Unlike Savings and Time Deposits,

Withdrawals and Deposits Available Anytime

[Asia Economy Reporter Minyoung Kim] With ultra-low interest rates in the 0% range and increased volatility in the financial markets due to the impact of the novel coronavirus disease (COVID-19), there is a growing tendency to stockpile cash in safe places. In particular, recently, as stock and bond investments have become unattractive, a large amount of idle money is flowing into parking accounts. These accounts offer a maximum interest rate of up to 2%, which is higher than fixed deposits that have fallen to the 0% range annually, and the ability to deposit and withdraw funds at any time is considered an attractive feature.

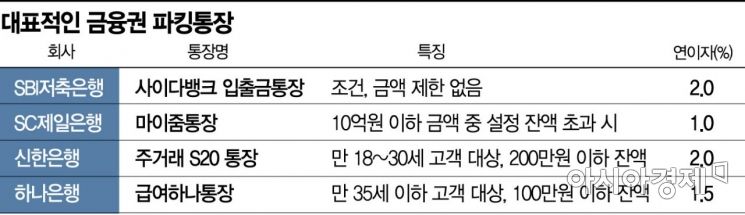

According to the financial sector on the 30th, the balance of deposits in the 2.0% interest rate demand deposit account sold through SBI Savings Bank’s mobile platform application, Cider Bank, recently surpassed 1 trillion won. This product, launched last year to commemorate the app’s release, is one of the parking accounts that calculates the daily balance and pays interest on the first day of each month. A parking account refers to a freely accessible deposit account that offers relatively high interest rates even if the money is deposited for a short period and withdrawn at any time, similar to temporarily parking a car.

An official from SBI Savings Bank said, “Because market deposit interest rates are so low, not only existing customers but also many new customers are coming in.”

Among commercial banks, SC First Bank’s ‘My Zoom Account’ is a representative parking account. Customers can set an amount up to 1 billion won, and as long as the balance exceeds that amount, they receive a 1.0% interest rate even if the money is deposited for just one day. According to SC First Bank, the recent deposit balance has exceeded 3 trillion won, and the number of subscribers has been increasing further since the interest rate cuts caused by COVID-19.

Due to the Bank of Korea’s base rate cuts, the interest rates on deposits and savings at commercial banks are lackluster, so parking accounts are reaping significant benefits.

Major large banks are also selling parking accounts. However, conditions such as age or minimum amounts tend to be somewhat strict. Shinhan Bank offers the ‘Main Transaction S20 Account’ to customers aged 18 to 30, providing a 2.0% interest rate on balances up to 2 million won. Hana Bank offers a 1.5% interest rate on balances up to 1 million won for customers aged 35 or younger who are subscribers to the ‘Salary Hana Account.’

NH Nonghyup Bank offers the ‘NH Main Transaction Preferential Account’ with a 2.0% interest rate on balances up to 1 million won if conditions such as a monthly salary transfer of 500,000 won or more, credit or check card spending of 200,000 won or more per month, and at least three automatic transfers or automatic payments are met, regardless of age. Although the amounts are small, there are products with high interest rates even at commercial banks if you look carefully.

There are forecasts that parking account interest rates may decline. A financial sector official said, “Parking accounts are the best way to attract new customers, so financial companies will maintain existing rates for the time being, but if ultra-low interest rates persist for a long time and the number of customers continues to increase, they will not be able to withstand the pressure to lower rates.” In fact, Kakao Bank lowered the interest rate on its ‘Safe Box’ (up to 10 million won), which is similar in nature to a parking account, by 0.3 percentage points from 1.0% to 0.7% on the 20th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.