7 Kospi Companies and 33 Kosdaq Companies Undergoing Delisting Procedures

Hanjin Heavy Industries and Dongbu Steel Removed from Management List

[Asia Economy Reporters Juyoun Oh and Minwoo Lee] Forty companies listed on the Korea Composite Stock Price Index (KOSPI) and KOSDAQ markets are facing delisting risks. Some KOSPI-listed companies, including Dongbu Steel and Hanjin Heavy Industries, have escaped from the management status and breathed a sigh of relief. The number of companies designated as management targets in the KOSDAQ market is also on a declining trend.

On the 31st, the Korea Exchange announced the companies undergoing delisting procedures and those newly designated or removed from management status after the submission deadline for the 2019 business year reports of December fiscal year companies in the KOSPI and KOSDAQ markets ended the previous day.

◆ Seven KOSPI and 33 KOSDAQ companies face delisting risk = In the KOSPI market, seven companies that received a 'disclaimer of opinion' (adverse opinion) from auditors were selected as companies undergoing delisting procedures. Among them, five companies including Yuyang D&U, Zico, Polus Biopharm, Converz, and Highgold No.8 can submit an objection letter, after which the Listing Committee will review and decide on delisting. The submission deadlines are December 9 for Yuyang D&U and Highgold No.8, December 20 for Zico and Polus Biopharm, and December 21 for Converz.

Two companies, Shinhan and Woongjin Energy, which received a 'disclaimer of opinion' for two consecutive years, will have their delisting status decided by the Listing Committee after the improvement period ends on December 9.

In the KOSDAQ market, a total of 33 companies were subject to delisting procedures. For 32 companies including Kona I, the reason was auditor's non-standard opinions (scope limitation, disclaimer). Pine Nex was subject to delisting standards due to failure to submit the business report. Among the companies undergoing delisting procedures, 23 were newly added this year, slightly fewer than the 25 companies last year. Ten companies, including P&Tel, were given an improvement period until December 9 due to non-standard audit opinions for 2018.

◆ Cheongho Comnet and Heung-A Shipping designated as management targets... KOSDAQ shows a decreasing trend = Two companies, Cheongho Comnet and Heung-A Shipping, were newly designated as management targets in the KOSPI market. Cheongho Comnet was designated as a management target on the 20th due to a capital impairment ratio of 84%. Heung-A Shipping was designated due to failure to submit the business report. If the business report is not submitted by December 13, delisting procedures will follow. Additionally, Kiwi Media Group is expected to determine whether it will be subject to a substantial review of listing eligibility based on evidence resolving full capital erosion as of the end of last year and confirmation of quarterly sales below 500 million KRW.

Among the nine companies previously designated as management targets, two companies, Dongbu Steel and Hanjin Heavy Industries, were removed from management status. Dongbu Steel received a 'clean' audit opinion, and Hanjin Heavy Industries resolved the reason of 'capital impairment exceeding 50%.'

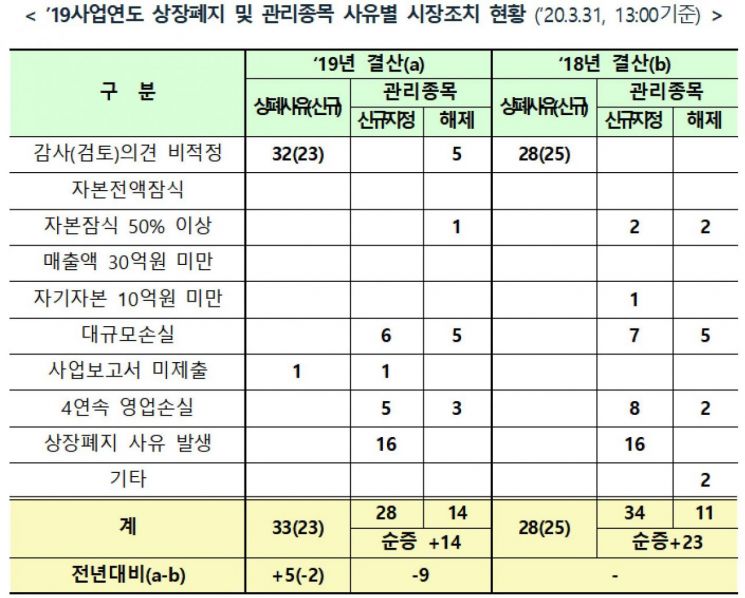

Status of Market Actions by Reason for Delisting and Management Item of KOSDAQ Companies in the 2019 Fiscal Year (Provided by Korea Exchange)

Status of Market Actions by Reason for Delisting and Management Item of KOSDAQ Companies in the 2019 Fiscal Year (Provided by Korea Exchange)

Meanwhile, in the KOSDAQ market, the increase in management target designations is slowing down. Twenty-eight companies, including Pixelplus, were designated as management targets due to operating losses over four consecutive fiscal years, large-scale losses, or delisting reasons. The net increase, subtracting companies removed from the newly designated ones, was 14 companies, nearly half compared to 23 companies last year (34 newly designated, 11 removed).

Meanwhile, 37 companies including IA Networks were newly designated as investment caution stocks due to inappropriate internal accounting control systems. Fourteen companies including Yes24 were removed from investment caution stocks after resolving internal accounting control issues. The net increase in investment management stocks was 23 companies, the same as last year (30 newly designated, 7 removed).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.