[Asia Economy Reporter Koh Hyung-kwang] Since the outbreak of the novel coronavirus disease (COVID-19), foreign investors' continuous net selling of Samsung Electronics shares shows no signs of stopping. Considering that during past economic crises, foreign investors reduced their stake in Samsung Electronics to the 40% range, there is a possibility that net foreign selling could intensify if the COVID-19 situation worsens.

On the other hand, individual investors are showing markedly different behavior compared to the past. Previously, individuals joined in the sell-off amid concentrated foreign selling, but this time, they absorbed all the foreign selling volumes under the banner of the 'Donghak Ant Movement.' They are poised to continue net buying based on the belief that 'buying Samsung Electronics at a low price will surely yield profits.' This is why the 'money war' between foreign and individual investors is heating up day by day.

According to the Korea Exchange on the 31st, foreign investors have shown massive selling on all but one trading day (March 4) out of 26 trading days from February 24 to March 30. The net selling amount reached a staggering 15.9445 trillion KRW. During this period, the stock most heavily sold by foreigners was Samsung Electronics, accounting for over 40% of the total selling amount (6.5537 trillion KRW out of 15.9445 trillion KRW). On average, they sold 252 billion KRW per day, with four trading days seeing sales exceeding 500 billion KRW.

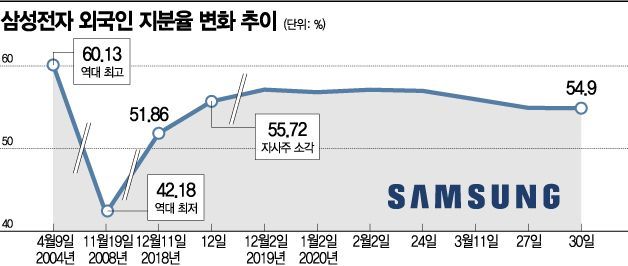

As foreign investors have steadily sold Samsung Electronics shares over the past month, their stake has dropped from 57.14% to 54.90%, a decrease of 2.24 percentage points. It remains uncertain how long this foreign selling streak will continue. However, compared to past cases, there is speculation that foreign selling pressure on Samsung Electronics may persist for some time.

During the financial crisis, the KOSPI index plunged more than 50% from its peak of 1901.13 on May 19, 2008, to a low of 892.16 on October 27 of the same year, as foreign capital flowed out like a receding tide. At that time, foreigners also sold off large amounts of Samsung Electronics shares, reducing their stake from 46.00% to 42.49%, a decrease of 3.51 percentage points. Compared to the recent decrease of 2.24 percentage points, there is still room for further selling.

A representative of an asset management firm said, "Foreign investors have mechanically been net selling large-cap stocks including Samsung Electronics," adding, "This is not so much due to a bleak outlook on the semiconductor industry but rather because the COVID-19 crisis has led to capital withdrawal from emerging markets including Korea, forcing them to pull money out of stocks with relatively large capital inflows."

Labor Gil, a researcher at NH Investment & Securities, explained, "Foreign investors account for about 40% of the domestic KOSPI market by market capitalization, and since the top three KOSPI stocks by market cap?Samsung Electronics, SK Hynix, and Samsung Electronics Preferred Shares?make up over 30% of the KOSPI, they cannot reduce their capital weight without selling semiconductor stocks."

Individual investors' buying appetite remains strong. Individual investor A said, "I hesitated to buy at around 53,000 KRW and ended up not purchasing much, but after the rebound, I missed the timing," adding, "I plan to buy more whenever the stock price falls in the future." Another investor B said, "Conversations among friends and colleagues always include talk about Samsung Electronics' stock price," and noted, "Just like when real estate or cryptocurrencies were in the spotlight, everyone is investing in Samsung Electronics, but on the other hand, there is some concern that it might be overheating."

The highest foreign ownership of Samsung Electronics was recorded on April 9, 2004, at 60.13%. The only period when foreigners held more than 60% of Samsung Electronics shares was for six trading days from April 7 to April 14 of that year. Conversely, the lowest stake was during the global financial crisis in 2008, when it dropped to 42.18% on November 19 of that year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)