Managed Assets but Helpless Against Major Adversities

Persistent Crisis Despite Bank of Korea's Unlimited RP Purchases

The novel coronavirus infection (COVID-19) crisis has struck the booming securities industry. Despite accumulating capital and managing liquidity in accordance with liquidity regulations, a major securities firm faced bankruptcy due to a market shock that came like a black swan. Although the government mobilized the Bank of Korea and policy banks to provide full liquidity support, if the COVID-19 crisis prolongs, another liquidity crunch may arise. Even if the crisis is overcome safely, a slump in performance due to investment losses awaits.

[Asia Economy Reporters Lim Jeong-su and Yoo Hyun-seok] The liquidity crisis of securities firms is expected to resurface. The liquidity crisis, which began with margin calls on equity-linked securities (ELS), seemed to ease with the government's package market support measures. However, the financial authorities excluded securities firms' commercial paper (CP), including project financing (PF)-related asset-backed commercial paper (ABCP) and asset-backed short-term bonds (ABCPㆍABSTB), from the support targets, causing renewed instability in the CP market.

According to financial authorities on the 1st, the domestic short-term financial market reached 354.9 trillion won last year, a 17.5% increase compared to 2018. The outstanding balance of CP issuance, including ABCP, was 182.9 trillion won at the end of last year, up 24.1 trillion won from the previous year. Among these, securities firms' CP outstanding balance accounted for the largest share at 11.6 trillion won, increasing by 4.6 trillion won compared to the previous year. This was due to increased funding demand amid asset expansion. Additionally, PF-ABCP also increased by 2.1 trillion won to 8.8 trillion won compared to the previous year.

Furthermore, the outstanding balance of short-term bonds issued by financial institutions rose by 900 billion won to 12.9 trillion won. In particular, the net issuance outstanding balance of short-term bonds by securities firms was 9.4 trillion won, down 800 billion won from the previous year. However, PF-ABSTB increased by 1.9 trillion won to 17 trillion won due to expanded credit extensions by securities firms. The outstanding balances of PF-ABCP and PF-ABSTB related to real estate projects exceed 25 trillion won.

Regarding contingent liabilities related to securitization by securities firms, Meritz Securities (as of the end of September last year) has the largest amount at 8.8 trillion won. Hana Financial Investment follows with 4.4 trillion won as of the end of last year. KB Securities has 4.07 trillion won, Korea Investment & Securities 3.95 trillion won, NH Investment & Securities 3.62 trillion won, Shinhan Financial Investment (as of the end of September last year) 3.59 trillion won, Samsung Securities 3.51 trillion won, and Mirae Asset Daewoo 2.87 trillion won.

PF-related securitized securities are mostly structured to be refinanced in units of three months or less. However, in the recent liquidity crunch, investors are reluctant to purchase ABCP and ABSTB, causing refinancing to not proceed properly. If there are no investors, securities firms that provided purchase commitments or payment guarantees must directly purchase or assume the debt. It is known that securities firms have directly purchased ABCP worth several hundred billion won recently due to the market's inability to absorb them.

Korea Ratings identified securities firms with large contingent liability burdens relative to liquidity gaps (liquid assets minus liquid liabilities) as Meritz Securities, Hana Financial Investment, Korea Investment & Securities, Kyobo Securities, Eugene Investment & Securities, and IBK Investment & Securities. In particular, Meritz, Hana, and Korea Investment & Securities were analyzed to have liquidity shortages as their contingent liabilities exceeded their liquidity gaps.

An investment banking (IB) industry official said, "As investors avoid purchasing securitized securities, even A1 (SF) rated securitized securities guaranteed by reputable securities firms are difficult to absorb in the market," adding, "Even if they circulate in some markets, they are sold at interest rates two to three times higher than usual." The official also said, "If financial authorities exclude securities firms' short-term securitized securities from liquidity support, a market shock is expected."

◆ Possibility of Recurrence of Liquidity Burden from ELS = The possibility of a recurrence of the liquidity crisis triggered by ELS still remains. This is because, as COVID-19 prolongs, it is uncertain when the volatility of major indices will increase again.

According to the Korea Securities Depository, the amount of ELS that were early redeemed last month was 2.0257 trillion won. This is the lowest amount since January last year, when it was 2.0785 trillion won. Many ELS failed to meet early redemption conditions as the stock prices used as underlying assets for ELS plummeted.

In particular, the plunge in underlying asset prices triggered a liquidity crisis for securities firms. When securities firms operate ELS issued based on the KOSPI and overseas indices as underlying assets, they take derivative positions linked to those indices for hedging purposes. The problem arose as overseas stock indices plummeted simultaneously due to the COVID-19 crisis, forcing securities firms to provide additional margin.

It is known that some large firms faced additional margin calls amounting to around 1 trillion won. Securities firms hurriedly issued CP and sold held bonds to secure emergency liquidity.

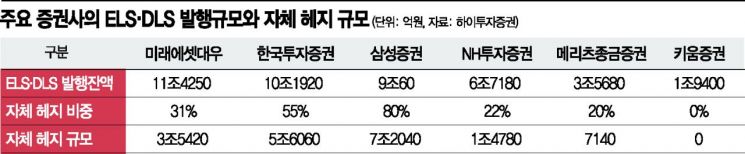

Large securities firms with high hedge ratios such as Samsung Securities, Korea Investment & Securities, and Mirae Asset Daewoo bore heavy hedge burdens. According to Hi Investment & Securities, Samsung Securities had the largest hedge size at 7.204 trillion won among domestic securities firms, followed by Korea Investment & Securities (5.606 trillion won) and Mirae Asset Daewoo (3.542 trillion won). An industry insider said, "Although the liquidity crisis in the ELS market has somewhat eased, it is difficult to rule out the possibility that increased index volatility will again lead to liquidity burdens for securities firms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)