[Asia Economy Reporters Kim Hyewon and Lee Seonae] Domestic companies suffering severe management difficulties due to the impact of the novel coronavirus infection (COVID-19) are desperately striving for survival by tightening the reins on restructuring. They are boldly selling fixed assets or unprofitable businesses to secure liquidity, frequently accepting applications for voluntary and honorary retirement, and actively reducing their size by curbing expenditures such as wages and various costs.

According to the industry on the 1st, there is a clear trend among domestic companies to secure both profitability and liquidity simultaneously through restructuring by "selling and splitting." A representative case is Haitai Confectionery’s sale of its subsidiary Haitai Ice Cream to Binggrae for 140 billion won. Even the food industry, which was relatively less affected by COVID-19, has begun focusing on selection and concentration, anticipating a prolonged COVID-19 crisis. Haitai Ice Cream recorded sales of around 180 billion won as of the end of last year, making it one of the big four in the domestic ice cream industry. Haitai Confectionery plans to use the funds secured from the sale to repay debts and invest in new equipment for its snack factory. A Haitai Confectionery official explained, "This is to focus core capabilities on the confectionery business to enhance market competitiveness and profitability."

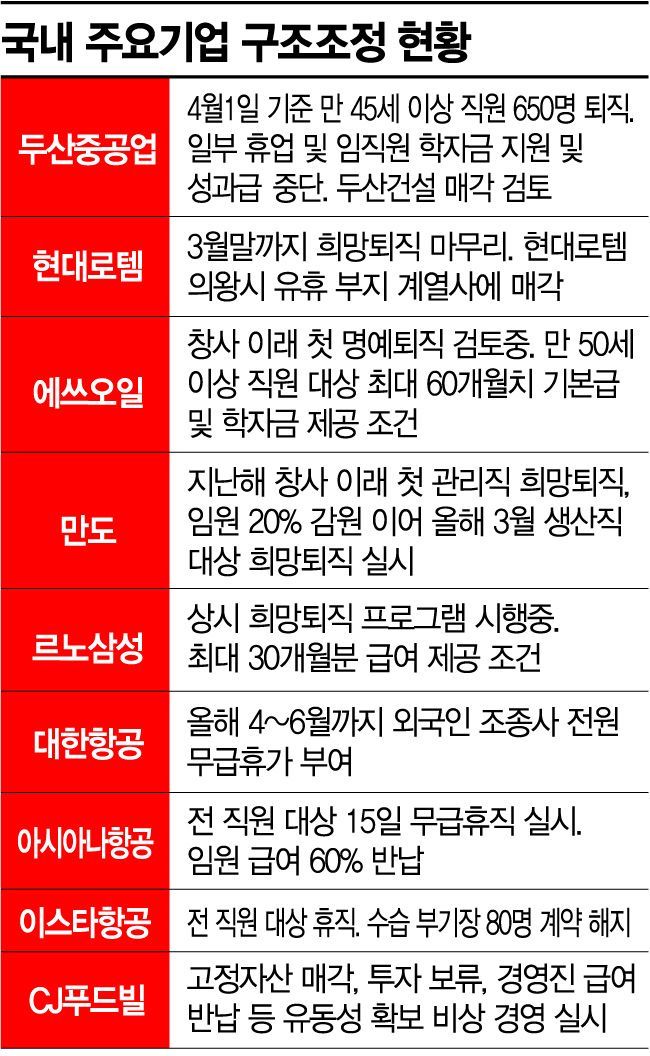

Doosan Heavy Industries plans to get rid of Doosan Construction, which has been struggling with chronic deficits, through this opportunity. Samsung Display is reorganizing its business by phasing out the unprofitable LCD business and focusing on next-generation QD display. Hyundai Rotem, which accepted voluntary retirement applications until the end of last month, decided to sell part of the idle land at its Uiwang research center to Hyundai Mobis. The sale of unprofitable business units is also under consideration.

The restructuring of the food service industry, where customer visits have sharply declined since COVID-19, also appears to be accelerating. CJ Group’s food service affiliate CJ Foodville has decided to implement a strong self-help plan. The core of the plan is to devote company-wide efforts to securing liquidity through the sale of fixed assets such as real estate, freezing new investments, maximizing expenditure control, executives returning salaries, and suspending new store openings. First, CJ Foodville will completely suspend and minimize all investments until it judges that management normalization has been achieved. Investment support funds, which were provided above the legal standard to strengthen mutual growth when renewing franchise stores, will be adjusted to meet the legal standard. To strengthen cash flow, bond and debt management will be tightened, and comprehensive cost control measures such as curbing internal and external cash expenditures will be implemented. In the food service business, stores with low profitability will be continuously closed, and new store openings will be suspended to improve cash liquidity. To lead the crisis management, the CEO, executives, and department heads have voluntarily agreed to return part of their monthly salaries until the first half of this year.

The scope of restructuring in domestic airlines, which are already implementing unpaid leave and salary returns, is expanding further. Korean Air has decided to mandate unpaid leave for all foreign pilots from this month until the end of June. The target includes 351 captains and 36 first officers, totaling 387 personnel. Initially, Korean Air implemented unpaid leave on a voluntary basis, but it appears to have expanded the application due to the suspension of most routes worldwide. Asiana Airlines will also implement 15 days of unpaid leave for all employees this month, which is five days longer than last month (10 days).

Some companies have entered full unpaid leave. Eastar Jet is a representative example. Eastar Jet implemented unpaid leave for all employees and recently terminated contracts of 80 first- and second-year trainee first officers. An industry insider said, "Currently, each company is enduring through unpaid leave or employment retention subsidies, but if the situation continues for several months, the level of restructuring will increase."

Doosan Heavy Industries has also pulled out the card of partial shutdown to reduce fixed costs related to idle personnel. The labor union has expressed opposition, stating that the scale and promotion of shutdowns should be decided through wage and collective bargaining agreements (wage and labor agreements), so this is expected to become a negotiation issue. The Doosan Heavy Industries labor union is considering advancing the wage and labor agreement, usually held in May, by about 20 days to either the 21st or 23rd of this month and plans to notify the company soon.

In the automotive parts sector, Mando, the second-largest company in the industry, delivered a considerable shock by conducting managerial restructuring last year for the first time since its founding, cutting 20% of executives, and this month is promoting voluntary retirement for production workers. An automotive industry official pointed out, "Mando’s case may be just the beginning," adding, "If COVID-19 is not controlled within the first half of this year, it is widely believed that not only lower-tier vendors but also first-tier vendors in the finished car industry will face chain bankruptcies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)