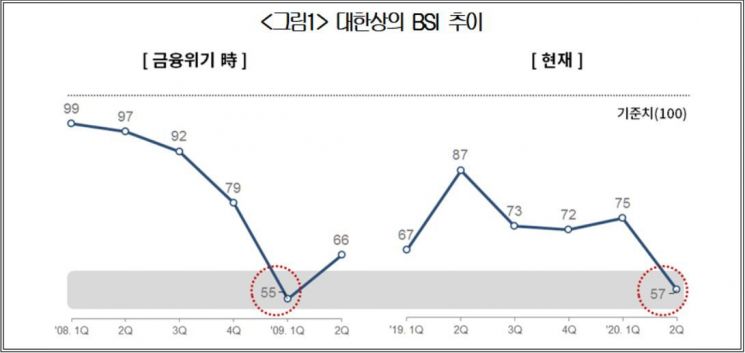

KCCI Survey: Manufacturing Sentiment Index Plummets 18p to '57' in Q2

Matches 2008 Global Financial Crisis Level (55)

71% of Manufacturers Report Business Impact from COVID-19

[Asia Economy Reporter Changhwan Lee] The sentiment among manufacturers in the second quarter has fallen to levels comparable to the 'Global Financial Crisis.' The COVID-19 pandemic has dealt a direct blow not only to domestic consumption and production but also to global demand, significantly lowering the business outlook for both domestic and export companies. It has been revealed that a considerable number of manufacturers have suffered damage due to COVID-19.

The Korea Chamber of Commerce and Industry (KCCI) recently announced on the 2nd that its survey of over 2,200 manufacturers nationwide on the '2nd Quarter Manufacturing Business Survey Index (BSI)' showed a decline of 18 points from the first quarter to 57. This figure is close to the '55' recorded in the first quarter of 2009, right after the Global Financial Crisis, and the drop is the largest since then (-24 points).

The KCCI's Business Survey Index means that a value above 100 indicates that more companies view the current quarter's business conditions more positively than the previous quarter, while a value below 100 indicates the opposite.

The damage perceived by companies was also reflected in the numbers. When asked whether their business activities were harmed due to the spread of COVID-19, 71.3% of respondents answered "Yes."

Specifically, the main difficulties cited included 'sales decline due to domestic demand contraction (70.3%)', 'export decrease due to sluggish global demand (30.1%)', 'difficulty in procuring Chinese parts and materials (29.4%)', 'shortage of quarantine supplies (29.4%)', 'financial tightening (24.0%)', and 'logistics and customs issues (14.5%)' (multiple responses allowed).

The expected average decrease in sales for the first quarter of this year compared to the first quarter of last year was 22%. Regarding the extent of damage in the industrial field compared to past economic crises, responses indicating 'similar to or worse than the IMF foreign exchange crisis (41.4% and 35.6%, respectively)' were higher than those indicating 'less' (23.0%). Similarly, responses indicating 'similar to or worse than the Financial Crisis (41.8% and 41.4%, respectively)' were much higher than those indicating 'less' (16.8%).

Accordingly, the business outlook for both export and domestic companies dropped sharply. The business outlook index for export companies in the second quarter was 63, down 25 points from the previous quarter, while the domestic sector fell 15 points to 56.

By region, all areas nationwide fell below the baseline. In particular, regions such as Jeju (43), which suffered over a 40% decrease in tourists in February due to COVID-19, and Chungnam (43), Daegu (50), and Gyeongbuk (51), which have high incidence rates per 100,000 people, showed sluggish performance.

By industry, all sectors fell below the baseline, centered on 'Textiles and Apparel (45)', 'Automobiles and Parts (51)', and 'Machinery (59)', which are concentrated in the Daegu and Gyeongbuk regions heavily affected by the infectious disease.

As policy tasks to minimize economic damage caused by COVID-19, respondents ranked 'financial and tax support (72%)', 'postponement of corporate investigations such as fair trade and tax audits (35.3%)', 'diplomatic efforts to resume operations (31.4%)', 'incentives to revive domestic demand and tourism (28.5%)', and 'regulatory reforms related to services and new industries (15.7%)' in order.

Woo Tae-hee, Executive Vice President of KCCI and head of the COVID-19 task force, emphasized, "The economic shock from COVID-19 is occurring very broadly and complexly across large and small companies, domestic and export sectors, and financial and real sectors. Given the increased possibility of prolonged impact, we must focus more on monitoring fund disbursement at frontline channels to ensure that normal businesses and small merchants do not collapse due to temporary financial tightening."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)