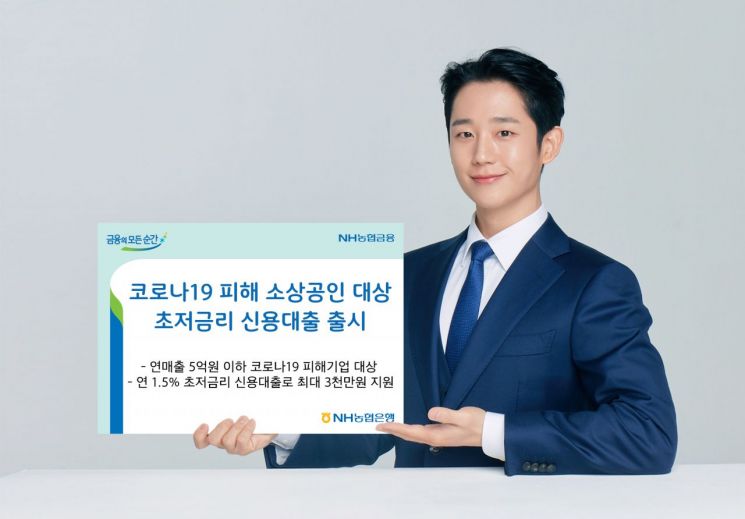

[Asia Economy Reporter Kwon Haeyoung] NH Nonghyup Bank announced on the 31st that it will launch the 'NH Small Business Owner Interest Subsidy Agreement Loan,' a specialized product for small business owners who have suffered direct or indirect damage from the novel coronavirus infection (COVID-19), on the 1st of next month.

This is in accordance with the government's 'COVID-19 Response Livelihood and Financial Stability Package Program.' Any small business owner with annual sales of 500 million KRW or less and a credit rating of 1 to 3 can apply. The loan limit is 30 million KRW, the loan period is within one year, and it can be used at an ultra-low interest rate of 1.5% per annum, with no prepayment penalty.

This is an unsecured credit loan that does not require a guarantee certificate and can be executed within a maximum of five days after the loan application. A special preferential interest rate of 0.5 percentage points for COVID-19 small business owners is applied to all accounts, and it is characterized by being able to support more small business owners due to exceptions in the industry-specific credit limit management standards.

Lee Chang-gi, Head of Marketing Strategy at Nonghyup Bank, said, "We launched this product to support small business owners who have been affected by COVID-19 and to overcome the crisis situation together. Going forward, Nonghyup Bank will continue to take the lead in overcoming difficulties caused by COVID-19 as a representative social contribution bank."

Detailed information about the product and individual loan limits can be confirmed at Nonghyup Bank branches nationwide.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.