Available for submission via corporate internet banking

Reduced waiting time... Practicing 'social distancing'

[Asia Economy Reporter Jo Gang-wook] KB Kookmin Bank announced on the 30th that it will launch the 'KB Small Business Second Interest Subsidy Agreement Loan' on the 1st of next month to support small business owners financially affected by COVID-19.

This agreement loan is a credit loan and is implemented as part of the government's 'COVID-19 Response Livelihood and Financial Stability Package Program.' The support target is small business owners with an annual sales of 500 million KRW or less who have suffered direct or indirect damage from COVID-19 and have KB Kookmin Bank's own credit rating of grades 1 to 3 (BBB or higher). The credit loan limit is up to 30 million KRW, the loan period is within one year, the applied interest rate is 1.5% per annum, and the early repayment fee is waived.

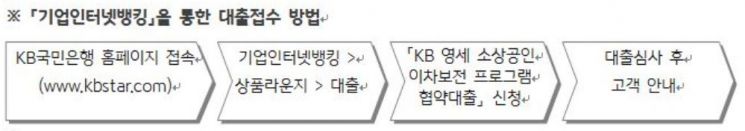

In particular, this loan can be applied for through corporate internet banking. KB Kookmin Bank has enabled non-face-to-face applications to actively practice 'social distancing' to prevent the spread of COVID-19, reduce waiting times at branches, and provide customer convenience. Additionally, elderly customers or corporate business owners can also apply through KB Kookmin Bank branches.

A KB Kookmin Bank official said, "We hope that this second interest subsidy agreement loan will provide even a little help to small business owners struggling due to COVID-19," and added, "We hope that the affected businesses will return to normal as soon as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)