Benefit of 1.43 Million KRW Savings with 70% Reduction in Individual Consumption Tax Rate... Up to 5 Million KRW for Old and Eco-friendly Cars

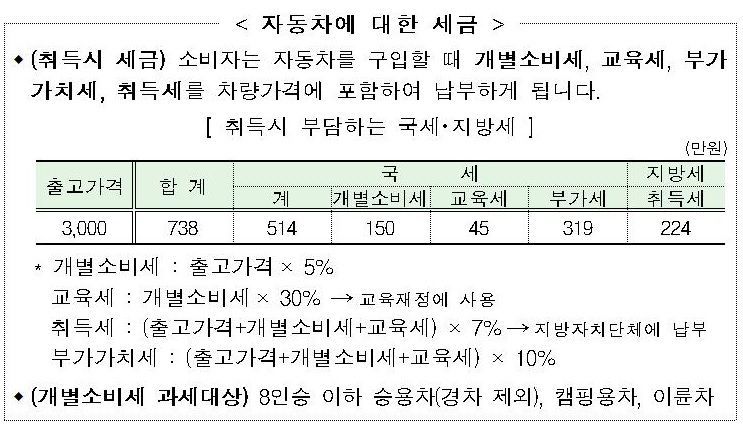

[Asia Economy Reporter Kwangho Lee] Now is the best time for consumers planning to purchase a new car. The government has been reducing the individual consumption tax on automobiles since last month to support domestic demand recovery and stabilize the vulnerable livelihood economy affected by the novel coronavirus disease (COVID-19). Consumers usually bear a 5% individual consumption tax on the car's ex-factory price, but until June 30, 70% of this tax will be reduced up to 1 million KRW.

According to the National Tax Service on the 1st, if a consumer purchases a car priced at 30 million KRW without any reduction or exemption of the individual consumption tax rate, they would have to pay a total national tax of 5.14 million KRW at the 5% rate. However, with the implementation of this tax reduction system, they can save a total of 1.43 million KRW. In other words, they only need to pay 3.71 million KRW.

The government had previously reduced the individual consumption tax rate on automobiles by 30% (from 5% to 3.5%) in 2015 during the Middle East Respiratory Syndrome (MERS) outbreak and in 2018 amid the global economic downturn. However, this is the first time the tax is effectively reduced to a 1.5% rate by exempting up to 70%. Compared to those times, consumers can save 780,000 KRW more now.

Additionally, if consumers replace cars older than 10 years with new ones or purchase eco-friendly vehicles such as hybrids, electric, or hydrogen cars, they can receive additional tax benefits of up to 5 million KRW.

The National Tax Service stated, "We will greatly simplify the exemption reporting procedures for automobile manufacturers and actively promote guidance and publicity through a dedicated consultation team to ensure many consumers can benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)