room for volatility to decrease further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.