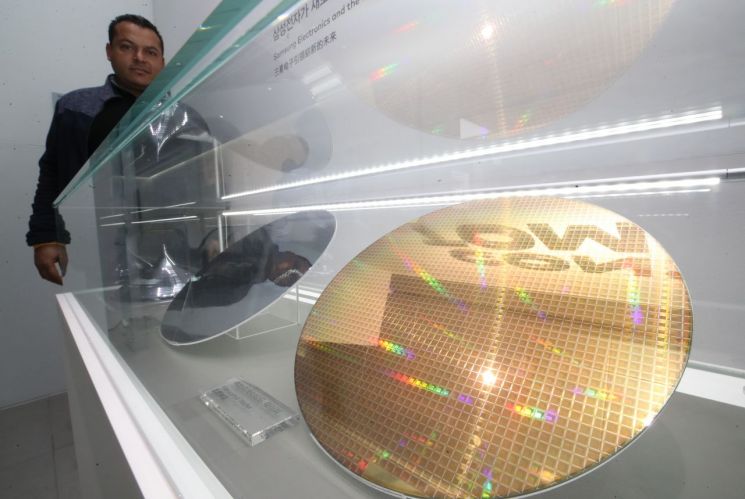

As South Korea's exports turned negative after a month, the outlook for the country's key export sector, the semiconductor industry, is divided. Global investment banks (IB) and research institutions foresee that the semiconductor market could enter a recession if global IT demand sharply declines due to the novel coronavirus disease (COVID-19). However, there are also opinions that the need to expand servers due to remote work could support semiconductor demand, leading to conflicting analyses.

On the 1st, the Ministry of Trade, Industry and Energy announced that exports in March amounted to $46.91 billion, down 0.2% compared to the same period last year. Monthly exports had returned to growth in February for the first time in 15 months but fell again after just one month. In particular, average daily exports excluding working days decreased by 6.4% year-on-year. Imports fell by 0.3% to $41.87 billion.

Among these, semiconductor exports declined by 2.7% compared to the previous year.

Experts predict that the longer COVID-19 persists, the more likely the semiconductor market will enter a recession. Recently, global investment banks (IB) and research institutions have been revising their worldwide semiconductor sales forecasts downward one after another.

Japan's Nomura Securities lowered its semiconductor sales growth forecast for this year from 8% to 3% and predicted semiconductor prices will continue to fall for the time being. In a recent report, Nomura stated, "There is a high correlation between global economic growth rates and semiconductor growth rates," adding, "Memory semiconductors experience large price fluctuations during economic slowdowns, so prices may decline over the next few months." Nomura particularly forecasted that "if global smartphone and PC demand drops by more than 15% year-on-year, the memory semiconductor market will enter a double-dip recession." A double-dip refers to a phenomenon where the economy enters a recession, recovers briefly, and then falls back into recession again.

Goldman Sachs and Citibank have lowered their annual earnings per share (EPS) forecasts for global semiconductor companies by 20-30% this year. This reflects the inevitability of reduced sales and profits for semiconductor companies due to the slowdown in global IT demand. During the 2008-2009 global financial crisis, worldwide semiconductor sales fell by 3% and 9% year-on-year, respectively. Market research firm IDC recently projected that global semiconductor sales will decline by 6% this year compared to the previous year.

However, some argue that the increase in remote work, video streaming, and online services due to COVID-19 will create demand for server expansion, which could offset the decline in IT product demand. Bank of America (BoA) forecasted that "due to increased server and data demand, DRAM prices will remain stable or rise from the second quarter through the second half of this year, slightly improving the profitability of companies."

Researcher Yoo Jong-woo of Korea Investment & Securities said, "Demand for server semiconductors remains strong," adding, "Despite growing concerns about a global economic slowdown due to the spread of COVID-19, demand for server semiconductors from global data center companies continues to be robust."

Yoo also analyzed, "Although uncertainty in overall memory semiconductor demand is increasing due to weak smartphone demand, the supply and demand for server semiconductors will remain stable," explaining, "The strong demand is driven by investment needs to respond to increased data traffic caused by the spread of COVID-19, price increases, and inventory buildup in preparation for limited supply growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)