[Asia Economy Reporter Kim Hyo-jin] Small and medium-sized enterprises (SMEs) and small business owners who have suffered direct or indirect damage from the novel coronavirus infection (COVID-19) can apply for loan principal repayment maturity extension and interest repayment deferral starting from the 1st of next month. This applies to all financial sectors including banks, insurance companies, credit finance companies, savings banks, credit unions, NongHyup, Suhyup, forestry cooperatives, and Saemaeul Geumgo. Household loans such as mortgage loans are excluded. At the same time, ultra-low interest loans at 1.5% through commercial banks will also be supplied.

The Financial Services Commission announced on the 31st the financial support measures for SMEs and small business owners related to COVID-19 containing these details.

Companies with annual sales of 100 million KRW or less will be considered as affected businesses and can receive support without separate proof. If annual sales exceed 100 million KRW, documents proving sales decline must be submitted. The financial authorities plan to broadly accept POS data, VAN company sales data, card company sales data, electronic tax invoices, bankbook copies, and other evidence as proof. If it is difficult to submit sales proof documents due to reasons such as less than one year of business operation, a management difficulty confirmation letter prepared jointly by the financial sector can be submitted according to the prescribed form.

There must be no insolvency such as principal and interest arrears, capital erosion, or business closure to receive support. However, even if arrears occurred between January and March, if all arrears with financial companies are resolved as of the application date, the applicant will be included in the support target. Businesses temporarily closed since January are also eligible for support unless due to other insolvency such as capital erosion. Loans to SMEs, including individual business owners, received before March 31 of this year and with repayment deadlines by September 30 are eligible. Guaranteed loans and foreign currency loans are also included. For guaranteed loans, consent from the guarantee institution is required.

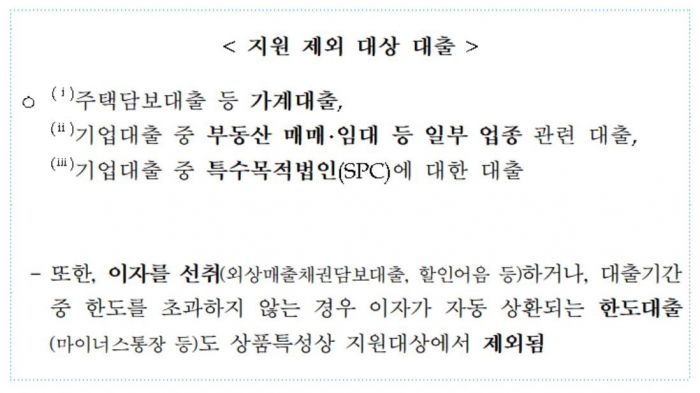

Household loans such as mortgage loans, loans related to certain industries like real estate sales and leasing among corporate loans, and loans to special purpose companies (SPCs) among corporate loans are not eligible for support. Loans where interest is collected in advance (such as accounts receivable secured loans, discounted bills) or revolving loans (such as overdraft accounts) where interest is automatically repaid as long as the limit is not exceeded during the loan period are also excluded from support.

Support will be provided by extending the maturity by at least six months from the application date and deferring interest repayment regardless of the repayment method such as lump-sum or installment. Extension of the grace period for grace-type loan products is also included. For principal and interest installment loans, principal repayment deferral is included. Applications can be made by visiting the branch of the financial company with which the applicant has a transaction, and in some cases, applications can be made non-face-to-face via phone or fax.

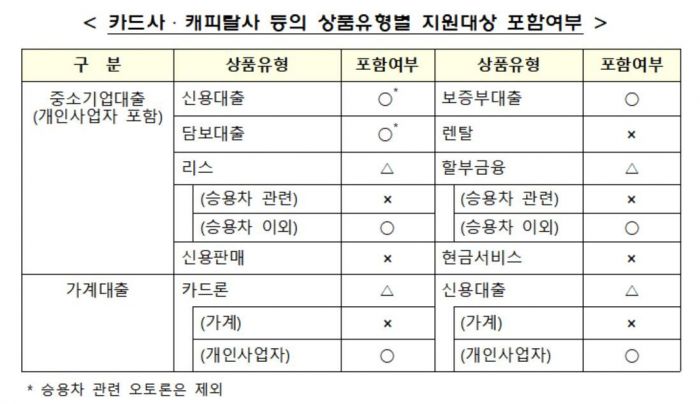

Among insurance policy loans, if the policyholder is an SME or individual business owner affected by COVID-19, they are included in the interest repayment deferral target. Card loans (including those from banks with dual operations), credit, secured, installment finance, and leases are also included in the deferral target, but credit sales, cash services, rental, and loans/leases/installment finance related to passenger cars are excluded.

Meanwhile, small business owners affected by COVID-19 can receive ultra-low interest loans (1.5%) similar to existing guaranteed loans from commercial banks starting from the 1st of next month. This is an interest subsidy loan where the government supports up to 80% of the difference from the market interest rate. The remaining 20% is borne by the bank. The scale is 3.5 trillion KRW, and the target is high-credit small business owners with annual sales of 500 million KRW or less. The criterion for 'high credit' corresponds to bank-specific internal credit ratings equivalent to personal credit bureau (CB) grades 1 to 3. It is not possible to receive multiple supports such as the commercial banks' interest subsidy loans, IBK Industrial Bank of Korea's ultra-low interest loans, and the Small Enterprise and Market Service's management stabilization funds simultaneously.

It can be used up to a maximum of 30 million KRW for up to one year. Applications can be made at branches of 14 commercial banks, and KB Kookmin Bank and Shinhan Bank also accept applications through non-face-to-face channels. KB Kookmin Bank supports through internet banking, and Shinhan Bank through mobile banking. A financial authority official said, "We expect loan execution to be possible within 3 to 5 business days after application." Applications can be submitted until the end of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.