Extension of Principal Maturity and Interest Payment Deferral for SME and Small Business Loans from April 1

Kiwoom Securities Raises Concern Over Potential Bank Insolvency if COVID-19 Prolongs

May Lead to Increase in Malignant Debtors...Advanced Countries like the US Do Not Grant Interest or Principal Deferrals

[Asia Economy Reporter Kim Hyo-jin] An analysis has emerged suggesting that the government's decision to extend the maturity and defer interest payments on loans for small and medium-sized enterprises (SMEs) and small business owners could lead to significant side effects, such as an increase in moral hazard among marginal debtors.

If restructuring of marginal companies is postponed and only banks are burdened, it could ultimately lead to bank insolvency and trigger a new crisis phase.

Seo Young-soo, a researcher at Kiwoom Securities, said on the 1st, "Interest payment deferral is an unprecedented measure that was not introduced even during the International Monetary Fund (IMF) financial crisis, the credit card crisis, or the 2008 financial crisis," adding, "It is positive in that it can mitigate the deterioration of banks' soundness in the short term." However, he expressed concern, saying, "It could cause an increase in moral hazard among marginal debtors, and if the COVID-19 pandemic prolongs, the side effects could be very severe."

Starting today, the government has decided to extend the maturity and defer interest payments on loan principal for SMEs and small business owners temporarily struggling due to COVID-19. This applies to all financial sectors, including banks, credit card companies, and savings banks. Household loans, real estate sales, and rental businesses are excluded, and it is estimated to cover about one-quarter of total loans based on commercial banks.

Researcher Seo diagnosed that for normal borrowers whose repayment ability has temporarily worsened due to COVID-19, extending loan maturity and deferring interest payments would hardly be helpful. He explained, "If they apply for principal and interest repayment deferral, it becomes difficult to obtain additional loans from financial institutions, so it is more advantageous to use a credit line loan or apply for additional loans rather than deferring principal and interest payments."

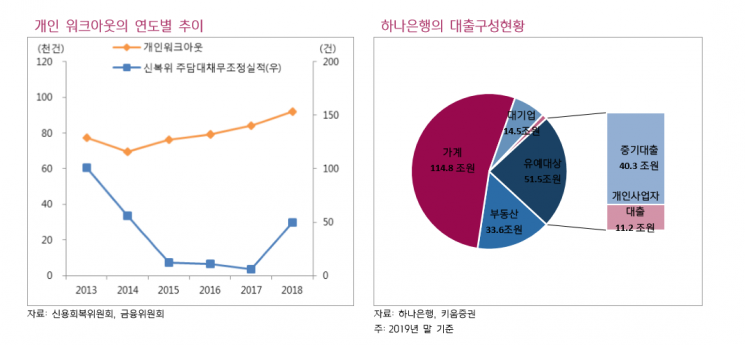

He also said that deferring interest payments could weaken the willingness of marginal debtors' households to repay debts and generate moral hazard, potentially increasing latent non-performing loans. Seo stated, "If not only the principal but also the interest is not repaid, borrowers cannot feel the burden of debt and may lose repayment ability after the deferral period ends." He added, "Moreover, since the government is effectively conducting first-come, first-served loans for low-credit borrowers, the possibility of producing malicious debtors who use the loan and then apply for debt restructuring with the Credit Recovery Committee or courts after six months cannot be ruled out."

From the banks' perspective, the difficulty in managing marginal debtors was also cited as a basis for side effects. He pointed out, "Usually, for marginal companies, changes in repayment ability can be identified through delinquencies in short-term debt or high-interest debt, but this opportunity will be lost." He added, "This measure gives marginal companies a six-month lifeline, but it imposes the burden of deteriorated soundness on banks and financial companies after six months."

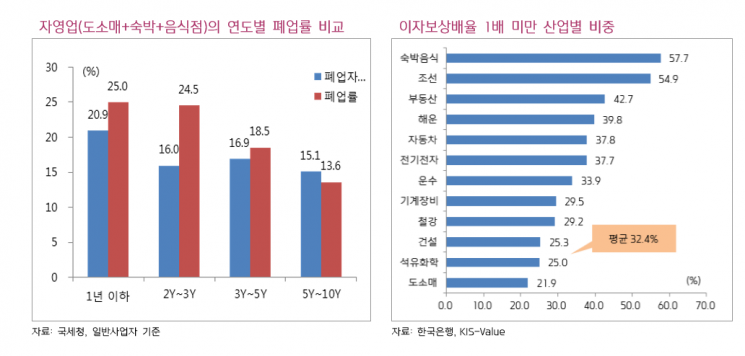

According to Kiwoom Securities, despite prolonged low interest rates, nearly half of companies have an interest coverage ratio below 1, and the closure rate of self-employed businesses reaches 25% within three years, meaning marginal companies exceed one-quarter of all companies.

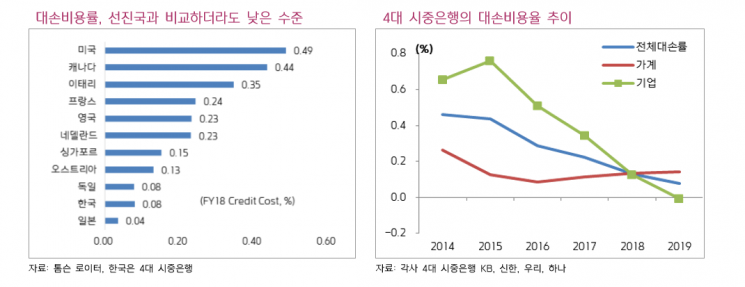

Researcher Seo expressed concern, saying, "The reason why Korea has recorded the lowest levels of delinquency rates and bad debt costs among major advanced countries worldwide is largely due to the government's delay in restructuring." He warned, "If restructuring of marginal companies is postponed again and only banks are burdened, it will ultimately lead to bank insolvency and trigger a new crisis phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)