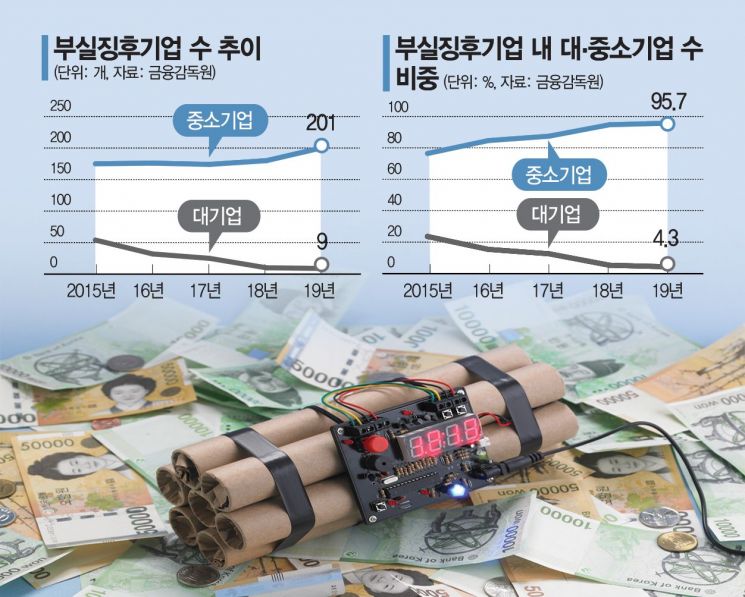

210 Companies Showing Signs of Insolvency Last Year... 201 Are SMEs, an Increase of 21

New Loans Surge Due to COVID-19... Rapid Support for Small Business Loans Without Verification

Failure to Manage Potential Insolvency Targets

[Asia Economy Reporter Kangwook Cho] "With the spread of the novel coronavirus infection (COVID-19), the number of small and medium-sized enterprises (SMEs) becoming insolvent is expected to surge, and it's quite frustrating. If we actively participate according to government policies, we might be held responsible if things go wrong, but we can't just ignore it either... It feels like we're caught in a 'prisoner's dilemma' in the banking sector." (A bank's loan officer)

As more companies face critical situations due to the spread of COVID-19, the management of companies showing signs of insolvency is being identified as a potential trigger for bank insolvencies. With the real economy shock exceeding expectations and growing concerns about deflation, the rapid increase in potentially insolvent companies could create a vicious cycle between the real economy and financial markets, potentially triggering a financial crisis.

According to the financial sector on the 1st, policy banks and commercial banks are closely monitoring their own safety warning systems called 'Loan Monitoring' and strengthening management systems for companies showing signs of insolvency. Loan Monitoring is a mechanism that issues warnings when a company’s financial condition deteriorates, such as a sharp decline in sales after a loan is granted. Through internal financial analysis systems and insolvency detection systems, banks closely examine changes in each company’s financial performance, CEO changes, credit rating fluctuations, and other management conditions.

Earlier, on the 11th of last month, when Heung-A Shipping, the 5th largest shipping company, applied for a workout (corporate rehabilitation) due to management difficulties, the banking sector prepared measures to strengthen management of companies under joint creditor management. Accordingly, the main creditor bank plans to quarterly review the implementation of MOUs for jointly managed companies based on items such as ▲achievement of management plans ▲execution of self-rescue plans ▲evaluation of management. Additionally, companies with low evaluation grades based on qualitative assessments of management transparency and management capabilities will be recommended to dismiss their management.

According to the Financial Supervisory Service, 210 companies were selected as companies showing signs of insolvency at the end of last year, an increase of 20 from the previous year. Among them, large companies numbered 9, down by one from the previous year, while SMEs numbered 201, up by 21. The number of companies showing signs of insolvency had decreased annually from 229 in 2015 to 190 in 2018 but reversed to an increasing trend last year. Notably, the proportion of SMEs among companies showing signs of insolvency rose from 76.4% in 2015 to 95.7% last year, an increase of nearly 20 percentage points.

The problem is that the number of companies newly borrowing from financial institutions is surging due to the COVID-19 crisis. Loan demand from small business owners and self-employed individuals, who previously had no transaction history with commercial banks, is flooding in, especially in industries directly hit such as aviation and travel, raising concerns about their potential transition into insolvent companies.

A representative from Bank B said, "While banks have been strengthening management by closely monitoring existing clients using accumulated know-how, the problem lies with companies newly entering into loan transactions," adding, "Especially, small business loan products currently being launched focus only on credit ratings and require rapid support, increasing the risk of inadequate verification."

Therefore, newly transacting companies that commercial banks are currently supporting by bearing risks are inevitably identified as potential insolvent companies. How these companies are managed has emerged as a core issue in managing banks' soundness risks. However, banks lament that despite the need to strengthen management of potential insolvent companies, they currently lack the capacity to do so.

A representative from Bank C said, "Since the government is focusing on corporate rehabilitation across the board, we have no choice but to prioritize support over management," adding, "Usually, relationship managers (RMs) responsible for corporate clients conduct on-site visits and due diligence, but currently, the workforce is severely insufficient compared to the increasing number of new client companies, making it difficult to strengthen management."

The banking sector expects a sharp rise in loan delinquency rates by the end of this year, triggering alarms over soundness management. Some suggest that zombie companies requiring restructuring might extend their lifespans using low-interest rates, creating negative factors. There are concerns that the government's 'handout-style' support measures could boomerang into future financial insolvencies. During the past IMF foreign exchange crisis, after the dismantling of Daewoo and Hyundai groups, the Korea Asset Management Corporation (KAMCO) and commercial banks, which actively cooperated with government policies and took on various non-performing loans, ended up bearing the insolvencies due to insufficient follow-up measures.

A representative from Bank D said, "While some customers affected by COVID-19 cannot even resolve urgent funds, rumors abound that others are taking out unsecured loans without burden in a low-interest environment to invest in stocks," adding, "Although there is cautious talk about the need to separate the wheat from the chaff, it is a very sensitive issue under current circumstances." He continued, "Some existing clients are already showing signs of insolvency, so newly transacting companies must be even more so," lamenting, "It is obvious that soundness risk issues will arise, but we are caught in a dilemma where we cannot refuse support either."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.