8 Card Companies' Card Loans Reach 105 Trillion Won... Highest Since 2011

Card Loans Up 7% Year-on-Year

Concerns Over Card Companies' Soundness If COVID-19-Induced Economic Downturn Continues

[Asia Economy Reporter Ki Ha-young] Last year, the amount of credit card loan usage reached its highest level in eight years, raising concerns that the spread of the novel coronavirus infection (COVID-19) could negatively impact the soundness of credit card companies. This is because it is expected that low-credit and low-income individuals in urgent need of funds will flock to card loans as sales of small business owners and micro-entrepreneurs sharply decline due to COVID-19.

According to the 'Operating Performance (Provisional)' report released on the 31st by the Financial Supervisory Service for eight specialized credit card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana, BC Card), the amount of card loan usage last year was 105.2 trillion KRW, an increase of 1.4 trillion KRW compared to the previous year. This is the highest level in eight years since 2011 (106.9 trillion KRW).

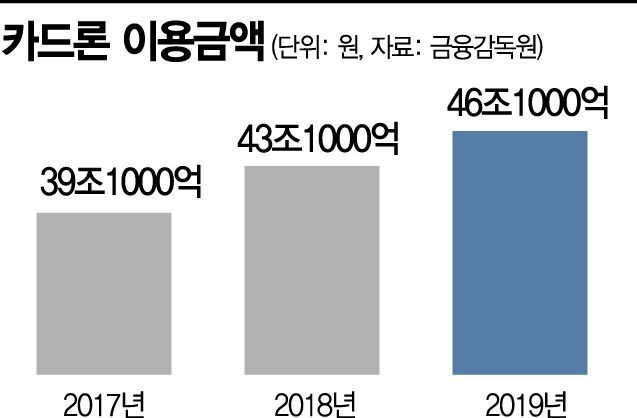

In particular, the increase in card loan usage was notable. Last year, the amount of card loan usage was 46.1 trillion KRW, an increase of 3 trillion KRW or 7% compared to the previous year. Card loan usage has been on the rise with 39.1 trillion KRW in 2017, 43.1 trillion KRW in 2018, and 46.1 trillion KRW in 2019. On the other hand, cash service usage decreased by 1.6 trillion KRW to 59.1 trillion KRW compared to the previous year.

The reason for the increase in card loan usage is largely due to credit card companies expanding card loans to compensate for revenue losses caused by the reduction in merchant fees. The problem is the concern that if the economic recession continues due to COVID-19 this year, card loan delinquencies will increase. Although the government has introduced various support measures to alleviate the financial difficulties of small business owners, there are criticisms that supply cannot keep up with demand. In a situation where even loan consultations have a surge in waiting customers, it is expected that the number of people taking out loans from the secondary financial sector will inevitably increase when urgent funds are needed immediately. This is why there are concerns that card loans and cash services, mainly used by low-credit and low-income individuals, will increase.

Card loans, which are high-interest loan products, allow borrowing up to 100 million KRW for a maximum of 36 months depending on creditworthiness. Although interest rates vary by credit card company, most are between 15% and 20%. Compared to bank credit loans, borrowers must bear interest rates that are three to four times higher.

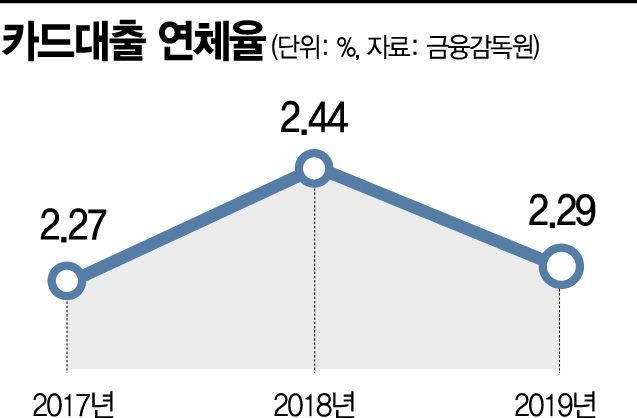

If the spread of COVID-19 prolongs, delinquency rates are also expected to rise. Last year, the card delinquency rate based on loans overdue by more than one month (excluding refinancing loans) was 2.29%, slightly down by 0.15% from 2.44% the previous year. However, looking at individual companies, the fixed and below non-performing loan ratio, an indicator of soundness, increased. According to each company's business report, Shinhan Card's fixed and below non-performing loan ratio was 1.14% in 2019, slightly up from 1.10% in 2018. Lotte Card's ratio increased by 0.45 percentage points to 1.48% in 2019 from 1.03% in 2018, and Hana Card also recorded 1.78%, up 0.23 percentage points from the previous year.

An industry insider said, "Customers using card loans often use card loans again because they already have loans from the secondary financial sector and need urgent funds," adding, "If the COVID-19 situation prolongs, the delinquency rate of loan assets will generally increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)